A Piece Of The Puzzle Missing From IES Holdings, Inc.'s (NASDAQ:IESC) 28% Share Price Climb

IES Holdings, Inc. (NASDAQ:IESC) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last month tops off a massive increase of 168% in the last year.

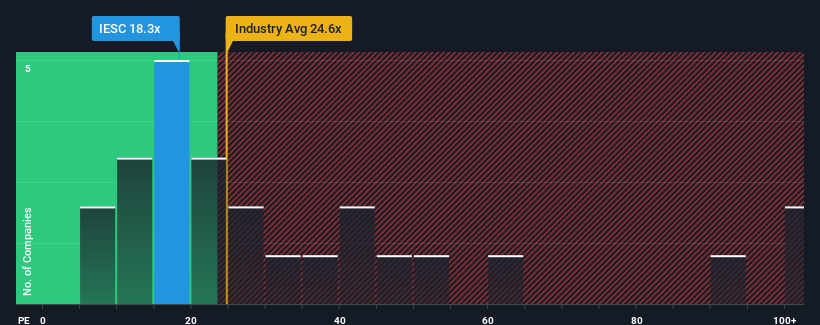

Even after such a large jump in price, there still wouldn't be many who think IES Holdings' price-to-earnings (or "P/E") ratio of 18.3x is worth a mention when the median P/E in the United States is similar at about 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

IES Holdings certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for IES Holdings

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on IES Holdings' earnings, revenue and cash flow.

How Is IES Holdings' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like IES Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 215% last year. The strong recent performance means it was also able to grow EPS by 133% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 10% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that IES Holdings' P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On IES Holdings' P/E

IES Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of IES Holdings revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for IES Holdings that you should be aware of.

Of course, you might also be able to find a better stock than IES Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.