Pilgrim's Pride (NASDAQ:PPC) Exceeds Q4 Expectations

Chicken producer Pilgrim’s Pride (NASDAQ:PPC) reported Q4 FY2023 results beating Wall Street analysts' expectations , with revenue up 9.7% year on year to $4.53 billion. It made a non-GAAP profit of $0.59 per share, improving from its loss of $0.49 per share in the same quarter last year.

Is now the time to buy Pilgrim's Pride? Find out by accessing our full research report, it's free.

Pilgrim's Pride (PPC) Q4 FY2023 Highlights:

Revenue: $4.53 billion vs analyst estimates of $4.48 billion (1.2% beat)

EPS (non-GAAP): $0.59 vs analyst estimates of $0.43 (36.6% beat)

Free Cash Flow of $166.8 million, similar to the previous quarter

Gross Margin (GAAP): 7.1%, up from 2.3% in the same quarter last year

Market Capitalization: $6.84 billion

“While our business faced a unique set of challenging conditions in 2023, we persevered as our team members maintained a leadership mindset and elevated their focus and execution of our strategy. As a result, we demonstrated an ability to drive profitable growth even under the most difficult circumstances as our sales and adjusted EBITDA strengthened throughout the year and showed increased momentum as we entered 2024,” said Fabio Sandri, Pilgrim’s CEO.

Offering everything from pre-marinated to frozen chicken, Pilgrim’s Pride (NASDAQ:PPC) produces, processes, and distributes chicken products to retailers and food service customers.

Packaged Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods, prepared meals, or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences.The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Pilgrim's Pride is one of the largest consumer staples companies and benefits from a strong brand, giving it customer trust and leverage in many purchasing and distribution negotiations.

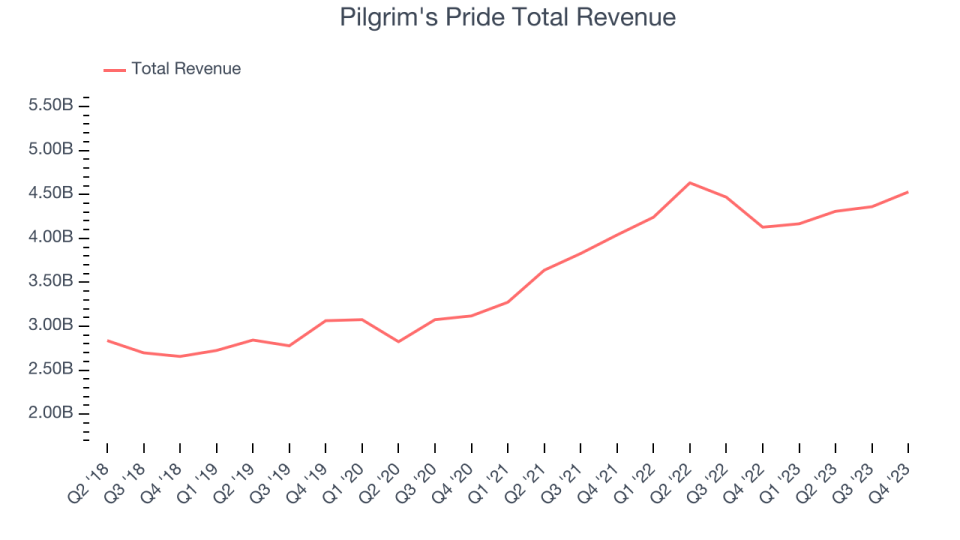

As you can see below, the company's annualized revenue growth rate of 12.8% over the last three years was solid for a consumer staples business.

This quarter, Pilgrim's Pride reported solid year-on-year revenue growth of 9.7%, and its $4.53 billion in revenue outperformed Wall Street's estimates by 1.2%. Looking ahead, Wall Street expects sales to grow 3.1% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

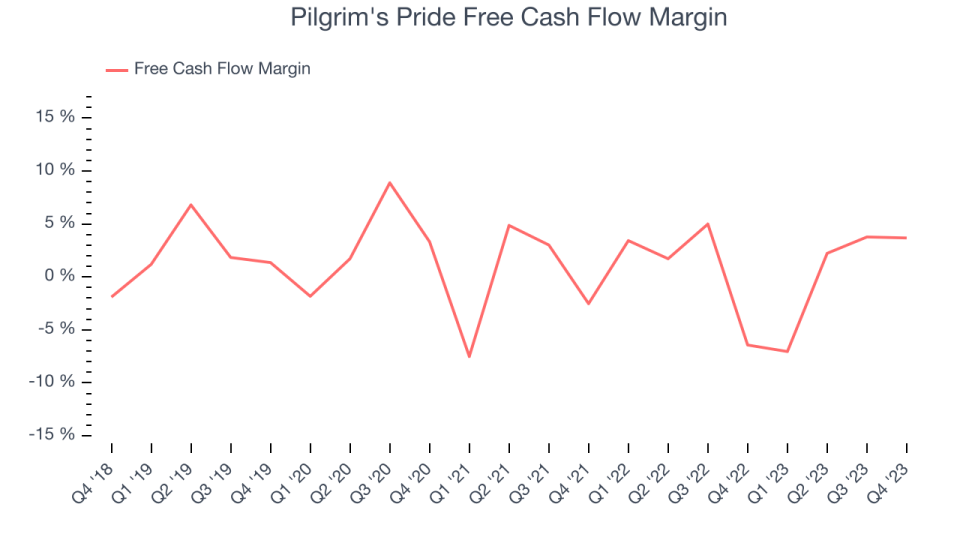

Pilgrim's Pride's free cash flow came in at $166.8 million in Q4, representing a 3.7% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to positive this quarter.

Over the last eight quarters, Pilgrim's Pride has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 0.9%, subpar for a consumer staples business. Pilgrim's Pride's margin has also been flat during that time, showing the company needs to take action and improve its cash profitability.

Key Takeaways from Pilgrim's Pride's Q4 Results

We were impressed by how significantly Pilgrim's Pride blew past analysts' gross margin, EBITDA, and EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. For the full year 2023, the company's Prepared Foods segment was the star of the show as its Just Bare and Pilgrim's brands grew 59% year on year. The company's sales through digital channels also doubled compared to 2022. Overall, we think this was a really good quarter that should please shareholders. The stock is up 4.5% after reporting and currently trades at $30.2 per share.

Pilgrim's Pride may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.