Piedmont Lithium Inc (PLL) Reports Full Year 2023 Results: A Year of Operational Ramp-Up and ...

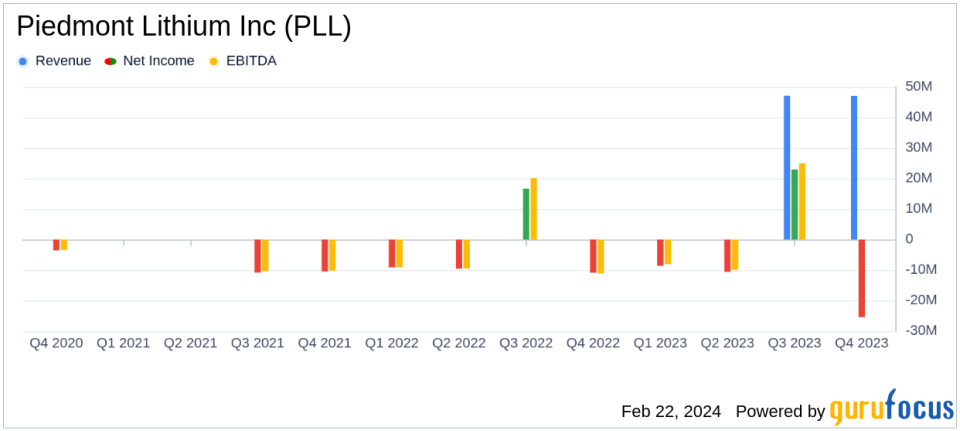

Revenue: Piedmont Lithium Inc reported $39.8 million in full-year revenue from sales of spodumene concentrate.

Gross Profit: The company achieved a gross profit of $5.7 million for the year, despite settlement accruals in Q4.

Balance Sheet: As of December 31, 2023, the company held $71.7 million in cash and cash equivalents.

Net Loss: Piedmont Lithium Inc recorded a net loss of $21.8 million for the full year.

Production and Sales: The company shipped 43.2 thousand dry metric tons (dmt) of spodumene concentrate in 2023.

Strategic Developments: Progress in permitting and regulatory approvals in Ghana and North Carolina, and a shift in sales strategy towards multi-year contracts to reduce volatility.

On February 22, 2024, Piedmont Lithium Inc (NASDAQ:PLL) released its 8-K filing, disclosing its fourth quarter and full year financial results for 2023. The company, a key player in the lithium industry with a focus on the development of its Piedmont Lithium Project in the Carolina Tin-Spodumene Belt (TSB), reported significant operational progress and strategic advancements despite facing a challenging lithium price environment.

Financial Performance and Challenges

Piedmont Lithium Inc's full-year revenue reached $39.8 million, stemming from the sale of 43.2 thousand dmt of spodumene concentrate. The company's gross profit for the year was $5.7 million, reflecting the impact of settlement accruals in the fourth quarter. Despite these figures, the company faced a net loss of $21.8 million for the year, which was attributed to a downturn in lithium prices and the associated volatility in the market.

The company's strategy to shift towards multi-year customer contracts aims to mitigate the impact of volatile spot sales and is expected to lead to more stable and higher average realized prices. This strategic move is crucial as it aligns with the company's goal to reduce exposure to market fluctuations and establish a more predictable revenue stream.

Operational Highlights and Future Outlook

Operationally, Piedmont Lithium Inc's joint venture, North American Lithium (NAL), has been ramping up production, hitting record levels in December 2023. The company anticipates further improvements in production and operating costs in 2024, which is vital for achieving full run-rate production levels later in the year.

Looking ahead, Piedmont Lithium Inc is well-positioned for long-term growth with its diversified project portfolio. The company is advancing through the permitting and approvals processes for the Ewoyaa Lithium Project in Ghana and is making strides towards obtaining a mining permit for its Carolina Lithium Project in North Carolina. These developments are significant as they represent critical steps towards realizing the company's strategic objectives and enhancing its position in the lithium market.

"Lithium has been a cyclical business for the past decade with trough markets in pricing generally followed by new record highs. As we navigate the current market, which seems to be in the throes of peak pessimism, were bolstering our balance sheet by monetizing non-core assets, deferring capital spending, and employing cost savings plans designed to reduce our corporate overhead. Our goal is to protect shareholder value in this downturn, while remaining strategically positioned for the lithium market recovery that we believe is a matter of time," said Keith Phillips, Piedmont Lithium President and Chief Executive Officer.

Financial Metrics and Importance

The company's financial achievements, such as the $71.7 million in cash and cash equivalents and the net proceeds of approximately $49.1 million from the sale of Sayona Mining and Atlantic Lithium shares, are indicative of a strong balance sheet that can support ongoing operations and strategic initiatives. These metrics are particularly important for a company in the Metals & Mining industry, where capital-intensive projects and market volatility can significantly impact financial stability and growth prospects.

In conclusion, Piedmont Lithium Inc's 2023 earnings report reflects a year of operational ramp-up and strategic positioning amidst market challenges. The company's focus on improving production efficiency, advancing key projects, and shifting sales strategies demonstrates its commitment to long-term growth and shareholder value. As Piedmont Lithium Inc continues to navigate the cyclical nature of the lithium market, its efforts to reinforce its balance sheet and optimize operations are essential steps towards achieving its vision of becoming a leading lithium hydroxide producer in North America.

Explore the complete 8-K earnings release (here) from Piedmont Lithium Inc for further details.

This article first appeared on GuruFocus.