Phoenix Holdings Ltd. Reduces Stake in Radware Ltd.

Phoenix Holdings Ltd. (Trades, Portfolio), a prominent investment firm, has recently adjusted its investment portfolio by reducing its stake in Radware Ltd. (NASDAQ:RDWR), an Israel-based cybersecurity company. On November 10, 2023, Phoenix Holdings Ltd. (Trades, Portfolio) sold 225,563 shares of Radware Ltd., resulting in a 9.92% decrease in their holdings. This transaction had a minor impact of -0.07% on the firm's portfolio, with the trade executed at a price of $15.29 per share. Following the sale, Phoenix Holdings Ltd. (Trades, Portfolio) retains 2,047,747 shares in Radware Ltd., which now represents 0.64% of their portfolio and 4.87% of their holdings in the traded stock.

Investment Firm Profile: Phoenix Holdings Ltd. (Trades, Portfolio)

Phoenix Holdings Ltd. (Trades, Portfolio) operates from its headquarters at 53 Derech Ha'shalom St., Givatayim, L3, 53454, and is known for its strategic investment decisions. The firm manages an equity portfolio worth $4.89 billion, with a diverse array of 310 stocks. Phoenix Holdings Ltd. (Trades, Portfolio)'s top holdings include RCD (RCD), Health Care Select Sector SPDR (XLV), Microsoft Corp (NASDAQ:MSFT), Palo Alto Networks Inc (NASDAQ:PANW), and Teva Pharmaceutical Industries Ltd (NYSE:TEVA), with a strong preference for the Technology and Healthcare sectors.

Radware Ltd.: A Cybersecurity Solutions Provider

Radware Ltd. specializes in developing and selling a comprehensive portfolio of network products, including application delivery controllers, web application firewalls, and intrusion prevention systems. The company caters to large enterprise and service provider segments, offering infrastructure support for DDoS scrubbing center services, cloud-based WAF, bot management, and other services such as Cloud Workload Protect and Content Delivery Network. Radware Ltd. operates through three key segments: Products, Services, and Subscriptions.

Radware Ltd.'s Market Valuation and Stock Performance

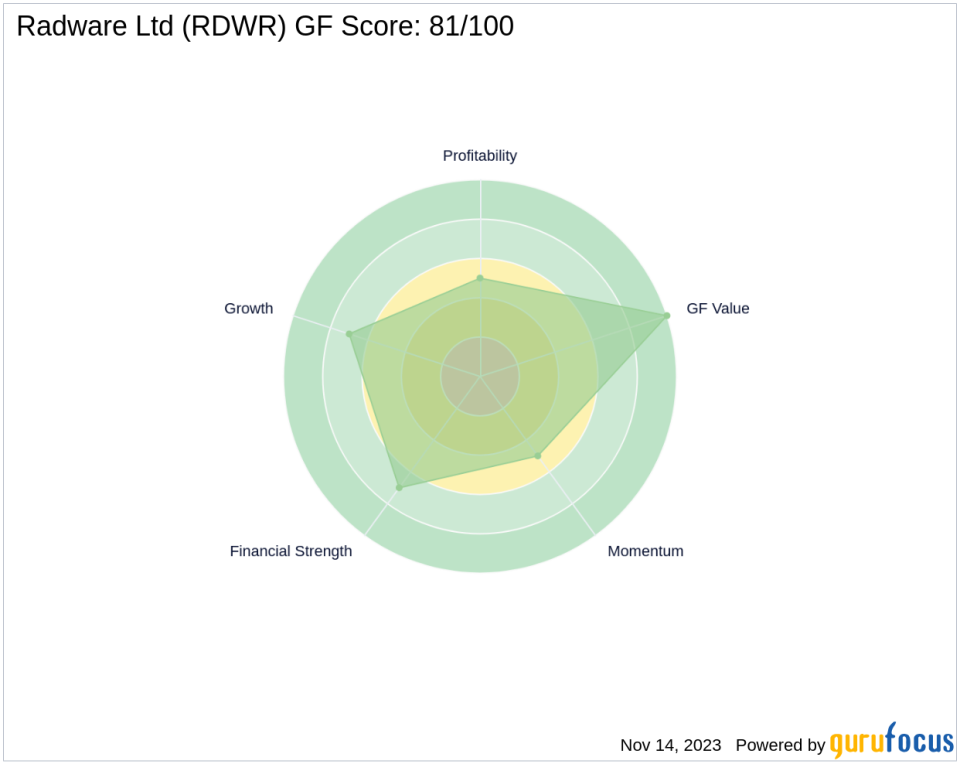

With a market capitalization of $653.895 million and a current stock price of $15.55, Radware Ltd. is considered significantly undervalued according to GuruFocus's GF Valuation. The stock's GF Value stands at $24.91, and the price to GF Value ratio is 0.62, indicating a potential undervaluation. Despite not having a PE Percentage due to the company's lack of profitability, the stock has shown a gain of 1.7% since the transaction date and an overall increase of 13.09% since its IPO on September 30, 1999. However, the year-to-date price change ratio stands at -22.44%.

Financial Health and Growth Prospects of Radware Ltd.

Radware Ltd. exhibits a Financial Strength rank of 7/10, a Profitability Rank of 5/10, and a Growth Rank of 7/10. The company's financial ratios, such as a Cash to Debt ratio of 15.78, ROE of -6.25%, and ROA of -3.20%, reflect its current financial position. Radware Ltd. has experienced a revenue growth of 7.90% over the past three years, although its EBITDA growth has declined by 31.60% during the same period.

Market Sentiment and Momentum of Radware Ltd.

The stock's momentum indices and RSI rankings provide insight into market sentiment. Radware Ltd. has an RSI of 60.77 over 5 days, 50.05 over 9 days, and 44.99 over 14 days. The stock's momentum index for the past 6 months is -17.75, and for the past 12 months, it is -22.57. These figures suggest a mixed sentiment, with some short-term positive momentum but overall negative performance in the longer term.

Transaction Impact Analysis

The recent reduction by Phoenix Holdings Ltd. (Trades, Portfolio) in Radware Ltd. shares is a strategic move that aligns with the firm's investment philosophy and portfolio management. While the trade has had a minimal impact on Phoenix Holdings Ltd. (Trades, Portfolio)'s portfolio, it reflects the firm's ongoing assessment of Radware Ltd.'s financial health, growth prospects, and market sentiment. Investors and market watchers will be keen to observe how this transaction influences Radware Ltd.'s stock performance and Phoenix Holdings Ltd. (Trades, Portfolio)'s future investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.