PHX Minerals Inc. Reports Fiscal Year 2023 Earnings and Provides 2024 Outlook

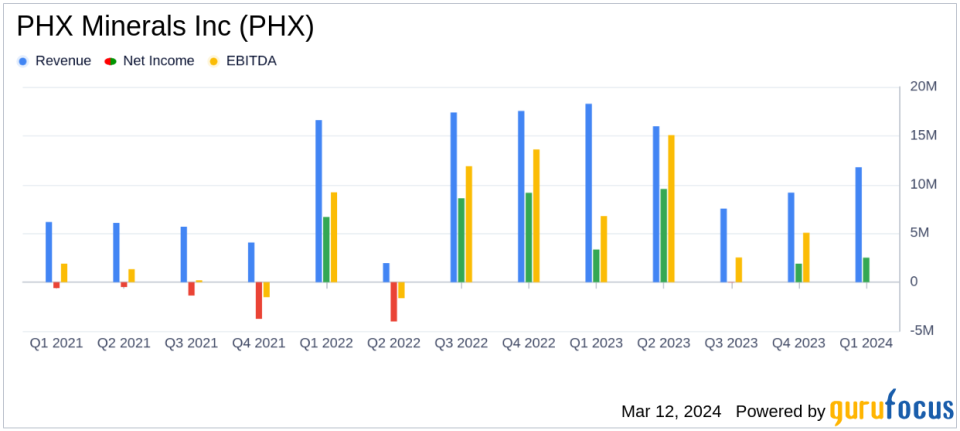

Net Income: $13.9 million for FY 2023, a decrease from $17.1 million in FY 2022.

Earnings Per Share: $0.39 per diluted share for FY 2023, down from $0.48 in the previous year.

Adjusted EBITDA: $22.7 million for FY 2023, compared to $26.7 million for FY 2022.

Royalty Production Volumes: Increased by 23% to 8,123 Mmcfe for FY 2023.

Debt to Adjusted EBITDA Ratio: 1.45x as of Dec. 31, 2023.

Dividend Announcement: Quarterly dividend of $0.03 per share, payable on March 29, 2024.

Operational Outlook: 2024 royalty production forecasted between 8,100 and 8,800 Mmcfe.

On March 12, 2024, PHX Minerals Inc (NYSE:PHX) released its 8-K filing, detailing the financial and operational results for the quarter and fiscal year ended December 31, 2023. The company, formerly known as Panhandle Oil & Gas, focuses on mineral and natural gas ownership, with significant mineral acreage across Oklahoma, North Dakota, Texas, New Mexico, and Arkansas.

PHX Minerals Inc (NYSE:PHX) reported a net income of $2.5 million, or $0.07 per diluted share, for the fiscal fourth quarter of 2023, and $13.9 million, or $0.39 per diluted share, for the full fiscal year. These figures represent a decrease from the net income of $17.1 million, or $0.48 per diluted share, reported for the previous fiscal year. The company's adjusted EBITDA also saw a decline, dropping to $22.7 million for FY 2023 from $26.7 million for FY 2022.

Financial and Operational Performance

Despite the decrease in net income and adjusted EBITDA, PHX Minerals Inc (NYSE:PHX) achieved a 23% year-over-year growth in royalty production volumes, reaching 8,123 Mmcfe for FY 2023. The company's net proved royalty interest reserves increased by 9% to 57.8 Bcfe at the end of the fiscal year. However, total production volumes saw a 3% decrease to 9,379 Mmcfe for FY 2023 compared to the previous year.

PHX Minerals Inc (NYSE:PHX) faced challenges in the form of a historic drop in gas prices and rising interest rates. Despite these headwinds, the company's strategy of modest leverage and a strong balance sheet allowed it to deliver consistent results and raise its quarterly dividend by 33%. The company's President and CEO, Chad L. Stephens, highlighted the company's resilience and optimism for the future, citing reduced drilling activity and the expansion of LNG export facilities as potential catalysts for market balance and improved commodity prices.

In 2023, PHX delivered year-over-year royalty volume growth of 23%, expanding 2P royalty reserves by 12%, generating significant operating cash flow and net income. These results enabled us to raise our quarterly dividend by 33% despite another challenging year in the natural gas pricing environment. Our strong balance sheet and strategy of modest leverage enabled us to deliver consistent results despite a historic drop in gas prices and rising interest rates validating our business strategy, which positions us for success in both up and down markets.

Looking Ahead

For 2024, PHX Minerals Inc (NYSE:PHX) is optimistic about its operational outlook, forecasting mineral and royalty production to be between 8,100 and 8,800 Mmcfe. The company's focus on high-quality mineral acquisitions, particularly in the Haynesville and SCOOP plays, is expected to drive royalty volumes, margin expansion, and cash flow in the coming years.

PHX Minerals Inc (NYSE:PHX) remains committed to its acquisition strategy and has deployed over $30 million to acquire nearly 2,400 net royalty acres. The company's financial position and targeted acquisition strategy are poised to unlock shareholder value as the commodity pricing environment improves.

Investors and stakeholders can expect PHX Minerals Inc (NYSE:PHX) to continue its disciplined approach to growth and value creation, with a keen eye on market conditions and strategic opportunities.

For more detailed information on PHX Minerals Inc (NYSE:PHX)'s financial results, operational updates, and future outlook, interested parties are encouraged to review the full 8-K filing.

PHX Minerals Inc (NYSE:PHX) will host a conference call to discuss the results on March 13, 2024, at 11 a.m. EDT, providing an opportunity for investors to engage with management directly.

For further inquiries, investors may contact PHX Minerals Inc (NYSE:PHX) at inquiry@phxmin.com or follow the investor relations contact details provided in the earnings release.

Explore the complete 8-K earnings release (here) from PHX Minerals Inc for further details.

This article first appeared on GuruFocus.