PJT Partners Inc. Announces Record Revenues and Robust Earnings for Full Year and Q4 2023

Record Annual Revenues: PJT Partners Inc. reported a 12% increase in annual revenues, reaching $1.15 billion.

Adjusted Earnings Per Share: The company achieved an adjusted EPS of $3.27 for the full year and $0.96 for the fourth quarter.

Capital Management: The firm ended the year with $437 million in cash and equivalents, and no funded debt.

Share Repurchase Authorization: The Board authorized a new $500 million Class A common stock repurchase program.

Dividend Declaration: A quarterly dividend of $0.25 per share of Class A common stock was declared, payable on March 20, 2024.

On February 6, 2024, PJT Partners Inc. (NYSE:PJT) released its 8-K filing, announcing its financial results for the full year and fourth quarter of 2023. The advisory-focused investment bank reported record revenues and robust earnings despite a challenging market environment. The company's strategic advisory, capital markets advisory, restructuring, and fundraising services across various industries and geographies have contributed to its strong financial performance.

Financial Performance Highlights

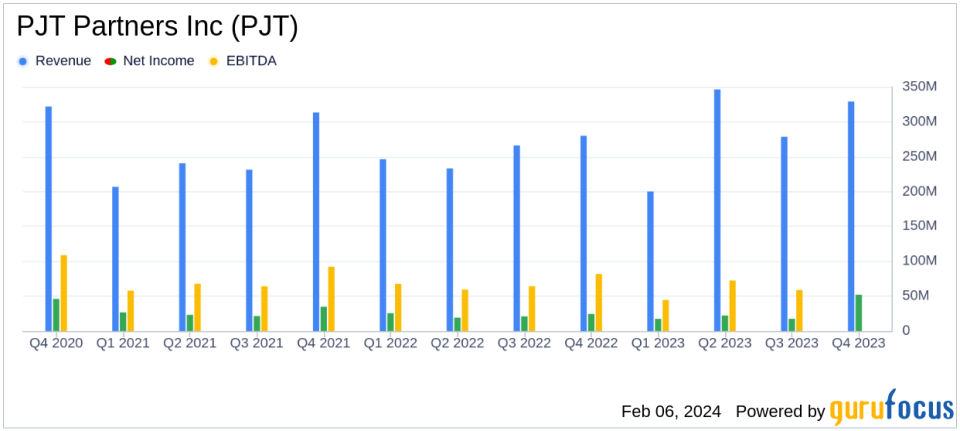

PJT Partners Inc. achieved record annual revenues of $1.15 billion, marking a 12% increase from the previous year. The growth was primarily driven by a 25% increase in advisory revenues, which reached $1.03 billion. However, placement revenues saw a significant decline of 47%, falling to $103 million. The firm's interest income and other revenues also saw a substantial increase of 162%, amounting to $24 million.

For the fourth quarter, the company reported revenues of $329 million, a 17% increase from the same period last year. This was largely due to a 26% increase in advisory revenues, which totaled $291 million. Despite the overall positive trend, placement revenues decreased by 35% to $28 million for the quarter.

The company's GAAP pretax income for the full year stood at $178 million, with an adjusted pretax income of $183 million. The GAAP diluted EPS was $3.12, and the adjusted EPS was $3.27. In the fourth quarter, GAAP pretax income was $52 million, and adjusted pretax income was $53 million, with GAAP diluted EPS at $0.87 and adjusted EPS at $0.96.

Operational and Capital Management

PJT Partners Inc. expanded its workforce by 12%, ending the year with a headcount of 1,012. The company also repurchased 2.2 million share equivalents and maintained a strong liquidity position with $437 million in cash, cash equivalents, and short-term investments. The Board's authorization of a $500 million stock repurchase program underscores the firm's commitment to delivering value to shareholders.

Chairman and CEO Paul J. Taubman commented on the firm's performance, stating:

We reported revenues that were the highest in our firm's history as our balanced business model enabled us to outperform in a challenging environment. 2023 was also a record year for senior recruiting as we took advantage of dislocated market conditions to accelerate our investment in senior talent, enabling us to expand our capabilities across the firm with particular emphasis on enhancing our Strategic Advisory industry footprint. Amidst continued market uncertainty, we remain highly confident in our future growth prospects.

Challenges and Outlook

While PJT Partners Inc. has delivered strong financial results, the firm acknowledges the ongoing market uncertainties and the impact of a challenging economic landscape. The decrease in placement revenues reflects the volatility in the capital markets and the potential challenges in fundraising activities. However, the firm's diversified revenue streams and strategic investments in talent position it well for future growth.

The company's proactive capital management, including the share repurchase program and the declaration of a quarterly dividend, demonstrates confidence in its financial stability and commitment to shareholder returns.

As PJT Partners Inc. continues to navigate a complex market environment, its strategic focus and robust financial performance signal a positive outlook for the firm's future endeavors.

Explore the complete 8-K earnings release (here) from PJT Partners Inc for further details.

This article first appeared on GuruFocus.