Phibro Animal Health Corp (PAHC) Reports Mixed Q2 Results and Revises FY2024 Guidance

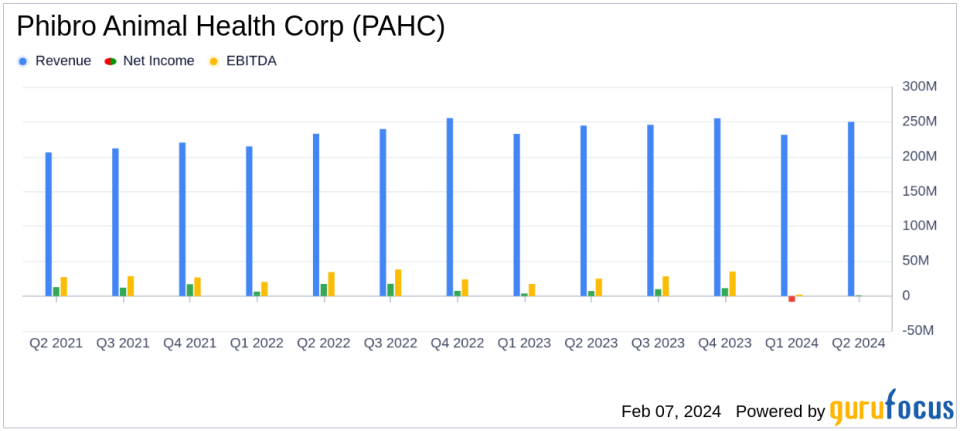

Net Sales: Increased by 2% to $249.9 million in Q2.

Net Income: Decreased by $5.9 million to $1.3 million in Q2.

Adjusted EBITDA: Decreased by 5% to $29.5 million in Q2.

Adjusted Net Income: Slightly decreased by 2% to $13.5 million in Q2.

Adjusted Diluted EPS: Decreased by 2% to $0.33 in Q2.

Guidance: FY2024 net sales guidance affirmed; Adjusted EBITDA, Adjusted Net Income, and Adjusted Diluted EPS guidance updated.

On February 7, 2024, Phibro Animal Health Corp (NASDAQ:PAHC) released its 8-K filing, detailing the financial outcomes for the second quarter ended December 31, 2023. The company, a diversified animal health and mineral nutrition entity, reported a modest increase in net sales but faced a significant decrease in net income and a slight dip in adjusted EBITDA.

Company Overview

Phibro Animal Health Corp operates as a diversified company in the animal health and mineral nutrition industry. It develops, manufactures, and markets a variety of products for food animals including poultry, swine, beef and dairy cattle, and aquaculture. Its portfolio includes antibacterials, anticoccidials, vaccines, and nutritional specialty products. The company's primary revenue driver is its Animal Health segment, which saw a 6% growth in net sales compared to the same quarter last year. Phibro sells its products both in the U.S. and internationally.

Financial Performance and Challenges

The company's net sales saw a slight increase, attributed to growth in the Animal Health segment, particularly from vaccine product introductions in Latin America and increased domestic demand. However, this was offset by decreased demand in the Mineral Nutrition and Performance Products segments. The net income experienced a significant decrease, primarily due to higher selling, general and administrative expenses, increased interest expense, and substantial foreign currency losses, notably from a major devaluation in Argentina.

The challenges faced by Phibro, including inventory imbalances and fluctuating demand, could lead to further problems if not addressed. However, the company's leadership remains optimistic about growth prospects in the Animal Health business and expects improvements in the other segments in the second half of the fiscal year.

Financial Achievements and Importance

Despite the challenges, Phibro managed to achieve a gross profit increase of 2% to $78.6 million, with a gross margin of 31.5%. This is particularly important for a company in the Drug Manufacturers industry, where margins can be indicative of the company's ability to manage costs and sustain profitability. The Animal Health segment's gross profit increased due to higher sales volume and favorable product mix, showcasing the strength of Phibro's core business.

Key Financial Metrics

Important metrics from the financial statements include:

Total debt stood at $476 million.

Adjusted EBITDA for the twelve months ended December 31, 2023, was $108 million.

The effective income tax rate increased significantly to 64.3% for the quarter, due to an unfavorable mix of pre-tax income and related tax provisions.

These metrics are crucial as they provide insights into the company's debt management, operational efficiency, and tax strategy.

Management Commentary

"I am pleased that we once again have delivered very strong top line growth in our core Animal Health segment, with 6% net sales growth as compared to the same quarter last year. Equally important, our Adjusted EBITDA growth in this segment grew at a similar pace, as we were led by the growth of high value new product introductions in our vaccine product line," said Jack Bendheim, Phibros Chairman, President, and Chief Executive Officer.

"We expect continuing growth in our Animal Health business in the second half of the year. We also expect to see significant improvement in our Mineral Nutrition and Performance Products segments in the second half of the year, as we work through inventory imbalances and as we see a rebound in demand," Jack continued.

Analysis of Company's Performance

Phibro's performance in Q2 reflects a mixed outcome with revenue growth overshadowed by declines in net income and adjusted EBITDA. The company's ability to grow its top line in the Animal Health segment is a positive sign, but the overall profitability was hampered by increased expenses and foreign currency losses. The revised guidance for FY2024 suggests that management is recalibrating expectations in light of these challenges.

For more detailed information and to stay updated on Phibro Animal Health Corp's financial performance, visit GuruFocus.com.

About Phibro Animal Health Corporation: Phibro Animal Health Corporation is a leading global diversified animal health and mineral nutrition company. It strives to be a trusted partner with livestock producers, farmers, veterinarians, and consumers who raise or care for farm and companion animals by providing solutions to help them maintain and enhance the health of their animals. For further information, please visit www.pahc.com.

Explore the complete 8-K earnings release (here) from Phibro Animal Health Corp for further details.

This article first appeared on GuruFocus.