Pitney Bowes Inc (PBI) Reports Decline in Q4 and Full Year 2023 Revenue Amid Restructuring Efforts

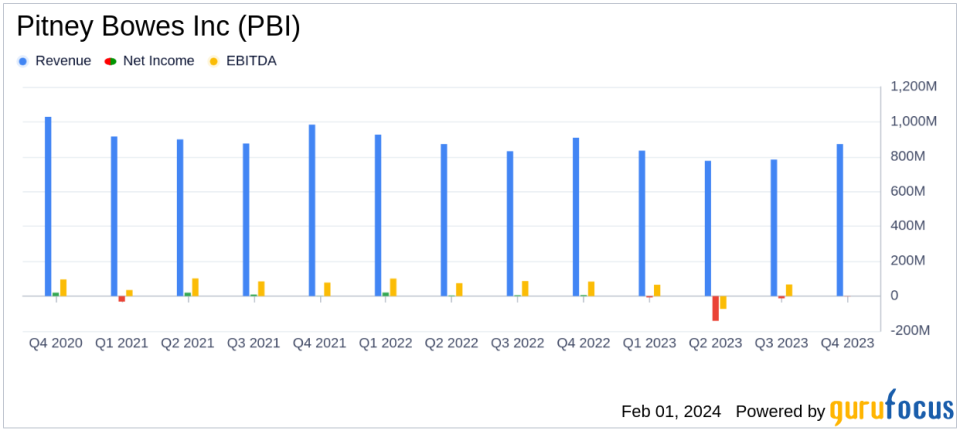

Revenue: Q4 revenue decreased by 4% to $872 million; full year revenue down 8% to $3.3 billion.

Net Income: Q4 GAAP EPS was a loss of $1.27, including a $1.24 loss from goodwill impairment; Adjusted EPS at $0.07.

Cost Reduction: On target with cost reduction and restructuring, aiming for incremental benefits in 2024.

Debt Management: Reduced total debt by $59 million and refinanced 2024 notes.

Segment Performance: SendTech and Presort segments delivered profit increases and margin expansion.

On February 1, 2024, Pitney Bowes Inc (NYSE:PBI) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The global technology company, known for its e-commerce solutions, reported a decrease in revenue for both the quarter and the year, attributing the decline to various challenges within its segments. Despite the revenue dip, the company highlighted progress in its cost reduction and restructuring efforts, which are expected to yield incremental benefits in the upcoming year.

Financial Performance Overview

Pitney Bowes Inc (NYSE:PBI) experienced a 4% decline in fourth-quarter revenue, amounting to $872 million, and an 8% decrease in full-year revenue, totaling $3.3 billion. The company's GAAP earnings per share (EPS) for the quarter was a loss of $1.27, primarily due to a non-cash goodwill impairment charge of $1.24 related to the Global Ecommerce segment. Adjusted EPS for the quarter was slightly up at $0.07 compared to $0.06 in the prior year. For the full year, GAAP EPS was a loss of $2.20, with adjusted EPS at $0.04.

Segment Highlights and Challenges

The SendTech Solutions segment, which provides mailing and shipping technology, saw a 4% decline in fourth-quarter revenue but achieved a 7% increase in adjusted segment EBIT due to gross margin improvements and cost reductions. The Presort Services segment reported a 3% revenue increase for the quarter and significant growth in adjusted segment EBIT and EBITDA, driven by new sales and improved labor productivity.

Global Ecommerce, however, faced challenges with a revenue loss from cross-border activities, although domestic parcel revenue grew by 7%. The segment's EBIT improved in the fourth quarter, reflecting cost actions and increased network productivity.

Looking Forward

For the full year 2024, Pitney Bowes Inc (NYSE:PBI) anticipates revenue growth ranging from flat to a low-single digit decline, with EBIT margins expected to remain relatively stable. The company plans to continue its cost reduction program, expecting to offset gains with the restoration of variable compensation and wage inflation.

Value Investor Insights

Value investors may find interest in Pitney Bowes Inc (NYSE:PBI)'s ongoing cost reduction and restructuring efforts, which are crucial for improving the company's profitability and operational efficiency. The company's ability to reduce debt and manage its financial obligations, as evidenced by the refinancing of its 2024 notes, also presents a positive outlook for financial stability.

The performance of the SendTech and Presort segments indicates resilience and potential for growth, despite the overall revenue decline. These segments' focus on productivity and revenue growth initiatives could be key drivers for the company's future success.

For a detailed understanding of Pitney Bowes Inc (NYSE:PBI)'s financials and strategic direction, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Pitney Bowes Inc for further details.

This article first appeared on GuruFocus.