Phibro (PAHC) Q4 Earnings Miss Estimates, Sales Surpass

Phibro Animal Health’s PAHC adjusted earnings per share (EPS) of 36 cents for the fourth quarter of fiscal 2022 reflected a 12.5% increase from the year-ago adjusted figure. However, the metric lagged the Zacks Consensus Estimate by 10%.

Meanwhile, without adjustments, GAAP EPS for the fiscal fourth quarter was 18 cents, down 57.1% from the year-ago figure.

For fiscal 2022, adjusted EPS was $1.31, up 3.2% from the year-ago figure.

Net Sales

In the quarter under review, net sales totaled $255.3 million, up 15.9% from the year-ago quarter. The figure beat the Zacks Consensus Estimate by 0.9%.

Net sales totaled $942.3 million for fiscal 2022, up 13.1% from the year-ago number.

Segmental Sales Break-Up

In the fiscal fourth quarter, Animal Health’s net sales increased 13.5% to $166.5 million. Within the segment, sales of medicated feed additives (MFAs) and others were $101.7 million, reflecting 11.5% year-over-year growth. The uptick was driven by higher demand for MFAs, particularly in the Latin America and Canada regions, and for processing aids used in the ethanol fermentation industry.

Within Animal Health, nutritional specialty product sales rose 15.5% to $42.5 million, primarily banking on higher domestic demand for dairy, growth in the Asia Pacific region and volume growth in the companion animal product.

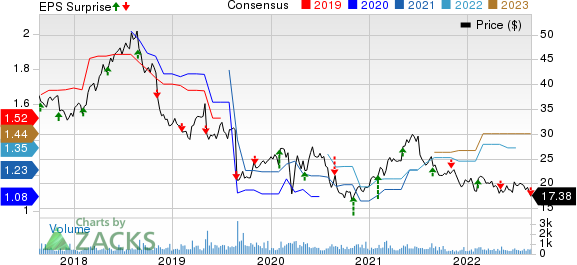

Phibro Animal Health Corporation Price, Consensus and EPS Surprise

Phibro Animal Health Corporation price-consensus-eps-surprise-chart | Phibro Animal Health Corporation Quote

Apart from this, net vaccine sales totaled $22.3 million, showing a year-over-year rise of 19.3% on increased domestic and international uptake.

Net sales in the Mineral Nutrition segment rose 22.2% year over year to $69.4 million on the increase in average selling prices of trace minerals, linked to the movement of the underlying raw material costs.

Net sales in the Performance Products segment rose 15.6% to $19.3 million. This growth was driven by higher volumes and average selling prices of copper-based products, as well as increased volumes of ingredients for personal care products.

Margins

Phibro’s fiscal fourth-quarter gross profit rose 12.5% year over year to $78.5 million. However, the gross margin contracted 94 basis points (bps) to 30.8% on a 17.5% rise in the cost of goods sold to $176.8 million.

Selling, general and administrative expenses in the reported quarter were $55.5 million, up 9.5% from the year-ago quarter.

Operating profit improved 20.4% year over year to $23 million and operating margin expanded 34 bps to 9% in the quarter under review.

Financial Update

The company exited the fiscal fourth quarter with cash and short-term investments in hand of $91 million compared with $93 million at the end of third-quarter fiscal 2022.

Cumulative net cash used in operating activities at the end of the fourth quarter was $31.6 million compared with $48.3 million a year ago.

Cumulative capital expenditure amounted to $37 million at the end of the fourth quarter of fiscal 2022 compared with $29.3 million in the year-ago quarter.

Outlook

Phibro provided its financial guidance for fiscal 2023.

The company expects net sales between $960 million and $1 billion for fiscal 2023. The Zacks Consensus Estimate for the metric is pegged at $971.67 million.

The adjusted EPS is expected to be $1.28-$1.38. The Zacks Consensus Estimate for the same is pegged at $1.44.

Our Take

Phibro exited fourth-quarter fiscal 2022 with better-than-expected revenues. Robust performances across Animal Health, Mineral Health and Performance Products segments are encouraging. The growing uptake of MFAs, dairy products and vaccines buoy optimism. The expansion of the operating margin is an added advantage. The company’s sales outlook for fiscal 2023 reflects substantial growth from the fiscal 2022 figure, raising investors’ confidence.

On the flip side, the company’s earnings for the quarter missed the consensus mark. The contraction in the gross margin is discouraging. The increase in raw material and production costs also continue to pose challenges.

Zacks Rank and Key Picks

Phibro currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space, which have announced quarterly results, are AMN Healthcare Services, Inc. AMN, McKesson Corporation MCK and Merck & Co. MRK.

AMN Healthcare, currently sporting a Zacks Rank #1 (Strong Buy), reported a second-quarter 2022 adjusted EPS of $3.31, which beat the Zacks Consensus Estimate by 11.8%. Revenues of $1.43 billion outpaced the consensus mark by 4.8%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has an estimated long-term growth rate of 3.2%. AMN’s earnings surpassed estimates in all the trailing four quarters, the average being 15.7%.

McKesson, presently carrying a Zacks Rank #2 (Buy), reported first-quarter fiscal 2023 adjusted EPS of $5.83, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $67.2 billion outpaced the consensus mark by 5.2%.

McKesson has an estimated long-term growth rate of 9.9%. MCK surpassed earnings estimates in the trailing three quarters and missed on one occasion, delivering a surprise of 13%, on average.

Merck reported second-quarter 2022 adjusted earnings of $1.87 per share, beating the Zacks Consensus Estimate by 11.9%. Revenues of $14.6 billion surpassed the Zacks Consensus Estimate by 5.4%. It currently carries a Zacks Rank #2.

Merck has a long-term estimated growth rate of 10.1%. MRK’s earnings surpassed estimates in the trailing four quarters, the average surprise being 16.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Phibro Animal Health Corporation (PAHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research