PGT Innovations (PGTI) Gets Miter's Unsolicited Bid, Stock Gains

In a surprising turn of events, PGT Innovations, Inc. PGTI, a leading provider of premium windows and doors, has received an unsolicited proposal from Miter Brands to acquire all outstanding shares for $41.50 per share in cash. This comes on the heels of PGT Innovations' agreement with Masonite International Corp. DOOR for $41.00 per share in a combination of cash and Masonite stock.

Shares of PGT Innovations lost 1.2% during the trading session on Jan 2 but gained 4.7% in the after-hour trading session on the same day.

The Masonite deal, announced on Dec 18, 2023, represented a significant 56.5% premium over the closing price per share of PGTI common stock on Oct 9, 2023. PGT Innovations' board of directors, guided by independent financial and legal advisors, will now thoroughly assess Miter Brands' proposal to determine if it could potentially lead to a superior offer.

As the review unfolds, PGT Innovations has urged its shareholders to refrain from taking any immediate action. The company remains committed to prioritizing shareholder value in this dynamic situation.

Evercore is serving as the exclusive financial advisor to PGT Innovations, with legal counsel provided by Davis Polk & Wardwell LLP. The developments underscore the strategic importance of PGT Innovations in the market, with multiple entities recognizing its value. Shareholders and industry observers alike will be closely watching as this unfolding narrative shapes the future trajectory of PGT Innovations.

PGT Innovations made a strategic move into the overhead garage door market with the acquisition of Martin Door Holdings for approximately $185 million in 2022. In contrast, Miter Brands was established in 2019 through the merger of MI Windows and Doors and Milgard.

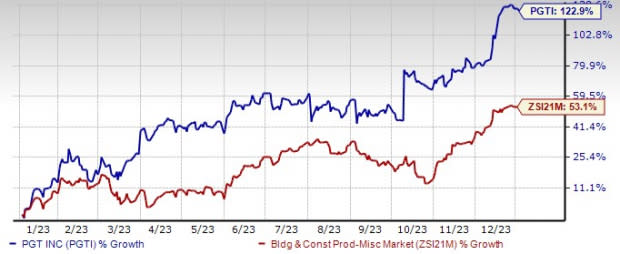

Share Price Performance

In the past year, PGTI has gained 122.9%, comparing favorably with the Building Products - Miscellaneous industry’s 53.1% rise.

Image Source: Zacks Investment Research

PGT Innovation currently carries a Zacks Rank #2 (Buy). This stock has seen an upward estimate revision of 2024 earnings to $2.44 per share from $2.41 over the past 60 days.

The company’s earnings topped the consensus estimate in three of the trailing four quarters and missed on one occasion, the average surprise being 8.4%. It carries an impressive VGM Score of A.

Other Key Picks

Some other top-ranked stocks from the Zacks Construction sector are:

Fluor Corporation FLR presently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 37.5%, on average. Shares of FLR have rallied 14.7% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FLR’s 2024 sales and earnings per share (EPS) suggests growth of 9.3% and 11.1%, respectively, from the year-ago period’s levels.

M-tron Industries, Inc. MPTI currently sports a Zacks Rank of 1. MPTI delivered a trailing four-quarter earnings surprise of 35.6%, on average. It has surged 335.4% in the past year.

The Zacks Consensus Estimate for MPTI’s 2024 sales and EPS indicates growth of 12.5% and 13.4%, respectively, from the previous year’s levels.

AECOM ACM currently carries a Zacks Rank of #2. It has a trailing four-quarter earnings surprise of 2.1%, on average. Shares of ACM have gained 8.5% in the past year.

The Zacks Consensus Estimate for ACM’s 2024 sales and EPS indicates an increase of 4.5% and 17.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

PGT, Inc. (PGTI) : Free Stock Analysis Report

Masonite International Corporation (DOOR) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report