Pioneer (PXD) Q2 Earnings Beat Estimates, Revenues Fall Y/Y

Pioneer Natural Resources Company PXD reported second-quarter 2023 earnings of $4.49 per share (excluding one-time items), which beat the Zacks Consensus Estimate of $4.12. However, the bottom line declined from the year-ago quarter’s level of $9.36.

Total quarterly revenues of $4,599 million missed the Zacks Consensus Estimate of $4,676 million. The top line declined from the year-ago quarter’s figure of $6,920 million.

Better-than-expected quarterly earnings were primarily driven by higher oil-equivalent production volumes. The positives were partially offset by lower realizations of commodity prices.

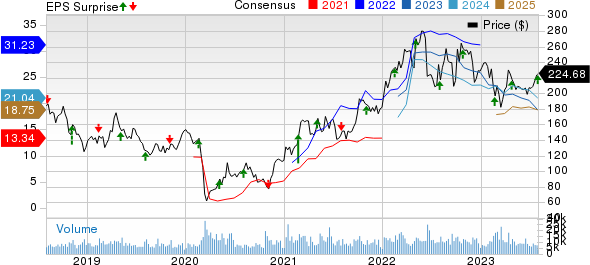

Pioneer Natural Resources Company Price, Consensus and EPS Surprise

Pioneer Natural Resources Company price-consensus-eps-surprise-chart | Pioneer Natural Resources Company Quote

Dividend Cut

For the third quarter, Pioneer announced a dividend payment of $1.84 per share of common stock, which includes a variable dividend of 59 cents per share and a base dividend of $1.25. This indicates a 45% decline from the last paid-out second-quarter dividends of $3.34 per share, comprising base dividends of $1.25 and a variable dividend of $2.09. Thus, while the base dividend remained the same, the variable dividend declined.

The new dividend will likely be paid on Sep 21, 2023, to stockholders of record at the close of business on Sep 6, 2023.

Production

For second-quarter 2023, the total production was 710.7 thousand barrels of oil equivalent per day (MBoe/d), up from the year-ago quarter’s figure of 642.8 MBoe/d. The reported figure also came in higher than our estimate of 678.7 Mboe/d.

Oil production was recorded at 369.1 thousand barrels per day (MBbls/d), up from the year-ago quarter’s level of 347.9 MBbls/d and higher than our estimate of 357.9 MBbls/d. Natural Gas Liquid (NGL) production was 181.1 MBbls/d compared with the prior-year quarter’s 160.2 MBbls/d. The figure came in higher than our estimate of 169.9 MBbls/d. Natural gas production amounted to 963.1 million cubic feet per day (MMcf/d), up from the year-ago quarter’s number of 808.2 MMcf/d and higher than our estimate of 904.9 MMcf/d.

Price Realization

On an oil-equivalent basis, the average realized price was $46.03 per barrel for the reported quarter compared with $79.31 a year ago. Our estimate for the same was pinned at $49.57. The company reported an average realized crude price of $72.90 a barrel, down from $110.56 in the June-end quarter of 2022. The figure was also lower than our estimate of $74.65.

The average natural gas price declined to $1.81 per thousand cubic feet from $6.72 in the prior-year quarter. It was also lower than our estimate of $2.17. NGLs were sold at $22.43 a barrel, down from $44.21 a year ago and lower than our estimate of $29.18.

Operating Costs

Pioneer’s expenses for oil and gas production totaled $487 million, up from $478 million in the year-ago quarter. Yet, total costs and expenses declined to $3,192 million in the second quarter from $3,892 million in the year-ago period. The reported figure came in lower than our estimate of $3296.6 million.

Cash, Debt and Capex

As of Jun 30, 2023, Pioneer’s cash and cash equivalents totaled $91 million, while long-term debt was $5,010 million. In the Jun-end quarter, the company spent a total of $1.2 billion.

Outlook

For 2023, Pioneer raised its oil production guidance to 364-374 thousand barrels of oil per day (MBo/d). The company projects a total production of 697-717 MBoe/d, indicating an increase from 649.8 MBoe/d reported in 2022.

For the third quarter, Pioneer expects oil production in the range of 367-377 MBo/d and a total production of 705-725 MBoe/d.

The company gave a reduced drilling, completions, facilities and water infrastructure capital budget of $4.38-$4.58 billion for the year. Additionally, it allotted a capital budget of $150-$200 million for exploration, environmental and other capital.

PXD boasted that the capital spending would be fully funded by its $9-billion projected cash flow for this year.

Zacks Rank & Stocks to Consider

Pioneer currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the energy space are Evolution Petroleum Corporation EPM, Murphy USA Inc. MUSA and MPLX LP MPLX. While both EPM and MUSA sport a Zacks Rank #1 (Strong Buy), MPLX carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Through its ownership interests in onshore oil and natural gas properties in the United States, Evolution Petroleum is touted as a key independent energy player.

Murphy USA serves 1.6 million customers daily and owns a dedicated line on the Colonial Pipeline. MUSA operates stations close to Walmart supercenters and is a low-cost, high-volume fuel seller. This enables the company to attract significantly more transactions than its peers.

MPLX generates stable fee-based revenues from diverse midstream energy assets via long-term contracts and is least exposed to commodity price fluctuations. The partnership is well positioned to capitalize on the growing demand for fresh midstream assets in order to support increasing volumes of crude oil, natural gas and NGLs in the prolific shale plays in the United States.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report