Pinnacle Financial Partners Inc Reports Mixed Results Amidst Challenging Banking Environment

Net Income: Reported a decrease of 32.4% in Q4 diluted EPS year-over-year.

Adjusted EPS: Adjusted EPS for Q4 stands at $1.68 after excluding special charges.

Balance Sheet Growth: Total assets grew by 14.3% year-over-year to $48.0 billion.

Loan Portfolio: Loans increased by 12.5% compared to the previous year.

Net Interest Margin: Remained flat quarter-over-quarter at 3.06%.

Dividends: Declared a quarterly cash dividend of $0.22 per common share.

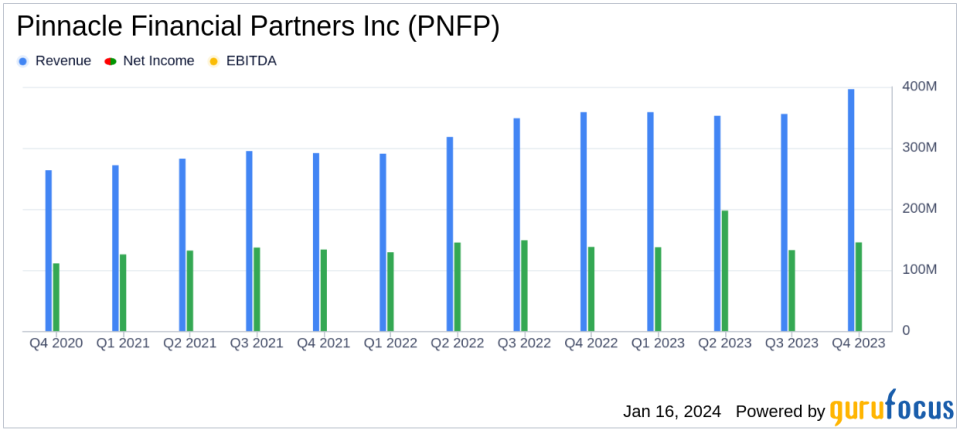

Pinnacle Financial Partners Inc (NASDAQ:PNFP) released its 8-K filing on January 16, 2024, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The report presents a mixed financial performance with notable adjustments due to special assessments and restructuring charges.

Pinnacle Financial Partners Inc is a financial holding company that operates through its subsidiary, Pinnacle Bank. The bank offers a range of lending products and focuses on commercial loans, primarily in real estate and industrial sectors. Pinnacle operates primarily in urban markets across Tennessee and the Southeast, with a strategy that includes growth through mergers and acquisitions.

Financial Performance and Challenges

The company reported a net income per diluted common share of $1.19 for Q4 2023, a significant decrease from $1.76 in the same quarter of the previous year. This decline of 32.4% reflects the challenging conditions faced by the banking sector. However, after adjusting for a special FDIC assessment and bank-owned life insurance (BOLI) restructuring charges, the adjusted diluted EPS was $1.68, closer to the prior year's $1.76. For the full year, the adjusted EPS was $6.99, slightly down from $7.17 in 2022.

These performance metrics are critical as they reflect the bank's ability to generate profit despite the adverse conditions, including two bank failures in the spring of 2023 that led to the FDIC special assessment. The BOLI restructuring is expected to improve future yields, indicating proactive management in optimizing the bank's noninterest income streams.

Financial Achievements and Industry Impact

Pinnacle's balance sheet growth is a testament to its resilience and strategic focus. Total assets increased by 14.3% year-over-year, reaching $48.0 billion. The loan portfolio expanded by 12.5%, with a significant portion attributed to commercial and industrial loans. This growth is particularly noteworthy in the banking industry, where loan growth is a primary driver of revenue.

Key Financial Metrics

The bank's net interest margin remained flat at 3.06% for Q4, which is important as it measures the difference between the interest income generated and the amount of interest paid out to lenders, relative to the amount of their interest-earning assets. Furthermore, the efficiency ratio increased to 63.37%, up from 50.29% in Q4 2022, indicating higher costs relative to revenue.

"There is no doubt that 2023 presented a very difficult operating environment for banks," said M. Terry Turner, Pinnacle's president and CEO. "But 2023 was actually a great year for our firm resulting in year-over-year tangible book value growth of 14.8 percent and a total shareholder return of 20 percent."

The bank's tangible book value per common share increased to $51.38, up from $44.74 at the end of 2022, which is a key indicator of the company's net asset value, providing a more accurate measure of the company's worth.

Analysis of Performance

Pinnacle's performance in 2023, despite the economic headwinds, showcases the firm's robust risk management systems and its ability to attract experienced bankers, which has enabled it to continue growing. The bank's strategic expansion into new markets, such as Jacksonville, Florida, and its ability to maintain a stable net interest margin suggest a strong foundation for future growth.

However, the bank faces ongoing challenges, including an inverted yield curve and the potential for changes in the FDIC special assessment amount. The bank's proactive measures, such as the BOLI restructuring, are steps taken to mitigate these challenges and position the bank for improved performance in 2024.

For a more detailed analysis of Pinnacle Financial Partners Inc's earnings and to stay updated on the latest financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Pinnacle Financial Partners Inc for further details.

This article first appeared on GuruFocus.