Philips (PHG) Adds Smart Fit Coils to Boost Diagnostic Imaging

Philips PHG unveiled three new ultra-lightweight magnetic resonance (MR) Smart Fit coils, namely Smart Fit TorsoCardiac 1.5T, Smart Fit 1.5T shoulder and Smart Fit Knee 3.0T at RSNA 2023.

Notably, the Smart Fit TorsoCardiac 1.5T coil is a versatile, thin, flexible and lightweight device designed for cross-sectional images of the head, body or extremities. It can bend over 90 degrees and be used for difficult anatomies.

The Smart Fit 1.5T shoulder coil is designed to enhance radiology productivity by 10%, whereas The Smart Fit Knee 3.0T coil is versatile and easy to use with a wide range of patients.

Additionally, all three coils offer enhanced flexibility, reduced patient setup time and improved image quality resolution with SmartSpeed AI solution.

Philips is expected to gain solid traction across healthcare providers on the back of its latest move.

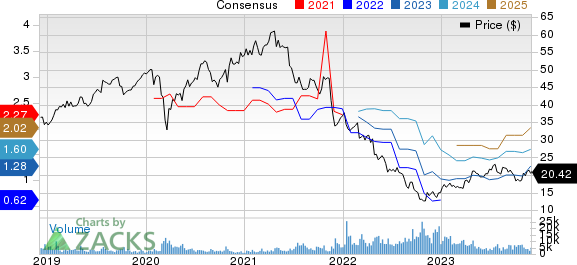

Koninklijke Philips N.V. Price and Consensus

Koninklijke Philips N.V. price-consensus-chart | Koninklijke Philips N.V. Quote

Growth Prospects

The latest move is in sync with the company’s deepening focus on strengthening its position in the global magnetic resonance imaging (MRI) market. This, in turn, will solidify its footing in the global diagnostic imaging market.

Per a Fortune Business Insights report, the global MRI imaging equipment market is expected to reach $11.5 billion by 2030, exhibiting a CAGR of 6.3% between 2023 and 2030.

A Mordor Intelligence report indicates that the global diagnostic imaging market will witness a CAGR of 6.1% during the forecast period of 2023-2028.

We believe the company’s growing prospects in these promising markets will likely instill investor optimism in the stock.

Philips has gained 36.2% on a year-to-date basis against the industry’s decline of 5.4%.

Diagnosis & Treatment Segment in Focus

The company’s growing efforts to bolster its Diagnosis & Treatment segment are evident from its product releases at RSNA 2023.

Notably, Philips has showcased BlueSeal MR Mobile, the world’s first helium-free mobile MRI system, at RSNA 2023. The new MRI system, featuring a lightweight 1.5T fully sealed magnet and requiring only 7 liters of liquid helium, offers cost and up-time advantages for diagnostic imaging.

Further, the company introduced Philips HealthSuite Imaging, a cloud-based Picture Archiving and Communication System, enhancing patient care, operational efficiency and IT management by providing high-speed remote diagnostic reading, integrated reporting and AI-enabled workflow orchestration.

Additionally, Philips introduced next-generation ultrasound systems, namely EPIQ Elite 10.0 and Philips Affiniti, to simplify clinical workflows with a single-user interface, shared transducers and automated tools, enhancing user experience.

All the above-mentioned endeavors are expected to enhance the underlined segment’s performance in the upcoming period.

In the third quarter of 2023, Philips reported Diagnosis & Treatment revenues of €2.2 billion, registering growth of 6% from the year-ago quarter.

Philips expects the 2023 Diagnosis & Treatment segment’s revenues to witness high-single-digit to double-digit growth.

Strength in the underlined segment will likely aid the company’s overall financial performance in the near term.

Philips expects 2023 comparable sales growth in the band of 6-7%.

Zacks Rank & Stocks to Consider

Currently, Philips carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical market sector are DaVita DVA, DexCom DXCM and Fate Therapeutics FATE. While DaVita sports a Zacks Rank #1 (Strong Buy), DexCom and Fate Therapeutics carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita shares have gained 35.9% in the year-to-date period. The long-term earnings growth rate for DVA is currently projected at 18.25%.

DexCom shares have gained 2% in the year-to-date period. DXCM’s long-term earnings growth rate is currently projected at 33.59%.

Fate Therapeutics shares have lost 75.3% in the year-to-date period. The long-term earnings growth rate for FATE is currently projected at 29.49%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Koninklijke Philips N.V. (PHG) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Fate Therapeutics, Inc. (FATE) : Free Stock Analysis Report