Philips (PHG) Q4 Earnings Beat Estimates, Revenues Fall Y/Y

Koninklijke Philips N.V. PHG reported fourth-quarter 2023 adjusted earnings of 44 cents per share, outpacing the Zacks Consensus Estimate by 7.3%.

Revenues of $5.45 billion missed the consensus mark by 0.4%.

In domestic currency, sales decreased 7% on a year-over-year basis to €5.06 billion.

Comparable sales (including adjustments for consolidation charges & currency effects) declined 1% year over year. The decline was attributed to provisions charged to sales of €174 million, mainly in connection with the Respironics consent decree, excluding which comparable sales increased 3% year over year.

This growth was primarily attributed to the robust performance of the Diagnosis & Treatment and Personal Health segments.

Comparable sales in the Diagnosis & Treatment and Personal Health businesses recorded mid-single-digit and high-single-digit growth year over year, respectively.

However, comparable sales in the Connected Care business witnessed a low double-digit decline on a year-over-year basis.

Further, Philips’ comparable order intake declined 3% year over year in the reported quarter, primarily due to tough comparison.

Sales improved 7% on a comparable basis in growth geographies. Sales in mature geographies were down 4% year over year on a comparable basis.

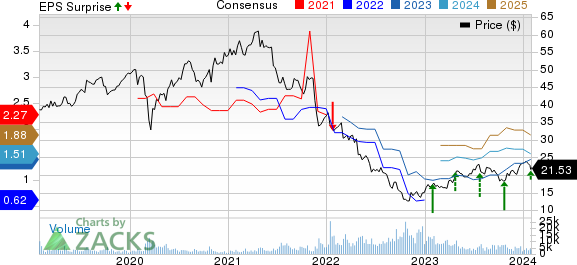

Koninklijke Philips N.V. Price, Consensus and EPS Surprise

Koninklijke Philips N.V. price-consensus-eps-surprise-chart | Koninklijke Philips N.V. Quote

Segmental Update

Diagnosis & Treatment revenues declined 2% from the year-ago quarter to €2.5 billion. Comparable sales jumped 5% year over year, driven by high-single-digit growth in Image-Guided Therapy.

Connected Care revenues decreased 17% year over year to €1.35 billion. Comparable sales fell 11%. Excluding provisions charged to sales related to Respironics consent decree, comparable sales remained flat with high single-digit growth in Enterprise Informatics.

Personal Health revenues rose 1% year over year to €1.07 billion. Comparable sales rose 7% year over year, owing to strength in Personal Care.

Other segment sales amounted to €143 million, down 26.3% on a year-over-year basis.

Operating Details

Gross margin contracted 550 basis points (bps) on a year-over-year basis to 35.5% in the reported quarter.

General & administrative expenses, as a percentage of sales, were 2.8%, which contracted 80 bps on a year-over-year basis. Moreover, selling expenses expanded 40 bps to 24.1%. Research & development expenses dipped 30 bps to 8.9%.

Restructuring, acquisition-related and other charges came in at €547 million compared with €350 million a year ago.

Operating model productivity, procurement and other productivity programs delivered savings of €149 million, €64 million and €58 million, respectively. This resulted in total savings of €271 million.

Phillips’ adjusted earnings before interest, taxes and amortization (EBITA) — the company’s preferred measure of operational performance — rose 0.3% year over year to €653 million. EBITA margin expanded 90 bps on a year-over-year basis to 12.9% in the reported quarter.

Diagnosis & Treatment’s adjusted EBITA margin contracted 180 bps on a year-over-year basis to 10.4%, primarily due to an unfavorable mix and phasing of production and costs.

Connected Care’s adjusted EBITA margin was 13.3% in the reported quarter, which expanded 170 bps on a year-over-year basis.

Personal Health’s adjusted EBITA margin expanded 290 bps on a year-over-year basis to 19.9%.

Balance Sheet

As of Dec 31, 2023, Philips’ cash and cash equivalents were €1.87 billion compared with €1.15 billion as of Sep 30, 2023. Total debt was €7.7 billion compared with €8.16 billion as of Sep 30, 2023.

Operating cash flow was €1.3 billion against the year-ago quarter’s operating cash flow of €540 million.

Free cash flow was €1.13 million against the year-ago quarter’s free cash flow of €303 million.

2024 Guidance

Philips expects to deliver 3-5% of comparable sales growth.

Further, adjusted EBITA margin is expected in the band of 11-11.5%.

Philips expects free cash flow to be between €800 million and €1 billion.

Zacks Rank & Stocks to Consider

Currently, Philips carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical market sector are DaVita DVA, Amedisys AMED and Encompass Health EHC. While DaVita sports a Zacks Rank #1 (Strong Buy) at present, Amedisys and Encompass Health carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita shares have gained 31.5% in the past year. The long-term earnings growth rate for DVA is currently projected at 17.26%

Amedisys shares have lost 1.5% in the past year. AMED’s long-term earnings growth rate is currently projected at 9.58%.

Encompass Health shares have lost 14.7% in the past year. The long-term earnings growth rate for EHC is currently projected at 13.51%

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amedisys, Inc. (AMED) : Free Stock Analysis Report

Koninklijke Philips N.V. (PHG) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report