Philip Morris' (PM) Smoke-Free Strength & Pricing Bode Well

Philip Morris International Inc. PM has demonstrated impressive resilience amid rising costs due to its smoke-free strength and pricing power. The consistent success of IQOS and the impressive growth of ZYN have solidified the company’s position, keeping it well-placed to become a majority smoke-free company by 2030.

Smoke-Free Transition on Track

Given consumers’ rising inclination toward reduced-risk products (RRPs), Philip Morris is progressing well with its business transformation, with smoke-free products generating 39.3% of the company’s net revenues in the fourth quarter of 2023. The company aims to generate more than two-thirds of its total revenues from smoke-free products by 2030.

To this end, the company’s IQOS, a heat-not-burn device, counts among one of the leading RRPs in the industry. In the fourth quarter, IQOS surpassed Marlboro in net revenues, becoming the leading international nicotine brand. The company expects such advanced and high-quality products to aid adult smokers in switching from traditional cigarettes to smoke-free options. IQOS ILUMA is expected to aid continued solid IQOS user growth in 2024 and ahead.

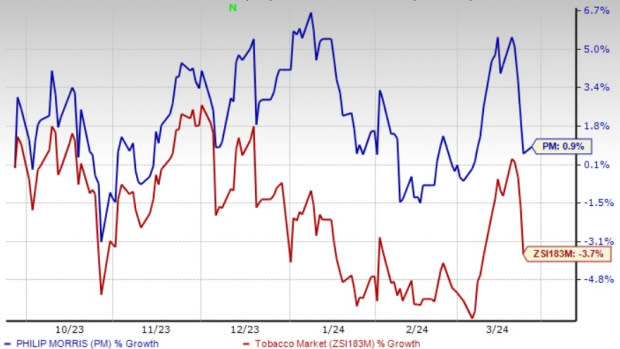

Image Source: Zacks Investment Research

Philip Morris recently unveiled its peak innovation, the IQOS ILUMA i, which offers an array of advanced features, promising users a cleaner, more seamless and highly flexible experience. Among other initiatives, Philip Morris became the majority owner of Swedish Match in November 2022 and witnessed impressive results, driven by the spectacular performance of ZYN in the United States.

In the fourth quarter of 2023, revenues from smoke-free products (excluding Wellness and Healthcare) jumped 21.7% to $3,489 million (up 14.2% organically). Total IQOS users at the end of 2023 were estimated at roughly 28.6 million, up 3.7% year over year. This includes nearly 20.8 million who switched to IQOS and stopped smoking. In 2024, management expects an acceleration in organic smoke-free net revenues and an increase in smoke-free gross profit from the 2023 levels. It expects an adjusted in-market volume increase of 14-16% for HTUs.

Pricing Power Aids Amid Hurdles

In the fourth quarter of 2023, Philip Morris’ profits were partially hurt by increased marketing, administration and research costs (stemming from inflation), as well as escalated manufacturing costs. PM witnessed considerable inflationary pressures on leaf, direct materials and other manufacturing costs. Management expects the increased cost of leaf and wages to linger in 2024 before easing thereafter. Philip Morris is also focused on making innovation-related investments to grow its smoke-free portfolio, especially the IQOS ILUMA. These investments may impact profits.

Additionally, cigarette volumes, in general, have been affected by consumers’ rising health consciousness and a shift to low-risk tobacco alternatives. In the fourth quarter, total cigarette and HTU shipment volumes fell by 0.5% to 185.1 billion units. In 2024, the total international industry volume for cigarettes and HTUs is estimated in the range of a decline of 2% to flat (excluding China and the United States). For Philip Morris, the total cigarette, HTU and oral smoke-free product shipment volume increase is likely to range between flat and rise 1%, mainly backed by smoke-free product strength.

That said, Philip Morris has been benefiting from its strong pricing power. Though higher pricing might lead to a possible decline in cigarette consumption, it is seen that smokers tend to absorb price increases due to the addictive quality of cigarettes. Higher pricing variance was an upside to the company’s performance (mainly due to increased combustible tobacco pricing) in the fourth quarter of 2023 and is likely to be a driver. For 2024, management expects net revenues to increase 6.5-8% on an organic basis.

Also, Philip Morris remains confident about its CAGR targets for 2024-2026, which include organic top-line growth of 6-8%, organic operating income growth of 8-10 and currency-neutral adjusted EPS growth of 9-11%.

Shares of this Zacks Rank #3 (Hold) company have increased 0.9% in the past six months against the industry’s decline of 3.7%.

Solid Staple Picks

The Chef’s Warehouse CHEF, which engages in the distribution of specialty food products, currently carries a Zacks Rank #2 (Buy). CHEF has a trailing four-quarter earnings surprise of 3.2%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal-year sales and earnings suggests growth of 8.7% and 4.7%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank #2. VITL has a trailing four-quarter average earnings surprise of 155.4%.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 18.6% and 35.6%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks, currently carrying a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2.6%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 15.8% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report