PHIO Jumps 91% on Encouraging Preclinical Cancer Drug Data

Shares of Phio Pharmaceuticals Corp PHIO surged 91.2% on Wednesday after the company announced favorable data from two preclinical studies on its cancer drug candidate PH-894.

Data from the first study showed that melanoma cells treated with PH-894 enhance their recognition of immune cells. This, in turn, increases their susceptibility to destruction by T cells. Based on this data, management concluded that PH-894 offers a strategy to reduce BRD4 expression (a protein associated with cancer growth) and simultaneously boost the immune response to cancer cells while minimizing the toxicities commonly associated with traditional systemic therapies.

Data from another study demonstrated the effectiveness of PH-894 as an antitumor cytotoxic agent, i.e., directly killing tumor cells. This is based on in vitro tests conducted by management on multiple cancer cell lines (like breast cancer, lung cancer and ovarian cancer, among others) wherein treatment with PH-894 induces concentration-associated apoptosis (i.e., the process of programmed cell death).

The overall data from the above two studies show that PH-894 provides a novel and safe approach to inhibit BRD-4 expression for treating cancer indications that rely on systemic approaches that generate significant toxicity.

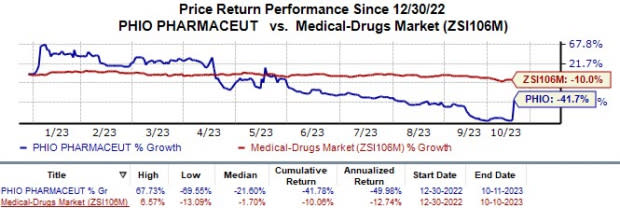

Shares of Phio Pharmaceuticals have lost 41.7% year to date compared with the industry’s 10.0% decline.

Image Source: Zacks Investment Research

Data from the above preclinical studies will be presented at the AACR-NCI-EORTC International Conference on Molecular Targets and Cancer Therapeutics on Oct 14.

Apart from PH-894, Phio only has one other pipeline candidate, PH-762, which received an investigational new drug (IND) application clearance from the FDA to initiate a clinical study on skin cancer indications. The FDA's clearance of the IND application for PH-762 marks a significant step toward the company's evolution from drug discovery to clinical development. PH-762 is also Phio’s lead pipeline product.

Phio intends to start a phase Ib study on PH-762 for patients with cutaneous squamous cell carcinoma, melanoma and merkel cell carcinoma. It plans to initiate a phase Ib study on the candidate before this year’s end.

The phase Ib study is one of two studies cleared by the FDA, which will utilize PH-762. Another study that recently started dosing participants is a collaborative clinical study sponsored by AgonOx, Inc. This clinical study will explore the treatment of AgonOx’s AGX148 ‘double positive’ CD8 TIL alone and combined with PH-762 in patients with melanoma and other advanced solid tumors.

Phio Pharmaceuticals Corp. Price

Phio Pharmaceuticals Corp. price | Phio Pharmaceuticals Corp. Quote

Zacks Rank & Stocks to Consider

Phio currently carries a Zacks Rank #4 (Sell).Some better-ranked stocks are Allogene Therapeutics ALLO, Annovis Bio ANVS, and Corcept Therapeutics CORT, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Allogene Therapeutics’ 2024 earnings per share narrowed from $2.23 to $2.21. Year to date, shares of Allogene Therapeutics have lost 51.0%.

Earnings of Allogene Therapeutics beat estimates in three of the trailing four quarters while meeting the mark on one occasion, witnessing an average earnings surprise of 3.93%. In the last reported quarter, Allogene Therapeutics’ earnings beat estimates by 10.17%.

In the past 60 days, estimates for Annovis Bio’s 2023 loss per share have narrowed from $4.89 to $4.38. During the same period, the loss estimates per share for 2024 have improved from $3.18 to $2.77. Year to date, shares of Annovis have lost 42.7%.

Earnings of Annovis Bio beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 13.40% on average. In the last reported quarter, Annovis’ earnings beat estimates by 6.14%.

In the past 60 days, estimates for Corcept Therapeutics’ 2023 earnings per share increased from 75 cents to 78 cents. During the same period, the estimates per share for 2024 have improved from 81 cents to 83 cents. Year to date, shares of Corcept Therapeutics have risen 34.9%.

Earnings of Corcept Therapeutics beat estimates in two of the trailing four quarters while missing the mark on the other two occasions, witnessing an average earnings surprise of 6.99%. In the last reported quarter, Corcept Therapeutics’ earnings beat estimates by 66.67%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Phio Pharmaceuticals Corp. (PHIO) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report