Pharma Stock Roundup: ABBV to Buy Immunogen, NVS Ups Mid-Term Sales View & More

This week, AbbVie ABBV announced a definitive agreement to acquire cancer biotech Immunogen at a premium valuation of $10.1 billion. Novartis NVS raised its mid-term sales growth outlook by 1%. Sanofi SNY and partner Regeneron’s second phase III chronic obstructive pulmonary disease (COPD) study showed that their blockbuster drug Dupixent significantly reduced exacerbations in such patients.Merck MRK announced positive data from a phase III study evaluating V116, its investigational 21-valent pneumococcal conjugate vaccine (PCV) specifically designed to protect adults.

Recap of the Week’s Most Important Stories

AbbVie to Buy Immunogen for $10.1B: AbbVie has offered to buy ImmunoGen, which will add its new ovarian cancer drug Elahere (mirvetuximab soravtansine), a first-in-class antibody-drug conjugate (ADC), to its portfolio. Per the deal terms, AbbVie will pay Immunogen $31.26 per share in cash, which adds up to a total equity value of approximately $10.1 billion.

Elahere, which is approved for platinum-resistant ovarian cancer, will accelerate AbbVie’s presence in the ovarian cancer market. Elahere is also being evaluated in multiple studies, both as monotherapy and in combination with other drugs, for ovarian cancer, which will expand the drug’s use in earlier lines of therapy and additional patient populations. Immunogen has some promising ADC candidates in its pipeline, like pivekimab sunirine (in phase II studies for blastic plasmacytoid dendritic cell neoplasm) and IMGN-151 (in phase I for ovarian cancer).

The transaction is expected to close in mid-2024, subject to shareholder and regulatory approval. The boards of directors of both companies have approved the transaction.

The FDA granted Breakthrough Therapy Designation (BTD) to epcoritamab for treating relapsed or refractory (R/R) follicular lymphoma (FL) after two or more therapies. Epcoritamab was approved (accelerated approval) by the name of Epkinly/Tepkinly (Epkinly’s brand name in EU) for R/R diffuse large B-cell lymphoma (DLBCL) in the United States and EU in 2023. The EMA also validated a Type II application for epcoritamab for the same indication. The FDA’s BTD and validated European application are based on data from the FL cohort of the phase I/II EPCORE NHL study.

AbbVie announced positive top-line data from the phase II LUMINOSITY study evaluating telisotuzumab-vedotin, also called Teliso-V, for patients with previously treated non-small cell lung cancer (NSCLC) with c-Met overexpression. Data from the LUMINOSITY study showed that the overall response rate (ORR) in the c-Met high group of patients was 35.0%. ORR is the study’s primary endpoint. The ORR in the c-Met Intermediate group of patients was 23%.

Novartis Ups Mid-Term Sales Outlook: Novartisraised its sales outlook for the mid-term on the R&D day. It now expects sales to witness a CAGR of 5% in the 2022-2027 timeframe compared to earlier expectations of 4%. Its core operating income margin is expected to be around 40% by 2027. In October 2023, Novartis spun off Sandoz, its generics and biosimilars division, into a new publicly traded standalone company. The company is now only focused on its pharmaceutical business, which has four therapeutic areas that offer potential for consistent growth. These areas are Cardiovascular-Renal-Metabolic, Immunology, Neuroscience and Oncology. Several of Novartis’ newly launched drugs, like Kisqali, are gaining traction, which should drive sales growth.

Sanofi’s Dupixent Meets Goal in 2nd COPD Study: Sanofi/Regeneron announced that a pivotal phase III study called NOTUS, which evaluated Dupixent for treating moderate-to-severe COPD, met its primary endpoint. In the study, Dupixent significantly reduced exacerbations by 34% compared to placebo.

In fact, treatment with the drug also led to rapid and significant improvement in lung function by 12 weeks, which was sustained at 52 weeks. These were the study’s key secondary endpoints. Notus is the second COPD study on Dupixent to show positive data. In March, the company announced results from the first study, called BOREAS, which showed that Dupixent led to a significant reduction in moderate or severe acute exacerbations by 30% compared with placebo.

Based on data from both studies, the companies expect to file regulatory applications seeking approval of Dupixent for the COPD indication by the end of 2023.

Merck’s V116 Shows Upbeat Responses in New Study: Merck announced positive data from phase III study on V116, which supported the immunogenicity of the 21-valent PCV compared to the standard of care, pneumococcal 20-valent conjugate vaccine or PCV20. In the cohort which included adults 50 years of age and older, vaccination with V116 resulted in non-inferior immune responses to PCV20 for all 10 shared serotypes, while responses were superior for 10 of the 11 serotypes included in V116 but not included in PCV20.

In the second cohort, which evaluated adults 18 to 49 years of age, the immune responses elicited by V116 were non-inferior to those elicited by adults 50 to 64 years of age. V116 targets serotypes that account for 83% of all invasive pneumococcal diseases in older adults in the United States, and it includes eight serotypes not covered by currently licensed vaccines

The FDA granted priority review to a supplemental biologics license application (sBLA) seeking approval for Keytruda plus Padcev as a first-line treatment for patients with locally advanced or metastatic urothelial carcinoma. The sBLA is based on data from phase III KEYNOTE-A39 study. In the study, the combination of Keytruda plus Padcev significantly improved overall survival, reducing the risk of death by 53% compared to chemotherapy. The FDA’s decision is expected on May 9, 2024.

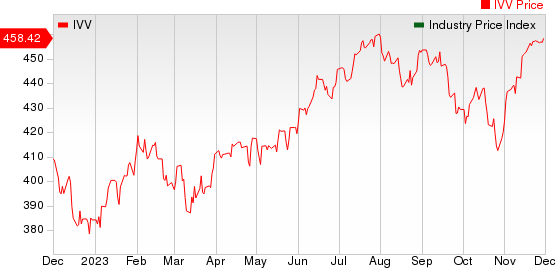

The NYSE ARCA Pharmaceutical Index rose 0.6% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

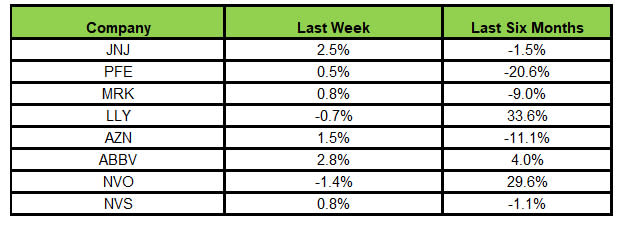

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, AbbVie rose the most (2.8%) while Novo Nordisk declined the most (1.4%).

In the past six months, Lilly has risen the most (33.6%), while Pfizer has declined the most (20.6%).

(See the last pharma stock roundup here: NVO & LLY to Expand Manufacturing Capacity in Europe & More)

What's Next in the Pharma World?

Watch for pipeline and regulatory updates next week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report