Pilgrim's Pride's (PPC) Operational Excellence Drives Growth

Pilgrim's Pride Corporation's PPC strategic focus and operational improvements across various global regions demonstrated a robust approach to achieving enhanced profitability and market presence.

In Europe and Mexico, the company diversified its marketplace presence through branded innovation and product launches. This led to strengthened foundations for profitable growth, and marketplace traction for branded and prepared offerings. Pilgrim's Pride experienced 65% year-over-year growth in its fully cooked branded offerings in the third quarter of 2023, and digital sales increased 90% over the past year, which was attributed to effective key customer media partnerships and investments.

Also, the business in Mexico showed a strong performance in the third quarter due to improvements in live operations, grain and currency favorability, and balanced supply and demand fundamentals. The company’s Mexico operations generated net sales of $559.7 million, up from $429 million in the prior-year quarter.

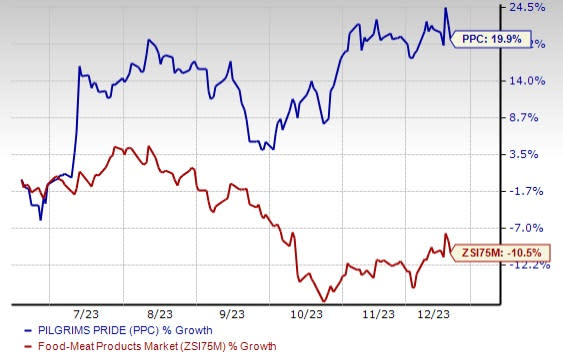

Image Source: Zacks Investment Research

Pricing Strategy Bodes Well

Pilgrim's Pride’s pricing strategy appears to be dynamic and responsive to market trends, product-specific demand, and broader economic factors. The company adjusts its pricing to align with seasonal patterns, supply and demand changes, and cost considerations to maintain profitability and market competitiveness.

The company maintained consistent sales volumes over the third quarter by adjusting prices and engaging in normal promotional activities. This strategy contributed to volume growth in the commodity and value-added frozen segments, as well as the dairy prepared department.

Effective Foodservice Operations

The company is working with distributors, schools and commercial chains as part of its broader strategy to enhance the presence and sales in the foodservice channel. The business enhanced its key customer partnerships with leading retailers and foodservice providers, leading to secured long-term business and diversified product offerings. There was an increase in volume sales within the foodservice channel in the third quarter. This improvement was attributed to an increased number of operators purchasing chicken and a rise in the velocity of those already buying chicken.

The Zacks Rank #1 (Strong Buy) company’s shares have gained 19.9% in the past six months against the industry’s 10.5% decline.

Other Stocks to Consider

We have highlighted three other top-ranked stocks, namely MGP Ingredients, Inc. MGPI, Celsius Holdings CELH and The Kraft Heinz Company KHC.

MGP Ingredients produces and markets ingredients and distillery products to the packaged goods industry. The company currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and EPS suggests growth of 6% and 14.2%, respectively, from the year-ago reported figures. MGPI has a trailing four-quarter earnings surprise of 16.2%, on average.

Celsius Holdings, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 81.6% in the third quarter of 2023.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 98.5% and 185.2%, respectively, from the year-ago reported numbers. CELH has a trailing four-quarter earnings surprise of 110.9%, on average.

The Kraft Heinz Company is one of the largest consumer packaged food and beverage companies. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for The Kraft Heinz Company’s current financial-year sales and earnings suggests growth of 1% and 6.5%, respectively, from the year-ago reported numbers. KHC has a trailing four-quarter earnings surprise of 9.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report