PIMCO Dynamic Income Fund's Dividend Analysis

Understanding PIMCO Dynamic Income Fund's Dividend Sustainability

PIMCO Dynamic Income Fund (NYSE:PDI) recently announced a dividend of $0.22 per share, payable on 2024-03-01, with the ex-dividend date set for 2024-02-09. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into PIMCO Dynamic Income Fund's dividend performance and assess its sustainability.

What Does PIMCO Dynamic Income Fund Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

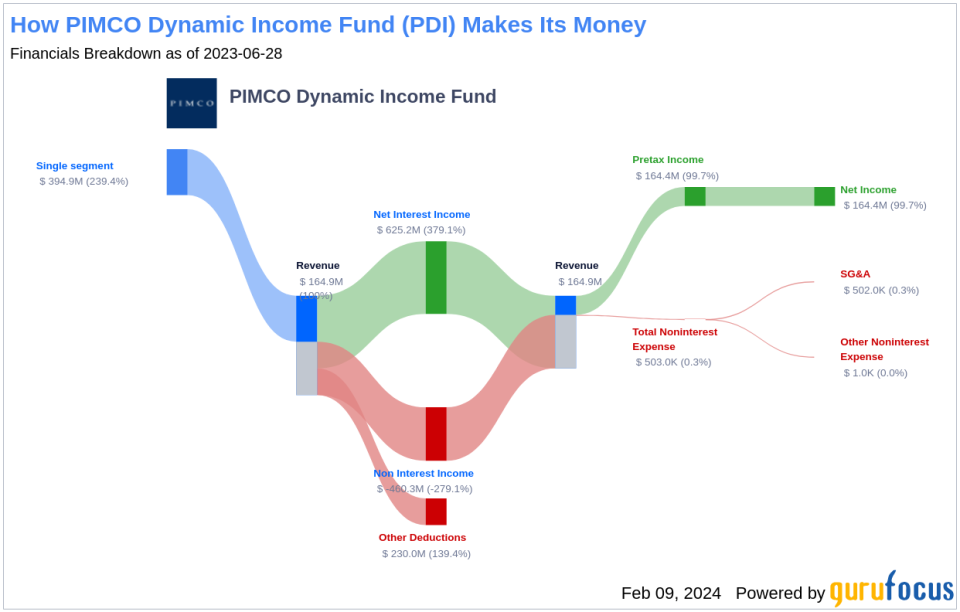

PIMCO Dynamic Income Fund is a United States-based closed-end management investment company. The fund's investment objective is to seek current income, with a secondary objective of capital appreciation. PIMCO Dynamic Income Fund invests globally in a diverse portfolio of debt obligations and other income-producing securities across various maturities, along with related derivative instruments. Its investments span mortgage-backed securities, investment grade and high-yield corporates, as well as corporate and sovereign bonds, among other income-producing securities and derivatives.

A Glimpse at PIMCO Dynamic Income Fund's Dividend History

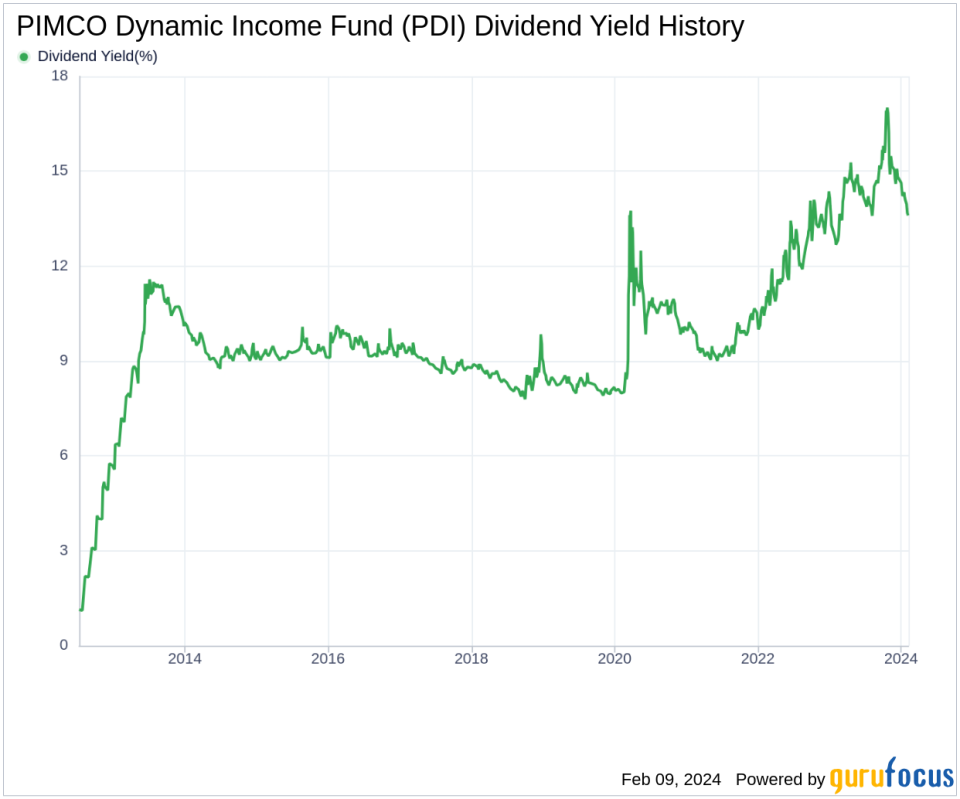

PIMCO Dynamic Income Fund has upheld a consistent dividend payment track record since its inception in 2012, with distributions made on a monthly basis. Tracking historical trends is made easier with a chart displaying annual Dividends Per Share.

Breaking Down PIMCO Dynamic Income Fund's Dividend Yield and Growth

As of today, PIMCO Dynamic Income Fund boasts a 12-month trailing dividend yield of 13.67% and mirrors this with a 12-month forward dividend yield of 13.67%. This parallel suggests an anticipation of consistent dividend payments in the year ahead.

Factoring in PIMCO Dynamic Income Fund's dividend yield and five-year growth rate, the 5-year yield on cost for PIMCO Dynamic Income Fund stock is approximately 13.67% as of today.

The Sustainability Question: Payout Ratio and Profitability

To gauge the sustainability of dividends, examining the company's payout ratio is crucial. The dividend payout ratio reveals the proportion of earnings allocated as dividends. A modest ratio implies the retention of a substantial portion of earnings for future growth and to cushion against downturns. As of 2023-06-30, PIMCO Dynamic Income Fund's dividend payout ratio stands at 4.30, which may raise concerns about the sustainability of the company's dividends.

PIMCO Dynamic Income Fund's profitability rank is another vital indicator, positioned at 2 out of 10 as of 2023-06-30. This ranking suggests that the dividend's sustainability could be in question, especially considering the company has only reported net profit in 4 of the past 10 years.

Growth Metrics: The Future Outlook

For dividends to be sustainable, a company must exhibit strong growth metrics. However, PIMCO Dynamic Income Fund's growth rank of 2 out of 10 indicates that the company may face challenges in this area, casting further doubt on the long-term viability of its dividend payments.

Next Steps for Investors

In conclusion, while PIMCO Dynamic Income Fund offers a high dividend yield, the underlying factors such as the payout ratio, profitability, and growth metrics suggest that investors should proceed with caution. It's essential to consider whether the high yield compensates for the potential risks associated with the fund's future performance. For those seeking to explore other high-dividend yield opportunities, GuruFocus Premium users can utilize the High Dividend Yield Screener to find stocks that match their investment criteria.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.