Plains All American (PAA) Q4 Earnings Top Estimates, Sales Lag

Plains All American Pipeline, L.P. PAA reported fourth-quarter 2023 adjusted earnings of 42 cents per unit, which surpassed the Zacks Consensus Estimate of 37 cents by 13.5%. The bottom line improved 27.3% from the year-ago quarter’s level of 33 cents.

The company reported GAAP earnings of 35 cents per unit compared with 30 cents in the year-ago period.

Full-year 2023 adjusted earnings were $1.42 per share, up 13% from the previous year’s reported figure of $1.26.

Total Revenues

Net sales of $12.7 billion missed the Zacks Consensus Estimate of $18.4 billion by 31%. The top line also declined 2% from the year-ago quarter’s figure of $13 billion.

Full-year 2023 revenues totaled $48.7 billion, down 15% from the previous year’s level of $57.3 billion.

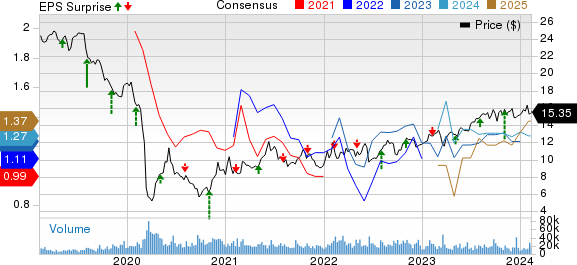

Plains All American Pipeline, L.P. Price, Consensus and EPS Surprise

Plains All American Pipeline, L.P. price-consensus-eps-surprise-chart | Plains All American Pipeline, L.P. Quote

Highlights of the Release

Total costs and expenses amounted to $12.3 billion, down 5.5% year over year. The decrease was primarily due to a decline in purchases and related costs.

Net interest expenses totaled $97 million, down 3% from the prior-year quarter’s level.

Segmental Performance

The Crude Oil segment’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) were $563 million, up 12% from the year-ago quarter’s figure. This increase was due to higher volumes across its pipeline systems, contributions from acquisitions and the benefit of tariff escalation.

Adjusted EBITDA for the NGL segment came in at $169 million, up 12% from the prior-year period’s figure. The increase was due to favorable NGL basis differentials and additional market-based opportunities.

Financial Update

As of Dec 31, 2023, cash and cash equivalents were $450 million compared with $401 million as of Dec 31, 2022.

As of Dec 31, 2023, total long-term debt was $7.3 billion compared with $7.28 billion as of Dec 31, 2022.

As of Dec 31, 2023, long-term debt-to-total book capitalization was 41% compared with 42% as of Dec 31, 2022.

Guidance

For 2024, Plains All American expects adjusted EBITDA in the range of $2.625-$2.725 billion. Adjusted free cash flow is anticipated to be $1.65 billion (excluding changes in assets and liabilities).

PAA remains focused on disciplined capital investments, anticipating full-year 2024 investment and maintenance capital of $375 million and $230 million, respectively.

Zacks Rank

PAA currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Cheniere Energy LNG is scheduled to report fourth-quarter results on Feb 22, before market open. The Zacks Consensus Estimate for earnings is pegged at $2.70 per share.

LNG’s long-term (three to five years) earnings growth rate is 25.77%. The company delivered an average earnings surprise of 92% in the last four quarters.

ONEOK, Inc. OKE is slated to report fourth-quarter results on Feb 26, after market close. The Zacks Consensus Estimate for earnings is pegged at $1.16 per share, implying a year-over-year increase of 7.4%.

OKE’s long-term earnings growth rate is 7.64%. It delivered an average earnings surprise of 6% in the last four quarters.

Devon Energy DVN is scheduled to report fourth-quarter results on Feb 27, after market close. The Zacks Consensus Estimate for earnings is pegged at $1.38 per share.

DVN’s long-term earnings growth rate is 51.35%. The company delivered an average earnings surprise of 1.6% in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Plains All American Pipeline, L.P. (PAA) : Free Stock Analysis Report

ONEOK, Inc. (OKE) : Free Stock Analysis Report

Cheniere Energy, Inc. (LNG) : Free Stock Analysis Report