A Piece Of The Puzzle Missing From Dorel Industries Inc.'s (TSE:DII.B) 31% Share Price Climb

Despite an already strong run, Dorel Industries Inc. (TSE:DII.B) shares have been powering on, with a gain of 31% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.4% in the last twelve months.

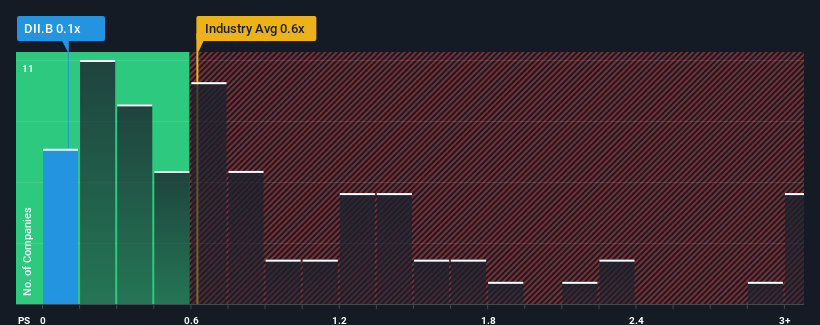

Even after such a large jump in price, there still wouldn't be many who think Dorel Industries' price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Canada's Consumer Durables industry is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Dorel Industries

How Dorel Industries Has Been Performing

Recent times haven't been great for Dorel Industries as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Dorel Industries will help you uncover what's on the horizon.

What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Dorel Industries would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. This means it has also seen a slide in revenue over the longer-term as revenue is down 43% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 4.2% as estimated by the only analyst watching the company. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 5.2%, that would be a solid result.

Despite the marginal growth, we find it odd that Dorel Industries is trading at a fairly similar P/S to the industry. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

Dorel Industries appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Dorel Industries' analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Dorel Industries with six simple checks on some of these key factors.

If you're unsure about the strength of Dorel Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here