Pfizer (PFE) Cuts 2023 Outlook as COVID Products' Demand Falls

Pfizer PFE slashed its previously issued revenue guidance for 2023 due to lower-than-expected demand for its COVID products, COVID-19 vaccine, Comirnaty, and its oral antiviral pill for COVID, Paxlovid.

Pfizer records direct sales and alliance revenues from its partner, BioNTech BNTX for Comirnaty, and product revenues from Paxlovid.

The revenue guidance was lowered from $67.0 to $70.0 billion to $58.0 to $61.0 billion, which includes a $7 billion cut in Paxlovid revenues and a $2 billion reduction in Comirnaty revenues. The earlier revenue guidance included approximately $13.5 billion in sales from Comirnaty and Paxlovid sales of approximately $8 billion. Full-year 2023 combined revenues for Paxlovid and Comirnaty are now expected to be approximately $12.5 billion compared with $21.5 billion expected previously.

Excluding COVID-19 products, Pfizer continues to expect its revenues to rise 6% to 8% on an operational basis in 2023 as sales from non-COVID drugs remain strong. With the demand for COVID products coming in lower than expected, Pfizer announced cost cuts, including layoffs, which are expected to deliver targeted savings of at least $3.5 billion. Of this, approximately $1.0 billion is expected to be realized in 2023 and at least $2.5 billion is expected to be realized in 2024.

In the third quarter, Pfizer will record a non-cash charge of $5.5 billion as COVID inventory write-offs in the cost of goods sold. As a result of the lower-than-expected COVID revenues and the inventory write-offs, adjusted EPS is expected in the range of $1.45 to $1.65, down from $3.25 to $3.45 expected previously.

Pfizer’s shares were down almost 2.5% on Friday in response to the guidance cut. Pfizer’s stock has declined 37.4% so far this year against an increase of 8.5% for the industry.

Image Source: Zacks Investment Research

Pfizer said it has amended its supply agreement with the U.S. government for Paxlovid and the latter will return approximately 7.9 million treatment courses of Emergency Use Authorized (EUA)-labeled U.S. government inventory at the end of 2023. In exchange, the U.S. government will receive credit for future NDA-labeled treatment courses from Pfizer. From 2024 beginning, Pfizer will begin selling Paxlovid in traditional commercial markets in the United States, with prices to be negotiated with payers. Earlier. Pfizer had said it will transition from government markets to commercial markets by the second half of 2023.

Pfizer reduced its 2023 outlook for Paxlovid due to the $4.2 billion non-cash revenue reversal for the return as well as the delay in transition to the commercial market, as discussed in the previous parah. The Comirnaty guidance was lowered by $2 billion due to lower-than-expected vaccination rates.

During the pandemic, Pfizer gave the world the first and most widely used vaccine, Comirnaty, and an oral treatment for COVID-19, Paxlovid. The profits that Pfizer generated from its COVID products in 2021 and 2022 strengthened its cash position, which is being used to make acquisitions, increase dividends, buy back shares and reduce debt. The cash enabled it to acquire Arena, ReViral, Biohaven and Global Blood Therapeutics in 2022. It also allowed Pfizer to increase investments in R&D and SI&A to support its expected new product launches. Overall, the profits and cash from COVID products allowed Pfizer to invest in support of its growth plans for the second half of this decade.

Zacks Rank & Stocks to Consider

Pfizer currently has a Zacks Rank #3 (Hold).

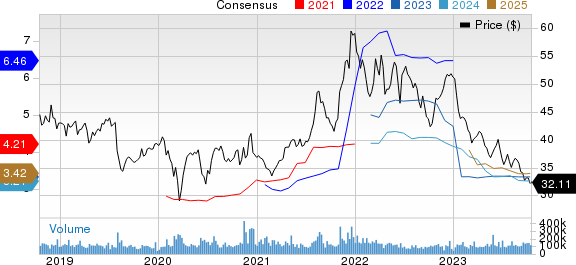

Pfizer Inc. Price and Consensus

Pfizer Inc. price-consensus-chart | Pfizer Inc. Quote

Some better-ranked drug/biotech companies worth considering are Alpine Immune Sciences ALPN and Aurinia Pharmaceuticals AUPH, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the consensus estimate for Alpine Immune Sciences’ 2023 loss has narrowed from $1.43 per share to $1.18 per share, while the same for 2024 has narrowed from $1.73 per share to $1.47 per share. Year to date, shares of Alpine Immune Sciences have rallied 39.6%.

ALPN’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average negative earnings surprise of 79.65%.

In the past 90 days, the bottom line estimate for Aurinia Pharmaceuticals for 2023 has narrowed from a loss of 71 cents per share to a loss of 58 cents per share, while the same for 2024 has narrowed from a loss of 43 cents per share to a loss of 27 cents per share. Year to date, shares of Aurinia Pharmaceuticals have gained 74.1%.

Earnings of Aurinia Pharmaceuticals beat estimates in all the last four quarters, delivering an earnings surprise of 45.61% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Aurinia Pharmaceuticals Inc (AUPH) : Free Stock Analysis Report

Alpine Immune Sciences, Inc. (ALPN) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report