The Plains All American Pipeline LP (PAA) Company: A Short SWOT Analysis

Strengths: Robust pipeline network and strategic asset base in key production areas, including the Permian Basin.

Weaknesses: Exposure to volatile commodity prices and regulatory challenges.

Opportunities: Expansion of infrastructure to accommodate growing energy demand and export potential.

Threats: Environmental concerns and competition from renewable energy sources.

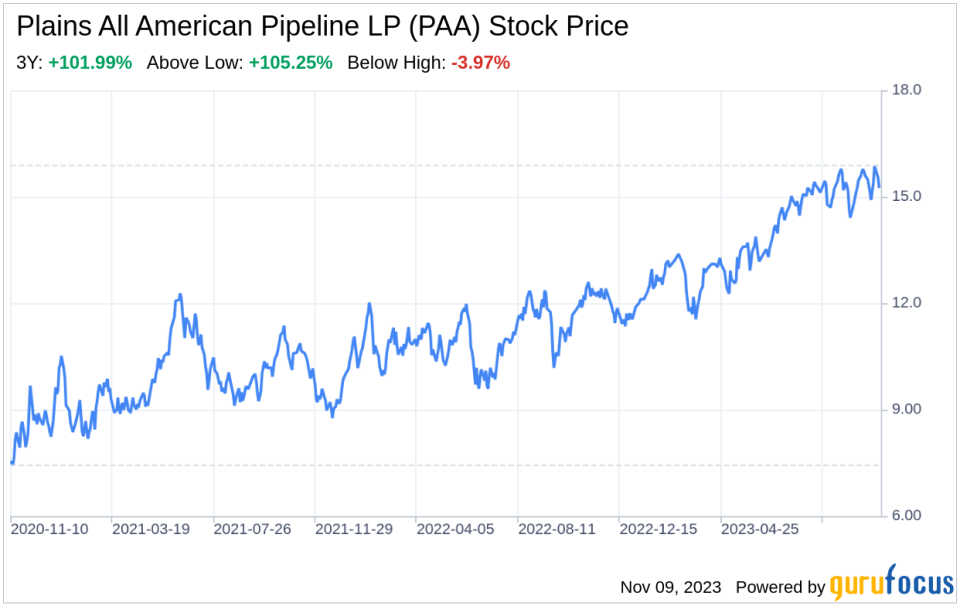

Plains All American Pipeline LP (NASDAQ:PAA) filed its 10-Q report on November 8, 2023, providing a snapshot of its financial performance and operational highlights. As a leading provider of midstream services for crude oil, natural gas liquids, and related products, PAA operates a vast network of assets across the United States and Canada, with a significant presence in the prolific Permian Basin. The financial tables from the filing reveal a mixed picture: while total revenues for the three months ended September 30, 2023, decreased to $12,071 million from $14,336 million in the same period of the previous year, net income attributable to PAA increased to $203 million from $384 million. This SWOT analysis aims to dissect the underlying factors contributing to these financial outcomes and provide investors with a comprehensive understanding of PAA's strategic position.

Strengths

Strategic Asset Base and Market Position: Plains All American Pipeline LP's strength lies in its extensive pipeline network and strategic asset base, particularly in the Permian Basin, one of the most prolific oil-producing regions in North America. The company's infrastructure is critical for transporting, storing, and processing energy commodities, positioning it as a key player in the midstream sector. This strategic positioning allows PAA to capitalize on the region's production growth and secure long-term contracts, contributing to a stable revenue stream.

Financial Resilience: Despite a decrease in total revenues, PAA has demonstrated financial resilience, as evidenced by the increase in net income attributable to PAA. This resilience is underpinned by the company's ability to manage costs effectively, as shown by the reduction in purchases and related costs from $13,071 million to $11,106 million year-over-year for the three-month period. Additionally, PAA's balance sheet reflects a robust liquidity position, with sufficient capital to fund operations and strategic growth initiatives.

Weaknesses

Commodity Price Sensitivity: Plains All American Pipeline LP's performance is inherently tied to the volatile nature of commodity prices. Fluctuations in the prices of crude oil and natural gas liquids directly impact the company's revenues and profitability. The recent decrease in product sales revenues from $14,001 million to $11,581 million for the three-month period underscores this vulnerability and highlights the need for PAA to enhance its hedging strategies to mitigate price risks.

Regulatory and Environmental Risks: PAA operates in a highly regulated industry, where changes in environmental policies and regulations can impose additional operational costs and compliance burdens. The company's exposure to potential environmental liabilities and litigation, as mentioned in the filing, represents a significant weakness that requires ongoing attention and proactive management to minimize financial and reputational impacts.

Opportunities

Infrastructure Expansion: With the growing demand for energy and the increasing export potential of North American oil and gas, PAA has the opportunity to expand its infrastructure and services. The company's strategic focus on key producing regions and transportation corridors positions it well to invest in new projects and partnerships that can drive future growth and enhance its service offerings.

Technological Advancements: The adoption of advanced technologies in pipeline operations and monitoring can improve efficiency, safety, and environmental performance. PAA's ongoing investments in technology and innovation present an opportunity to differentiate itself from competitors and meet the evolving needs of its customers and stakeholders.

Threats

Environmental and Social Concerns: The midstream sector faces increasing scrutiny from environmental groups and the public, which can lead to opposition to pipeline projects and increased regulatory pressures. PAA must navigate these challenges carefully to maintain its social license to operate and avoid project delays or cancellations that could impact its growth prospects.

Renewable Energy Competition: The global shift towards renewable energy sources poses a long-term threat to the demand for fossil fuels and, consequently, PAA's services. The company must monitor this trend closely and explore opportunities to diversify its services to remain relevant in a changing energy landscape.

In conclusion, Plains All American Pipeline LP (NASDAQ:PAA) exhibits a strong market position with a strategic asset base that provides a competitive edge in the midstream sector. However, the company must address its weaknesses related to commodity price sensitivity and regulatory risks while capitalizing on opportunities for infrastructure expansion and technological advancements. PAA also faces threats from environmental concerns and the rise of renewable energy, which necessitate a forward-looking strategy to ensure long-term sustainability and growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.