Phibro (PAHC) Q2 Earnings Surpass Estimates, 2022 View Up

Phibro Animal Health Corporation’s PAHC adjusted earnings per share (EPS) of 37 cents for the second quarter of fiscal 2022 reflected an 8.8% increase from the year-ago adjusted figure. The metric surpassed the Zacks Consensus Estimate by 12.1%

Meanwhile, without adjustments, GAAP EPS for the second quarter was 43 cents, up 34.4% from the year-ago figure.

Net Sales

In the quarter under review, net sales totaled $232.7 million, up 12.9% from the year-ago quarter.

During the fiscal second quarter, Animal Health net sales increased 10.8% to $150.9 million. Within this segment, sales of medicated feed additives (MFAs) and others were $91.7 million, reflecting 12.4% year-over-year growth, driven by higher demand in North America and South America, indicating ongoing recovery from pandemic-led impact. The processing aids utilized by producers of ethanol, distillers corn oil and distillers grain products contributed $3.5 million to the overall net sales gain in MFAs and other.

Within Animal Health, nutritional specialty product sales rose 2.5% to $37.3 million, primarily due to increased selling prices and volumes as well as increased revenues from companion animal products.

Apart from this, net vaccine sales totaled $21.9 million, showing a rise of 19.7% year over year on increased domestic and international volumes.

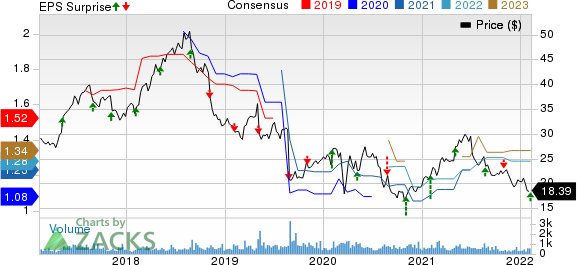

Phibro Animal Health Corporation Price, Consensus and EPS Surprise

Phibro Animal Health Corporation price-consensus-eps-surprise-chart | Phibro Animal Health Corporation Quote

Net sales at the Mineral Nutrition segment rose 23.1% year over year to $66.7 million on the increase in average selling prices of trace minerals correlated to the underlying raw material costs.

Net sales at the Performance Products segment fell 4.4% to $15.1 million. This decline was due to lower average selling prices and reduced volumes in copper-based products, partially offset by higher sales of personal care product ingredients.

Margins

Phibro’s fiscal second-quarter gross profit rose 3.7% year over year to $70.7 million. Gross margin contracted 271 basis points (bps) to 30.4%.

Selling, general and administrative expenses in the reported quarter were $48.4 million, unchanged from the year-ago quarter.

Operating profit rose 12.6% year over year to $22.3 million and operating margin contracted 2 bps to 9.6% in the quarter under review.

Financial Update

The company exited the fiscal second quarter with cash and short-term investments in hand of $95 million compared with $97 million at the end of first-quarter fiscal 2022.

Cumulative net cash used in operating activities at the end of the second quarter was $23.9 million compared with $28.6 million a year ago.

Cumulative capital expenditure amounted to $15.1 million at the end of the second quarter of fiscal 2022, compared with $14.7 in the year-ago figure.

Outlook

Phibro has updated its fiscal 2022 financial guidance.

The company projects net sales for fiscal 2022 in the range of $890.0-$920.0 million, an improvement from the earlier-provided band of $860.0-$890.0 million. The Zacks Consensus Estimate for the metric is pegged at $875.05 million.

Adjusted EPS was reiterated in the band of $1.30-$1.39, up from the earlier-provided band of $1.25-$1.32. The Zacks Consensus Estimate for the same is pinned at $1.28.

Our Take

Phibro exited second-quarter fiscal 2022 with better-than-expected earnings. The year-over-year increase in the top line was primarily driven by continued demand for the company’s products globally. Robust performance by the Animal Health and Mineral Health segments buoys optimism. Further, the company has raised its revenue and EPS guidance for fiscal 2022 on improving business trends.

On the flip side, a decline in net sales at the Performance Products segment raises apprehension. Meanwhile, the increase in raw material costs and freight costs continue to pose challenges. Contraction of both margins is another disadvantage.

Zacks Rank and Key Picks

Phibro currently has a Zacks Rank #3 (Hold).

Here are a few stocks worth considering, as these have the right combination of elements to beat on earnings this reporting cycle.

AMN Healthcare Services, Inc. AMN has an Earnings ESP of +10.29% and a Zacks Rank of #2 (Buy). The company is slated to release fourth quarter and full-year 2021 results on Feb 17. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare’s long-term earnings growth rate is estimated at 16.2%. AMN’s earnings yield of 6.3% compares favorably with the industry’s 0.7%.

Allscripts Healthcare Solutions, Inc. MDRX has an Earnings ESP of +5.38% and a Zacks Rank of #2. Allscripts will release fourth quarter and full-year 2021 results on Feb 24.

Allscripts’ long-term earnings growth rate is estimated at 11.1%. MDRX’s earnings yield of 4.9% compares favorably with the industry’s (4.9%).

Henry Schein, Inc. HSIC has an Earnings ESP of +0.83% and a Zacks Rank of #2. The company will report fourth quarter and full-year 2021 results on Feb 15.

Henry Schein’s long-term earnings growth rate is estimated at 11.8%. HSIC’s earnings yield of 6.1% compares favorably with the industry’s 4.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allscripts Healthcare Solutions, Inc. (MDRX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Phibro Animal Health Corporation (PAHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research