Phoenix Holdings Ltd. Increases Stake in Camtek Ltd.

Phoenix Holdings Ltd. (Trades, Portfolio), a prominent investment firm, recently expanded its portfolio by acquiring additional shares in Camtek Ltd. (NASDAQ:CAMT). This article will delve into the details of this transaction, providing valuable insights for value investors. We will also profile Phoenix Holdings Ltd. (Trades, Portfolio) and Camtek Ltd., discussing their investment philosophies, top holdings, and financial health.

Overview of the Transaction

On July 31, 2023, Phoenix Holdings Ltd. (Trades, Portfolio) added 1,013,719 shares of Camtek Ltd. to its portfolio, increasing its stake by 84.48%. The shares were purchased at a price of $47.61 each, bringing the firm's total holdings in Camtek Ltd. to 2,213,607 shares. This transaction had a 0.98% impact on Phoenix Holdings Ltd. (Trades, Portfolio)'s portfolio and increased its position in Camtek Ltd. to 2.13%. As a result, Phoenix Holdings Ltd. (Trades, Portfolio) now holds 4.95% of Camtek Ltd.'s shares.

Profile of Phoenix Holdings Ltd. (Trades, Portfolio)

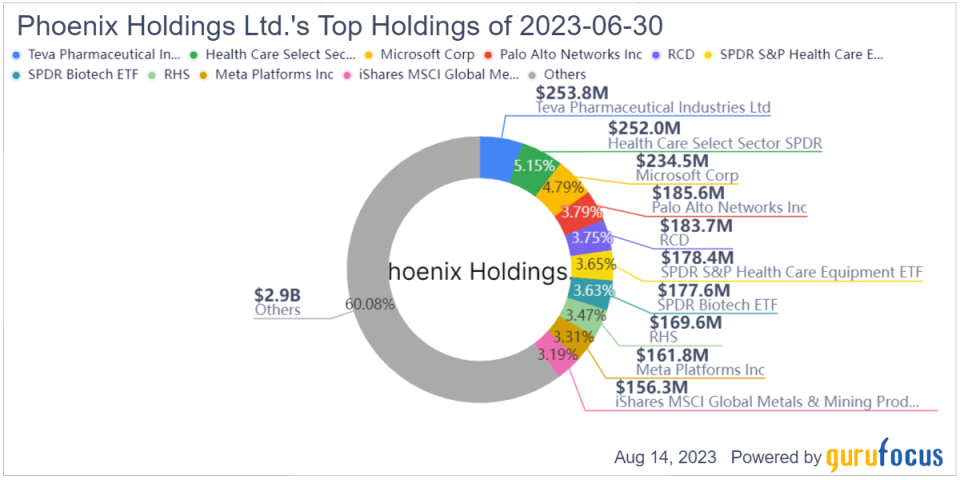

Phoenix Holdings Ltd. (Trades, Portfolio) is a leading investment firm based in Givatayim, Israel. The firm manages a diverse portfolio of 310 stocks, with a total equity of $4.89 billion. Its top holdings include RCD, Health Care Select Sector SPDR, Microsoft Corp, Palo Alto Networks Inc, and Teva Pharmaceutical Industries Ltd. The firm primarily invests in the technology and healthcare sectors.

Detailed Information about Camtek Ltd.

Camtek Ltd. (NASDAQ:CAMT) is an Israel-based company that specializes in the manufacturing of metrology and inspection equipment. The company, which went public on July 28, 2000, primarily serves the Advanced Packaging, Memory, CMOS Image Sensors, MEMS, RF, and other sectors. As of August 14, 2023, Camtek Ltd. has a market cap of $2.06 billion and a stock price of $46.16. The company's PE percentage stands at 28.49, indicating its profitability. However, according to GuruFocus's GF Valuation, the stock is significantly overvalued, with a GF Value of 34.63 and a Price to GF Value of 1.33.

Analysis of Camtek Ltd.'s Financial Health

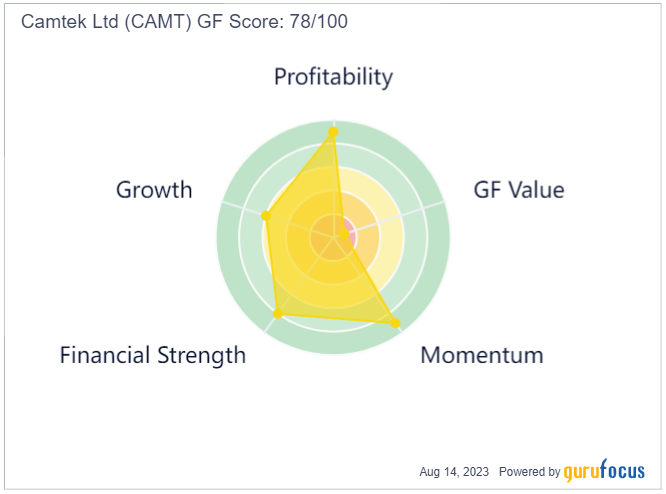

Camtek Ltd. has a strong financial profile, with a Balance Sheet Rank of 8/10 and a Profitability Rank of 9/10. The company's Growth Rank is 6/10, indicating steady growth. However, its GF Value Rank is 1/10, suggesting that the stock is overvalued. The company's Momentum Rank is 9/10, indicating strong momentum. Camtek Ltd.'s Piotroski F-Score is 3, and its Altman Z score is 6.55, suggesting financial stability.

Evaluation of Camtek Ltd.'s Stock Performance

Camtek Ltd.'s stock performance is evaluated using various indicators. The company's RSI 5 Day is 39.83, RSI 9 Day is 55.26, and RSI 14 Day is 62.07. Its Momentum Index 6 - 1 Month is 28.52, and Momentum Index 12 - 1 Month is 12.88. These figures suggest that the stock has been performing well recently.

Conclusion

In conclusion, Phoenix Holdings Ltd. (Trades, Portfolio)'s recent acquisition of additional shares in Camtek Ltd. is a significant move that could potentially impact both the firm's portfolio and the stock's performance. Despite Camtek Ltd.'s overvaluation, its strong financial health and positive momentum make it an attractive investment. However, investors should always conduct their own due diligence before making investment decisions.

This article first appeared on GuruFocus.