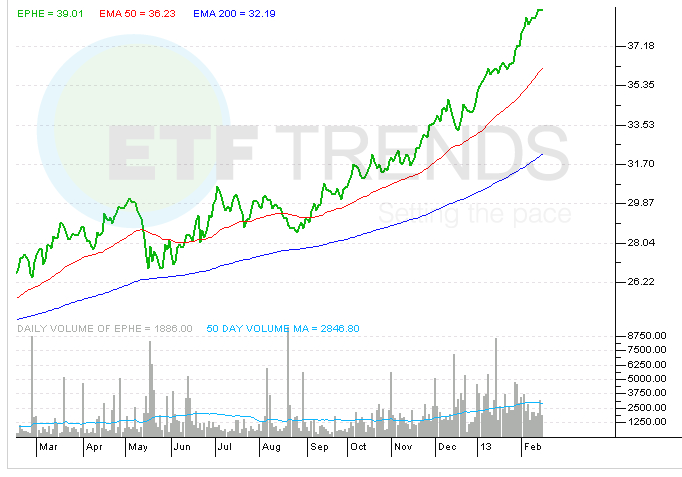

Philippines ETF Rises to Lifetime High

A specialized ETF that has made a name for itself in terms of impressive outperformance compared to broad Emerging Markets benchmarks such as the MSCI EM Index is EPHE (iShares MSCI Philippines Investable Market Index, Expense Ratio 0.59%).

The fund debuted in September of 2010 and has raised more than $300 million in assets under management, recently closing at an all-time product high on Friday.

EPHE remains the only ETF in the landscape that provides direct exposure to the equity market of the Philippines, and thus has that “first comer advantage” that has been a driving force in asset raising for many ETFs over the years.

From a portfolio breakdown standpoint, the fund has its highest weightings to Real Estate (20.42%), Consumer Discretionary (20.15%), Utilities (15.85%), and Financial Services (13.78%), followed by smaller weightings to other sectors.

Top individual equity holdings in EPHE weigh in as the following SM Investments (10.38%), Ayala Land Inc. (7.99%), Philippine Long Distance Telephone (6.20%), SM Prime Holdings Inc. (6.12%), and BDO Unibank Inc. (5.62%).

Averaging more than 269,000 shares per day on a daily basis traded, the fund is showing little signs of slowing down, particularly if Asian based equities and particularly Emerging Markets in general continue their 2012 rally.

iShares MSCI Philippines

For more information on Street One ETF research and ETF trade execution/liquidity services, contact Paul Weisbruch at pweisbruch@streetonefinancial.com.