Pinning Down Denali Therapeutics Inc.'s (NASDAQ:DNLI) P/S Is Difficult Right Now

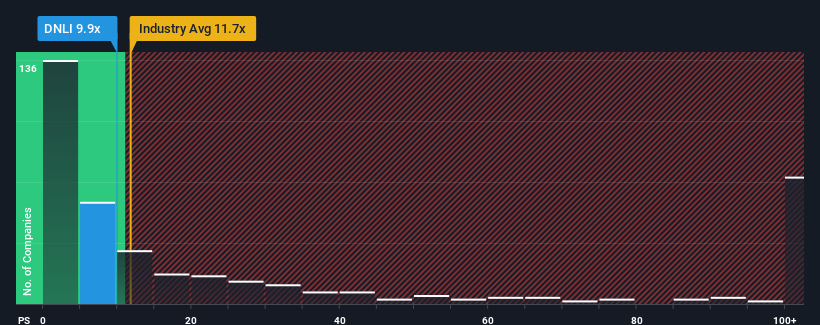

There wouldn't be many who think Denali Therapeutics Inc.'s (NASDAQ:DNLI) price-to-sales (or "P/S") ratio of 9.9x is worth a mention when the median P/S for the Biotechs industry in the United States is similar at about 11.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Denali Therapeutics

How Has Denali Therapeutics Performed Recently?

With revenue growth that's superior to most other companies of late, Denali Therapeutics has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Denali Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.

How Is Denali Therapeutics' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Denali Therapeutics' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 205%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 4.3% per annum during the coming three years according to the twelve analysts following the company. With the industry predicted to deliver 117% growth per annum, that's a disappointing outcome.

With this information, we find it concerning that Denali Therapeutics is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Denali Therapeutics' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears that Denali Therapeutics currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

It is also worth noting that we have found 3 warning signs for Denali Therapeutics (1 shouldn't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Denali Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.