Pinterest (PINS) Q3 Earnings Beat on Solid Revenue Growth

Pinterest, Inc. PINS reported strong third-quarter 2023 results, with the bottom and the top line surpassing the respective Zacks Consensus Estimate. The San Francisco-based Internet content provider reported a revenue expansion year over year. The introduction of AI-driven guided browsing experience, advancement in ad formats, enhanced shoppability and conversion rate increased user engagement on the platform and boosted the top line.

Net Income

On a GAAP basis, net income was $6.7 million or a penny per share against a loss of $65.2 million or a loss of 10 cents per share in the prior-year quarter. Solid net sales growth boosted the net income during the quarter.

Non-GAAP net income was $193.3 million or 28 cents per share, up from $76.5 million or 11 cents per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 7 cents.

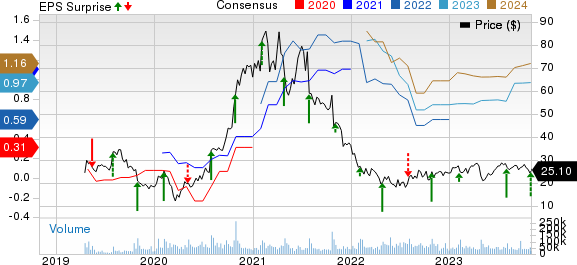

Pinterest, Inc. Price, Consensus and EPS Surprise

Pinterest, Inc. price-consensus-eps-surprise-chart | Pinterest, Inc. Quote

Revenues

During the quarter, net sales aggregated at $763.2 million, up from $684.6 million in the prior-year quarter. The top line beat the Zacks Consensus Estimate of $743 million. Pinterest witnessed 8% year-over-year growth in global monthly active users (MAUs) to an all-time high of 482 million.

Management’s effort to enhance personalization on the platform is driving user engagement across all regions. The introduction of exciting features such as the ‘More Ideas tab’ in the home feed and AI recommendation engines is driving more content saving on the platform. Continuous advancement in ad tools and measurement solutions is enabling advertisers and retailers to capitalize on users' commercial mindset and improve monetization on the platform.

The Direct Link product launch on the platform simplified the shoppability for users and resulted in a 235% jump in conversion rate for participating advertisers. The other ad formats like Premier Spotlight, showcase and quiz ads are also witnessing positive demand from brand advertisers. Collaboration with Adobe Commerce and Salesforce Commerce Cloud is driving more API conversions.

The United States and Canada generated $618 million in revenues, up 8% year over year. Net sales beat our revenue estimate of $598.9 million. Healthy demand in CPG (Consumer packaged goods), retail, financial services and restaurants drove the top line.

Revenues from Europe totaled $114 million, up 33% from $86 million in the year-ago quarter. The top line surpassed our estimate of $112.4 million. Strong momentum in CPG and emerging verticals such as travel, technology and auto boosted the top line.

Net sales from the Rest of World rose to $31 million from $24 million recorded in the prior-year quarter, exceeding our revenue estimate of $28.8 million.

MAUs from the United States and Canada were 96 million, up 1% year over year. The quarterly figure marginally surpassed our estimate of 95 million. The Rest of World registered MAUs of 258 million, up 12% from 230 million in the year-earlier quarter and beat our estimate of 239 million. MAUs from Europe increased to 128 million from 120 million in the year-ago quarter and beat our estimate of 125.3 million.

In the September quarter, the global average revenues per user (ARPU) stood at $1.61 compared with the year-ago quarter’s figure of $1.56. ARPU in Europe improved 26% year over year to 91 cents, while the United States and Canada rose 5% to $6.46. ARPU from the Rest of World was up 16% year over year to 12 cents.

Other Details

Adjusted EBITDA was $184.7 million in third-quarter 2023, up from the prior year quarter’s tally of $77.3 million. Disciplined cost management and net sales growth led to the year-over-year improvement.

Total costs and expenses were $768.2 million, up from $753.9 million in the year-ago quarter. On a GAAP basis, research and development expenses rose to $264.7 million from $254.7 million. Administrative costs increased to $106.6 million from $86.8 million a year ago.

Cash Flow & Liquidity

The company generated $354.7 million of cash from operating activities in the first nine months of 2023 compared with $410.9 million in the prior-year period. As of Sep 30, 2023, Pinterest had cash and cash equivalents of $1,168.4 million, with $170.9 million of operating lease liabilities.

Outlook

For the fourth quarter of 2023, Pinterest anticipates net sales growth in the range of 11-13% year over year. Non-GAAP operating expenses are expected to decrease 9-13% year over year. Management expects its third-party partnership with Amazon will likely have a positive impact on revenues from the beginning of 2024. In the upcoming quarters, the company will continue to focus on cost optimization, improving operational efficiency to achieve its mid to long-term margin expansion goals.

Zacks Rank & Other Stocks to Consider

Pinterest currently sports a Zacks Rank #1 (Strong Buy).

Here are some other top-ranked stocks that investors may consider.

Model N Inc MODN, sporting a Zacks Rank #1 at present, delivered an earnings surprise of 21.26%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 45.83%. You can see the complete list of today’s Zacks #1 Rank stocks here.

It provides revenue management solutions for life sciences and technology companies, including applications for configure, price, quote, rebates management and regulatory compliance.

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1, delivered an earnings surprise of 9.79%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 29.19%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit or GPU. Over the years, the company’s focus has evolved from PC graphics to artificial intelligence-based solutions that now support high-performance computing, gaming and virtual reality platforms.

Arista Networks, Inc. ANET, presently carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and is well-positioned for healthy growth in the data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report