Pilgrim's Pride Corp (PPC) Reports Mixed Results Amidst Market Volatility

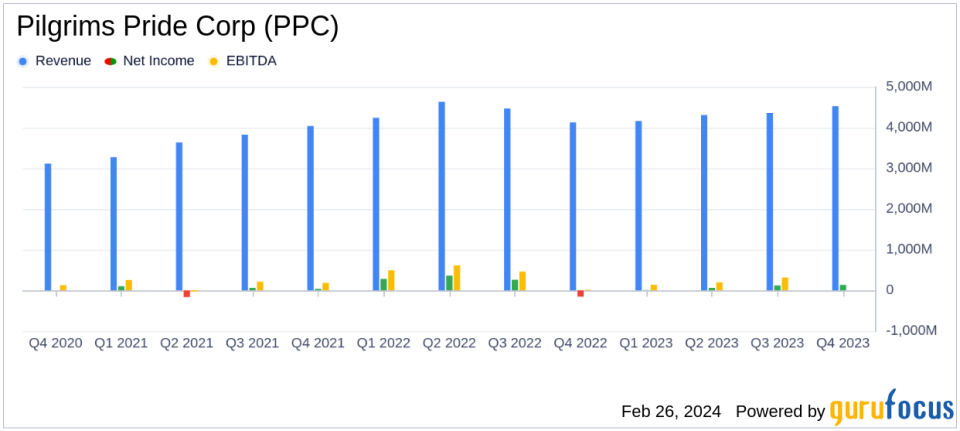

Net Sales: Reported at $17.4 billion for 2023, a slight decrease of 0.6% year-over-year.

GAAP Net Income: Dropped significantly to $321.6 million in 2023 from $745.9 million in 2022.

Adjusted EBITDA: Reached $1.0 billion, marking a 37.3% decrease from the previous year.

GAAP EPS: Stood at $1.36, compared to $3.10 in the prior year, reflecting a 56.1% decline.

Liquidity and Leverage: Maintained a strong liquidity position with a net leverage ratio of 2.5x Adjusted EBITDA.

Operational Highlights: Expansion at Athens, GA facility and a new protein conversion plant set to start by end of Q1 2024.

On February 26, 2024, Pilgrim's Pride Corp (NASDAQ:PPC), a leading poultry producer, released its 8-K filing, detailing its financial performance for the fourth quarter and year-end 2023. The company, which operates in the U.S., U.K., Europe, and Mexico, faced a challenging year marked by volatile commodity markets and elevated input costs. Despite these hurdles, PPC's diversified portfolio and strategic initiatives helped mitigate the impact of adverse market conditions.

Financial Performance Overview

Pilgrim's Pride Corp reported net sales of $17.4 billion for the year, a marginal decrease from the previous year's $17.5 billion. The company's GAAP net income took a significant hit, dropping to $321.6 million from $745.9 million in 2022, while GAAP EPS also declined to $1.36 from $3.10. Adjusted EBITDA for the year was $1.0 billion, a substantial decrease from $1.65 billion in the prior year, reflecting the challenging conditions the company faced.

Operational Highlights and Strategic Initiatives

Despite the market volatility, Pilgrim's Pride demonstrated resilience, particularly in its U.S. fresh portfolio, which overcame supply and demand challenges and elevated input costs. The company's Prepared Foods segment saw significant growth, with branded offerings like Just Bare and Pilgrims expanding by over 59% year over year. In the U.K. and Europe, PPC focused on scaling profitable growth with Key Customers and driving operational excellence. The Mexico segment also made strides in diversifying its offerings and strengthening Key Customer relationships.

"While our business faced a unique set of challenging conditions in 2023, we persevered as our team members maintained a leadership mindset and elevated their focus and execution of our strategy. As a result, we demonstrated an ability to drive profitable growth even under the most difficult circumstances as our sales and adjusted EBITDA strengthened throughout the year and showed increased momentum as we entered 2024," said Fabio Sandri, CEO of Pilgrim's Pride.

Financial Health and Future Investments

Pilgrim's Pride Corp maintained a strong liquidity position, ending the year with a net leverage ratio of 2.5x Adjusted EBITDA. The company's progress in investments to support Key Customer growth and operational excellence remains on target, with the expanded Athens, GA facility initiating production and a new protein conversion plant expected to start by the end of Q1 2024.

Challenges and Market Conditions

The company navigated a year of exceptionally volatile commodity markets, with supply and demand imbalances and elevated cost inflation. However, PPC's strategic focus on operational excellence and customer-centric initiatives helped to partially offset these challenges.

Conclusion

While Pilgrim's Pride Corp faced significant headwinds in 2023, its diversified business model and strategic investments position the company to potentially capitalize on improved market fundamentals as it moves into 2024. Investors and stakeholders will be watching closely to see how the company's efforts in operational excellence and sustainability continue to unfold in the face of ongoing market volatility.

For a more detailed analysis of Pilgrim's Pride Corp's financial results and strategic initiatives, interested parties can access the full earnings report and listen to the conference call via the company's website.

Explore the complete 8-K earnings release (here) from Pilgrims Pride Corp for further details.

This article first appeared on GuruFocus.