Pharvaris (PHVS) Up as FDA Lifts Clinical Hold on HAE Program

Pharvaris N.V. PHVS, a Netherlands-based clinical-stage company, announced that the FDA has lifted the clinical hold on the investigational new drug application for deucrictibant for the prophylactic treatment of hereditary angioedema (HAE) attacks.

A rare genetic disease, HAE, is marked by severe and potentially fatal swelling of the arms, legs, face and throat. The hold was lifted after the FDA reviewed data from a 26-week rodent toxicology study conducted by the company.

Pharvaris’ novel investigational candidate, deucrictibant, is an oral bradykinin B2 receptor antagonist to treat and prevent HAE attacks. The company is developing two formulations of deucrictibant, an immediate-release capsule formulation to enable rapid onset of activity for acute treatment and an extended-release tablet to enable sustained absorption and efficacy in prophylactic treatment. The extended-release formulation of the drug is being evaluated in a phase I study for the prophylaxis treatment of HAE.

The company is gearing up to progress the global development of deucrictibant for long-term prophylaxis after the FDA lifted the clinical hold in the United States. Pharvaris also plans to resume the open-label portion of its phase II proof-of-concept CHAPTER-1 study of deucrictibant for the prevention of HAE attacks in the country.

PHVS also expects to request a meeting with the FDA soon to align on key elements of the anticipated global phase III CHAPTER-3 study of deucrictibant extended-release tablets for the prophylactic treatment of HAE attacks.

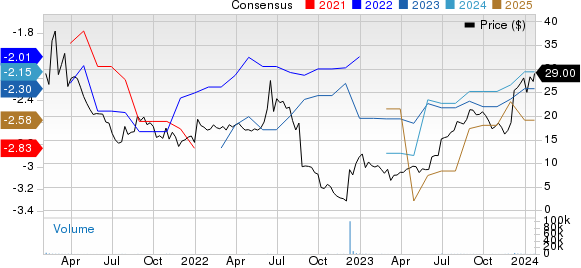

The company’s stock rose 6.3% on Jan 22, in response to the news. In the past year, shares of Pharvaris have skyrocketed 186.8% against the industry’s 14.1% decline.

Image Source: Zacks Investment Research

We remind the investors that in August 2022, the FDA had placed clinical studies of deucrictibant, including the mid-stage CHAPTER-1 study, on hold. The clinical hold in the United States did not, however, affect the regulatory status of deucrictibant outside the country.

Consequently, in June 2023, the FDA removed the clinical hold of deucrictibant for the on-demand treatment of HAE in the United States. The decision was reached after the regulatory body reviewed the data from a preplanned interim analysis of a 26-week rodent toxicology study.

Recently, the company also announced positive top-line results from its phase II CHAPTER-1 study of deucrictibant for the prophylactic treatment of HAE attacks.

Pharvaris N.V. Price and Consensus

Pharvaris N.V. price-consensus-chart | Pharvaris N.V. Quote

Zacks Rank and Stocks to Consider

Pharvaris currently carries a Zacks Rank #3 (Hold).

Some better-ranked drug/biotech stocks worth mentioning are Puma Biotechnology, Inc. PBYI, ADMA Biologics ADMA and Acadia Pharmaceuticals ACAD. While PBYI and ADMA sport a Zacks Rank #1 (Strong Buy) each, ACAD carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Puma Biotech’s 2023 earnings per share (EPS) has increased from 72 cents to 73 cents. During the same time frame, the consensus estimate for Puma Biotech’s 2024 EPS has increased from 64 cents to 69 cents. Over the past year, shares of PBYI have risen 9.2%.

PBYI's earnings beat estimates in three of the last four quarters and missed the same in one, delivering an average surprise of 76.55%.

In the past 30 days, the Zacks Consensus Estimate for ADMA Biologics’ 2023 loss per share has remained constant at 2 cents. The consensus estimate for ADMA Biologics’ 2024 EPS is pegged at 22 cents. Over the past year, shares of ADMA have rallied 49.9%.

ADMA's earnings beat estimates in three of the trailing four quarters and met in one, delivering an average surprise of 63.57%.

In the past 30 days, the Zacks Consensus Estimate for Acadia’s 2023 loss per share has remained constant at 33 cents. During the same time frame, the consensus estimate for Acadia’s 2024 EPS is pegged at $1.04. Over the past year, shares of ACAD have surged 46.1%.

ACAD's earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 20.69%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Pharvaris N.V. (PHVS) : Free Stock Analysis Report