Philip Morris (PM) Rewards Investors With Dividend Hike

Philip Morris International Inc. PM is focused on enhancing shareholders’ returns. The leading international tobacco company hiked its regular quarterly dividend by 2.4%. This takes the annualized rate to $5.20 per share.

The company will pay a quarterly dividend of $1.30 per share, up from the previous rate of $1.27 per share. The hiked dividend will be payable on Oct 12, 2023, to shareholders of record as of Sep 27.

Philip Morris currently has a dividend payout of 86%, a dividend yield of 5.4% and a free cash flow yield of 5%. With an annual free cash flow return on investment of 18.7%, the increased dividend is likely to be sustainable. Dividend payouts are one of the biggest enticements for investors and Philip Morris is committed to boosting shareholders’ value.

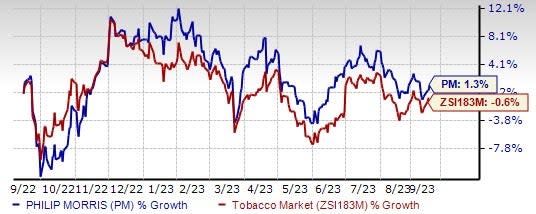

Image Source: Zacks Investment Research

What Else Should You Know?

Philip Morris has been benefiting from its strong pricing power, which has aided its revenues and adjusted operating income even in the face of the unfavorable tax environment and declining cigarette volumes. Though higher pricing might lead to a possible decline in cigarette consumption, it is seen that smokers tend to absorb price increases owing to the addictive quality of cigarettes. Higher pricing variance was an upside to the company’s performance (mainly due to increased combustible tobacco pricing) in the second quarter of 2023.

Serious health hazards due to cigarette smoking have pushed consumers toward low-risk, reduced risk products (RRPs). The company is progressing well with its business transformation, with smoke-free products generating 35.4% of the company’s net revenues in the second quarter of 2023. The company is well placed to become a majority smoke-free company by 2025. Toward this end, the company’s IQOS, a heat-not-burn device, counts as one of the leading RRPs in the industry.

Shares of this Zacks Rank #3 (Hold) company have inched up 1.3% in the past year against the industry’s decline of 0.6%.

Looking for Solid Consumer Staple Stocks? Check These

MGP Ingredients MGPI, which produces and markets ingredients and distillery products, currently sports a Zacks Rank #1 (Strong Buy). MGPI has a trailing four-quarter earnings surprise of 18% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and earnings per share suggests growth of 5.8% and 10.4%, respectively, from the corresponding year-ago reported figures.

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 2.3%.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales suggests growth of 6.7% from the year-ago period’s actuals. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

McCormick & Company MKC, a manufacturer, marketer and distributor of spices, seasoning mixes and condiments, currently carries a Zacks Rank #2. The company has an expected EPS growth rate of 7.5% for three-five years.

The Zacks Consensus Estimate for McCormick’s current financial-year sales and EPS suggests 6.4% and 5.1% growth, respectively, from the year-ago reported figures. MKC has a trailing four-quarter earnings surprise of 4.2% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report