Pine Cliff Energy (TSE:PNE) Will Pay A Dividend Of CA$0.0108

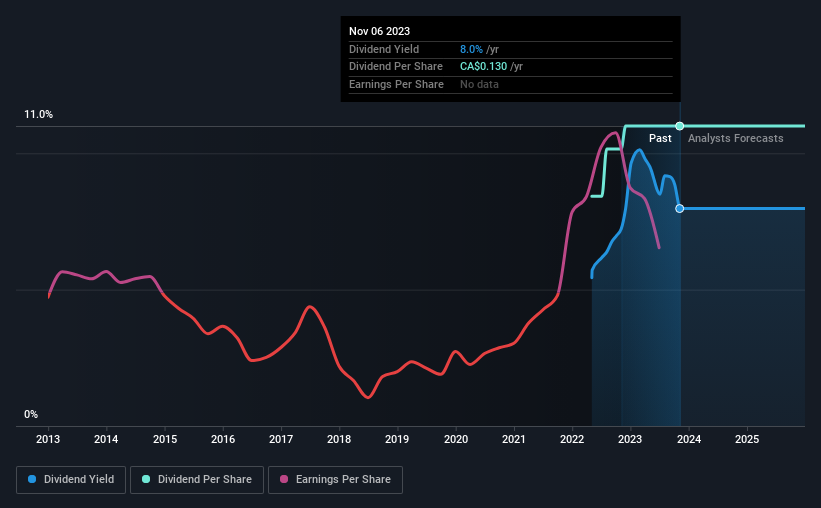

Pine Cliff Energy Ltd.'s (TSE:PNE) investors are due to receive a payment of CA$0.0108 per share on 30th of November. This makes the dividend yield 8.0%, which will augment investor returns quite nicely.

View our latest analysis for Pine Cliff Energy

Pine Cliff Energy Doesn't Earn Enough To Cover Its Payments

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last payment made up 91% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

Looking forward, earnings per share is forecast to fall by 18.6% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 120%, which could put the dividend in jeopardy if the company's earnings don't improve.

Pine Cliff Energy Doesn't Have A Long Payment History

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Pine Cliff Energy's Dividend Might Lack Growth

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Pine Cliff Energy has seen EPS rising for the last five years, at 64% per annum. EPS is growing rapidly, although the company is also paying out a large portion of its profits as dividends. If earnings keep growing, the dividend may be sustainable, but generally we'd prefer to see a fast growing company reinvest in further growth.

Our Thoughts On Pine Cliff Energy's Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 2 warning signs for Pine Cliff Energy that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.