Piedmont Lithium (PLL) to Sell Portion of Its Atlantic Shares

Piedmont Lithium Inc. (PLL) announced that it inked a deal to sell a portion of shares it holds in Atlantic Lithium to Assore International Holdings. This move will further bolster Piedmont Lithium’s cash balance.

The company has agreed to sell 24.3 million Atlantic shares for GBP0.25 per share, which represents a premium above the current market price. The shares to be sold represent 3.9% of Atlantic's outstanding shares. It will result in $7.8 million in proceeds for Piedmont.

The sale of these shares has no bearing on Piedmont's joint venture, earn-in, or offtake agreement with Atlantic or the Ewoyaa project.

Following the sale, Assore will own 28.4% of Atlantic. Piedmont will keep 32.7 million Atlantic shares, accounting for 5.2% of Atlantic's holding.

Piedmont Lithium remains optimistic about Ewoyaa's potential as a logistically advantageous, low-cost producer of spodumene concentrate. However, it is taking a cautious approach to capital deployment in the current lithium price environment and positioning itself for the anticipated lithium market recovery.

The company ended 2023 with $72 million in cash and $47.4 million in marketable securities.

In the third quarter of 2023, Piedmont Lithium recorded earnings of 88 cents per share, missing the Zacks Consensus Estimate of $1.51. This compares to a loss of 36 cents per share a year ago. The company posted revenues of 47 million, missing the Zacks Consensus Estimate of $57 million.

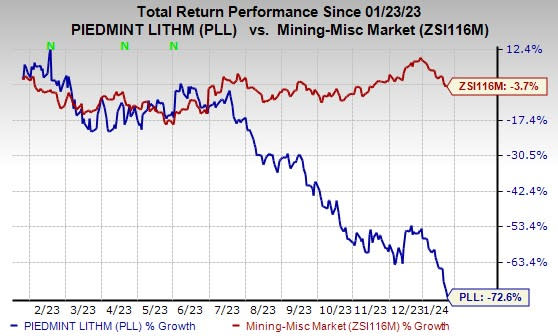

Price Performance

Piedmont Lithium’s shares have fallen 72.6% in the past year compared with the industry’s fall of 3.7%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Piedmont Lithium currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Ternium S.A. TX and Osisko Gold Royalties Ltd OR. CRS and TX sport a Zacks Rank #1 (Strong Buy), and OR carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $3.96 per share. The consensus estimate for 2024 earnings has moved 11% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 71.2% in a year.

The Zacks Consensus Estimate for Ternium’s 2023 earnings is pegged at $7.98 per share. It has an average trailing four-quarter earnings surprise of 38.6%. TX’s shares have gained 36.5% in a year.

Osisko Gold has an average trailing four-quarter earnings surprise of 13.4%. The Zacks Consensus Estimate for OR’s 2023 earnings is pegged at 43 cents per share. Earnings estimates have been unchanged in the past 60 days. OR shares rallied 13.4% last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Piedmont Lithium Inc. (PLL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Ternium S.A. (TX) : Free Stock Analysis Report

Osisko Gold Royalties Ltd (OR) : Free Stock Analysis Report