Philip Morris Stock (NYSE:PM) Under $90 Calls Dividend Seekers

Philip Morris stock (NYSE:PM) has been traditionally held by dividend investors who seek a reliable and steady quarterly income. Displaying a noteworthy pattern in its trading history, the stock consistently finds robust support around the $90 mark. Investors have historically seized the opportunity to capitalize on the stock’s above-average yield at these levels. With shares now trading below this key point after its Q4 results, I believe Philip Morris now presents a compelling entry point. Thus, I am bullish on the stock.

A Look at Philip Morris Stock’s Trading Pattern

I usually don’t pay attention to a stock’s trading patterns, as I generally find little merit in technical analysis and arbitrary lines when assessing an investment opportunity. Nevertheless, I must admit that Philip Morris stock, in particular, features a very distinct trading pattern. Looking at the stock’s trading chart, you will quickly realize that the stock tends to see strong support below $90 and encounter strong resistance above $100.

I believe two forces are at play behind this consistent trading pattern. On the support front, there appears to be a magnetic attraction for investors when the stock dips below $90, driven by the allure of a hefty dividend yield (usually 5.8%+) at these levels. The robust dividend prospects of Philip Morris and notable yield form an enticing risk/reward proposition here.

Conversely, resistance kicks in around the $100 mark, where investors perceive heightened risk, leading to a less attractive risk/reward ratio. Philip Morris’ investment landscape comes with notable risks, including regulatory uncertainties surrounding consumer health concerns, a declining population of smokers, and intense competition in the heated tobacco and oral nicotine markets.

In the present market scenario, it seems increasingly likely that the first force will come into play sooner rather than later, urging investors back into an accumulation phase below the $90 mark. The company’s Q4 results appeared to fall short of estimates at first glance, thus justifying the slight post-earnings sell-off. That said, I believe the numbers were rather strong, while management’s promising outlook for 2024 should instill confidence in investors, further supporting the stock price at its current levels.

FY2024: Building Momentum on Strong FY2023 Results

Philip Morris concluded Fiscal 2023 on a robust note, propelling the company into a promising trajectory for Fiscal 2024. Despite encountering the customary challenges associated with diminishing demand for combustibles, the company’s Heated Tobacco and Oral portfolios showcased remarkable growth, marking Fiscal 2023 as a record-breaking year for revenues and adjusted earnings.

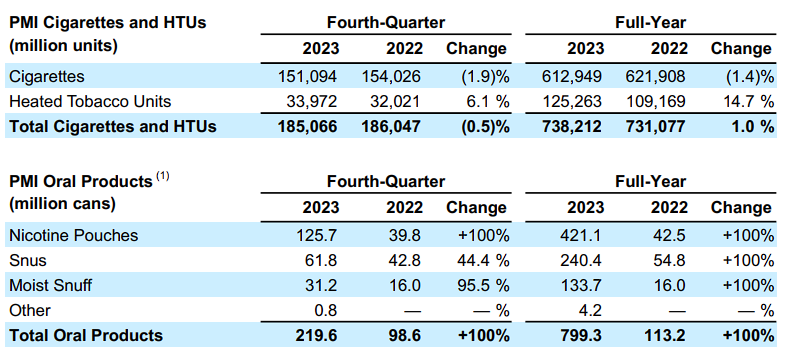

Specifically, while Cigarette shipment volumes witnessed a marginal decline of 1.4% throughout the year, Heated Tobacco shipment volumes rose by 14.7%. Moreover, oral nicotine product shipment volumes saw an extraordinary uptick, skyrocketing by 606% compared to the previous year. This increase reflects Philip Morris’ acquisition of Swedish Match in late 2022, which enriched its Oral category product portfolio.

The result of notable shipment volume increases and strong pricing power led to net revenues for the year growing by 7.8% in constant currency to a new all-time high of $35.2 billion.

Philip Morris also posted robust profitability, a crucial aspect for a company primarily catering to income-oriented investors seeking increasing dividends. The company reported adjusted EPS of $6.01, marking a year-over-year increase of 11%. Furthermore, management anticipates the continued strength in the adoption of heated tobacco and oral nicotine products throughout 2024.

Projections indicate a 14% to 16% rise in Heated Tobacco shipment volumes, with an estimated shipment of approximately 520 million cans of nicotine pouches in the U.S. This represents a substantial year-over-year increase of 23%, considering the company shipped 421.1 million pouches the previous year. Based on these factors, the company expects net revenue growth of 6.5% to 8% on an organic basis, coupled with adjusted EPS ranging between $6.43 and $6.55, suggesting continued bottom-line growth.

Philip Morris’ Dividend Case Shines Again

It appears that the Philip Morris dividend case is shining again, driven by the stock trading below $90 and the anticipation of Fiscal 2024 marking a year of record adjusted EPS. The former factor translates to an above-average yield for investors, which currently hovers at 5.8%, while the latter factor suggests increased dividend coverage, thus improving dividend growth prospects.

It’s worth noting that Philip Morris has a remarkable history of consistently increasing its dividend, dating back to its time as part of Altria (NYSE:MO), proudly boasting an unofficial (due to being spun-off) streak of 54 consecutive years of annual dividend increases.

Is PM Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Philip Morris carries a Moderate Buy consensus rating based on seven Buys and three Hold recommendations assigned in the past three months. At $103.80, the average Philip Morris stock price target suggests 16.4% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell PM stock, the most profitable analyst covering the stock (on a one-year timeframe) is Gaurav Jain of Barclays (NYSE:BCS), with an average return of 11.01% per rating and a 63% success rate.

The Takeaway

Overall, I believe Philip Morris presents a compelling opportunity for investors, particularly income-oriented ones. The stock’s distinct trading pattern, with robust support below $90 and resistance around $100, suggests it might be prime time to be bullish.

In the meantime, Philip Morris posted strong results in Fiscal 2023, while management suggests that the company is positioned for sustained momentum in 2024. With an anticipated rise in heated tobacco and oral nicotine products set to keep driving earnings growth and, thus, dividend growth, Philip Morris appears to be an attractive income pick, in my view.