Philippe Laffont's Coatue Management Makes a Significant Bet on Salesforce in Q4 2023

Coatue Management's Latest 13F Filing Highlights Key Tech Investments and Portfolio Adjustments

Philippe Laffont (Trades, Portfolio), the founder of Coatue Management, has a reputation for his tech-savvy investment strategies. A disciple of Julian Robertson's Tiger Management (Trades, Portfolio), Laffont established Coatue in 1999 and has since focused on leveraging fundamental analysis to navigate the tech landscape. With a keen eye for both long and short opportunities, Coatue Management has become a prominent name in the investment community, particularly for its significant stakes in the information technology sector. The firm's latest 13F filing for Q4 2023 offers a glimpse into its strategic moves and portfolio adjustments during a dynamic period for the market.

Summary of New Buys

Philippe Laffont (Trades, Portfolio)'s Coatue Management has expanded its portfolio with 29 new stocks. Noteworthy additions include:

Salesforce Inc (NYSE:CRM), with 2,144,062 shares, making up 2.37% of the portfolio and valued at $564.19 million.

Apple Inc (NASDAQ:AAPL), comprising 2,444,368 shares, representing 1.97% of the portfolio, with a total value of $470.61 million.

Domino's Pizza Inc (NYSE:DPZ), with 783,202 shares, accounting for 1.35% of the portfolio and a total value of $322.86 million.

Key Position Increases

Coatue Management also bolstered its holdings in 19 stocks, with significant increases in:

Intuitive Surgical Inc (NASDAQ:ISRG), adding 516,054 shares for a total of 1,301,595 shares. This represents a 65.69% increase in share count, impacting the portfolio by 0.73%, and valued at $439.11 million.

Adobe Inc (NASDAQ:ADBE), with an additional 243,218 shares, bringing the total to 1,475,381. This adjustment marks a 19.74% increase in share count, with a total value of $880.21 million.

Summary of Sold Out Positions

During the fourth quarter of 2023, Philippe Laffont (Trades, Portfolio) exited 16 holdings, including:

Paramount Global (NASDAQ:PARA), selling all 4,894,992 shares, impacting the portfolio by -0.32%.

Gap Inc (NYSE:GPS), liquidating all 4,011,859 shares, causing a -0.22% impact on the portfolio.

Key Position Reductions

Notable reductions in Coatue Management's portfolio encompass 44 stocks, with the most significant being:

Alphabet Inc (NASDAQ:GOOGL), reduced by 3,302,342 shares, resulting in a -63.71% decrease and a -2.19% portfolio impact. The stock traded at an average price of $134.36 during the quarter.

Intuit Inc (NASDAQ:INTU), reduced by 729,866 shares, marking a -48.62% reduction and a -1.89% portfolio impact. The stock traded at an average price of $551.59 during the quarter.

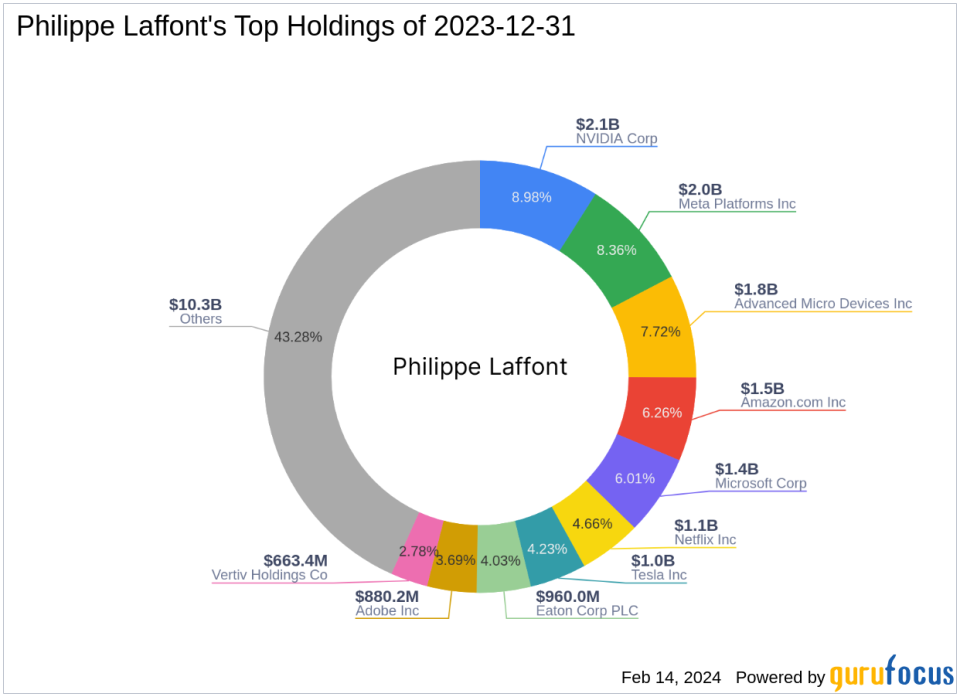

Portfolio Overview

As of Q4 2023, Philippe Laffont (Trades, Portfolio)'s portfolio comprised 100 stocks, with top holdings including 8.98% in NVIDIA Corp (NASDAQ:NVDA), 8.36% in Meta Platforms Inc (NASDAQ:META), 7.72% in Advanced Micro Devices Inc (NASDAQ:AMD), 6.26% in Amazon.com Inc (NASDAQ:AMZN), and 6.01% in Microsoft Corp (NASDAQ:MSFT). The investments span across 10 of the 11 industries, with a strong focus on Technology, Communication Services, Consumer Cyclical, and other sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.