Pieris (PIRS) Pursues Strategic Alternatives, Stock Rises

Pieris Pharmaceuticals’ PIRS shares were up almost 12% on Jul 18, after management announced strategic update in light of the recent events that have impacted its respiratory franchise. In order to seek assistance with its strategic decisions, Pieris has retained Stifel, Nicolaus & Company, Inc. (as PIRS’ exclusive financial advisor).

These strategic alternatives include a potential sale, merger, divestiture of assets, licensing or other strategic transaction. Management will provide an update to investors on these alternatives once the company enters into a definitive agreement/arrangement or when a disclosure is necessary.

The company is considering these strategic alternatives after partner AstraZeneca AZN decided to discontinue enrollment of the phase IIa study of elarekibep for the treatment of asthma. In addition to this, AstraZeneca also terminated its research and development collaboration agreement with Pieris and returned the rights to elarekibep. It also discontinued the remaining discovery program.

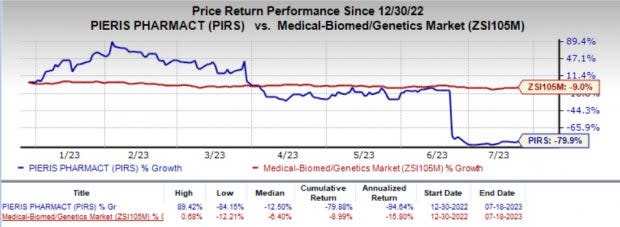

Shares of Pieris have nosedived 79.9% year to date compared with the industry’s 9% decline.

Image Source: Zacks Investment Research

In response to these challenges, PIRS aims to focus on executing new or expanded partnerships to advance its therapeutic programs. It specifically aims to prioritize the development of cinrebafusp alfa (PRS-343), PRS-220 and PRS-400.

Pieris is diligently seeking an optimal development partner and deal structure to reinitiate the clinical development of cinrebafusp alfa, a promising immuno-oncology asset.Despite previously discontinuing the HER2+ gastric cancer study for strategic reasons, cinrebafusp alfa has exhibited an impressive 100% overall response rate in five patients.

The company’s board of directors approved a restructuring plan to preserve cash by reducing its existing workforce by nearly 70%. As of Jun 30, 2023, the company had approximately $54.9 million in cash, cash equivalents and investments.

These cost-saving measures and other strategic initiatives will help Pieris to maximize its ability to pursue a range of transactions across its respiratory and immuno-oncology franchises, as well as its discovery platform.

PIRS plans to determine the strategic value of its balance sheet, public company position and other assets for third parties.

Pieris Pharmaceuticals, Inc. Price and Consensus

Pieris Pharmaceuticals, Inc. price-consensus-chart | Pieris Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Pieris currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the overall healthcare sector are Omega Therapeutics OMGA and Alkermes ALKS, both sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Omega Therapeutics has narrowed from a loss of $2.49 per share to a loss of $2.05 for 2023 in the past 90 days. Shares of the company have lost 3.9% year to date.

OMGA’s earnings beat estimates in two of the trailing four quarters, met the mark in one and missed in another, delivering an average surprise of 8.24%.

The bottom-line estimate for Alkermes has gone up from 7 cents to $1.02 for 2023 in the past 90 days. The company's shares have rallied 20.5% year to date.

ALKS’ earnings beat estimates in three of the trailing four quarters and met the mark in one, delivering an average surprise of 90.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

Pieris Pharmaceuticals, Inc. (PIRS) : Free Stock Analysis Report

Omega Therapeutics, Inc. (OMGA) : Free Stock Analysis Report