Pinning Down Alpine Immune Sciences, Inc.'s (NASDAQ:ALPN) P/S Is Difficult Right Now

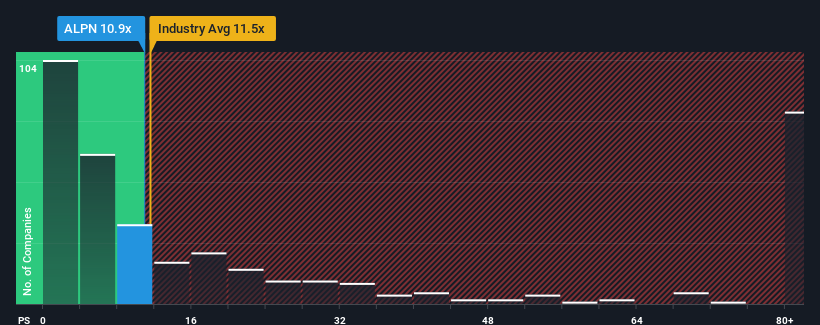

It's not a stretch to say that Alpine Immune Sciences, Inc.'s (NASDAQ:ALPN) price-to-sales (or "P/S") ratio of 10.9x right now seems quite "middle-of-the-road" for companies in the Biotechs industry in the United States, where the median P/S ratio is around 11.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Alpine Immune Sciences

What Does Alpine Immune Sciences' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Alpine Immune Sciences has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alpine Immune Sciences.

How Is Alpine Immune Sciences' Revenue Growth Trending?

In order to justify its P/S ratio, Alpine Immune Sciences would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 12% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 104% per year.

In light of this, it's somewhat alarming that Alpine Immune Sciences' P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of Alpine Immune Sciences' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Alpine Immune Sciences (2 are concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Alpine Immune Sciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here