Philips' (PHG) New Innovation to Boost Radiation-Free Imaging

Koninklijke Philips PHG recently announced the introduction of its new imaging technology, LumiGuide, powered by Fiber Optic RealShape (FORS) technology. LumiGuide uses light instead of X-ray to enable doctors to navigate through blood vessels.

This latest innovation has the potential to provide numerous benefits for complex aortic procedures and is likely to be more effective and efficient compared to X-ray imaging as X-ray only produces 2D black and white images along with harmful radiations.

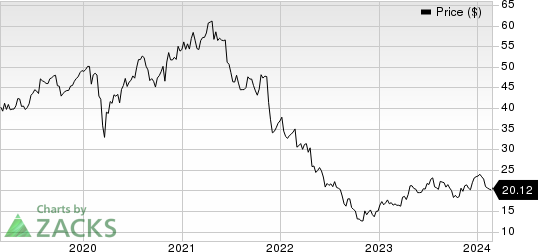

Price Performance

For the past six months, PHG’s shares have lost 8.6% against the industry’s rise of 8.9%. The S&P 500 increased 14.6% in the same time frame.

Image Source: Zacks Investment Research

More on LumiGuide Imaging Technology

LumiGuide creates real-time, 3D, high-resolution color images of devices, including commercial catheters, within a patient's body in various viewpoints and at any angle by using light reflected along an optical fiber inside a guidewire. It indicates that doctors are aware of which way their equipment is pointed and can observe their intended route. All of this navigation is possible without an X-ray.

According to Philips, the company has already seen encouraging research outcomes from more than 900 patients who have had operations using LumiGuide. Compared to an X-ray, one location resulted in a 37% reduction in the duration of the challenging aortic surgery and a 56% decrease in radiation exposure.

The company has now made LumiGuide available to major aortic clinics that undertake complex aortic procedures in the United States and Europe. LumiGuide was initially utilized to treat patients in the Netherlands in late 2023.

Philips intends to gather additional clinical data at current locations before LumiGuide is made available globally. It intends to expand the technology's compatibility and potentially expand its application beyond aortic surgeries.

Technology Benefits

For complicated aortic surgeries, LumiGuide's radiation-free technology offers potentially revolutionary advantages. In vascular surgery, doctors frequently use tools like catheters and guidewires to do endovascular surgery via arteries like the femur.

For many years, the only method available to clinicians for guiding their devices via blood vessels was x-rays. However, x-rays can be harmful. Apart from its potentially hazardous radiation, x-rays can only create two-dimensional, black-and-white images. As doctors perform more intricate endovascular operations, such as repairing an aortic aneurysm cases take longer, and patients and doctors receive larger radiation doses as a result.

The next-generation FORS solution, LumiGuide, is only compatible with Philips interventional systems such as Azurion. LumiGuide has additional time-saving capabilities in addition to building upon the knowledge, information, and clinical input from the first limited edition engine and devices utilized at the nine locations.

With LumiGuide, physicians may expedite procedure times and improve accuracy by using AI-based recognition to register the guidewire rapidly and efficiently with the image-guided therapy platform, eliminating the need for manual device registration.

Industry Prospects

Per a report by Precedence Research, the global diagnostic imaging market was estimated at $28.1 billion in 2022 and is expected to reach more than $51.5 billion by 2032 at a growth rate of 6.3%.

The rising demand for the early detection of diseases is significantly fueling growth of the global diagnostic imaging market. The rising prevalence of various chronic diseases and the growing geriatric population are the major drivers of the diagnostic imaging market.

Moreover, the demand for diagnostic imaging is exponentially rising owing to the growing old age population, as old age people are more prone to various diseases and are required to be monitored frequently.

With the given market potential for diagnostic imaging, Philips is likely to boost its business with its latest LumiGuide technology, which provides an edge over the traditionally used X-ray imaging.

Notable Developments

Philips recently announced the FDA 510(k) clearance for its latest X11-4t Mini 3D TEE transducer, designed to serve more patients with improved overall comfort. This latest innovation has the potential to remove anesthetic during shorter heart procedures and is likely to serve a broader spectrum of patients ranging from pediatric to older adults.

In December 2023, Philips announced three new ultra-lightweight magnetic resonance Smart Fit coils, namely Smart Fit TorsoCardiac 1.5T, Smart Fit 1.5T shoulder and Smart Fit Knee 3.0T at RSNA 2023.

All three coils enhance flexibility, reduce patient setup time, and improve image quality resolution with SmartSpeed AI solution.

Koninklijke Philips N.V. Price

Koninklijke Philips N.V. price | Koninklijke Philips N.V. Quote

Zacks Rank & Stocks to Consider

PHG carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space that have announced quarterly results are Cencora, Inc. COR, Elevance Health, Inc. ELV and Cardinal Health, Inc. CAH.

Cencora, carrying a Zacks Rank of 2 (Buy), reported first-quarter fiscal 2024 adjusted earnings per share (EPS) of $3.28, beating the Zacks Consensus Estimate by 14.7%. Revenues of $72.25 billion outpaced the consensus mark by 5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cencora has a long-term estimated growth rate of 8.6%. COR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 6.7%.

Elevance Health reported fourth-quarter 2023 adjusted EPS of $5.62, beating the Zacks Consensus Estimate by 1.3%. Revenues of $42.45 billion outpaced the consensus mark by 1.5%. It currently carries a Zacks Rank #2.

Elevance Health has a long-term estimated growth rate of 12%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.1%.

Cardinal Health reported second-quarter fiscal 2024 adjusted EPS of $1.82, beating the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion surpassed the Zacks Consensus Estimate by 1.1%. It currently carries a Zacks Rank #2.

Cardinal Health has a long-term estimated growth rate of 15.9%. CAH’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 15.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Koninklijke Philips N.V. (PHG) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report