PLAYSTUDIOS Inc (MYPS) Reports Mixed Q4 Results Amid Strategic Realignment

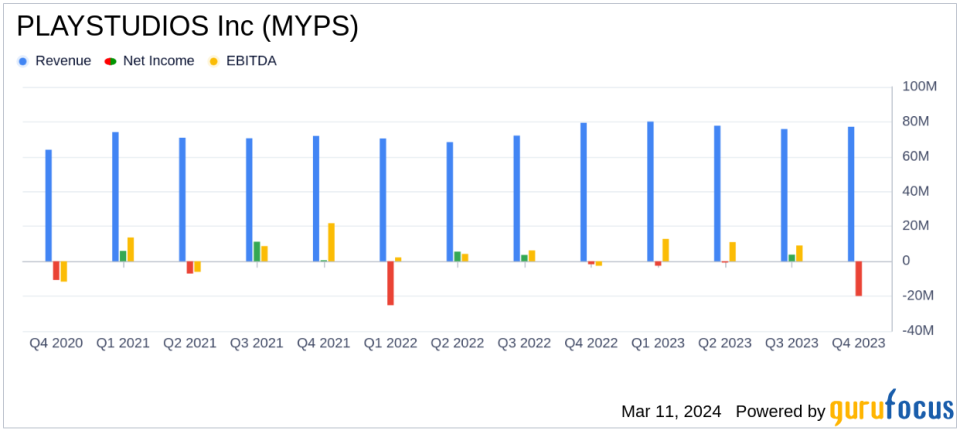

Revenue: Q4 revenue decreased to $77.1 million from $79.4 million in Q4 2022.

Net Loss: Net loss widened to $19.9 million in Q4 2023 from $1.7 million in Q4 2022.

AEBITDA: Adjusted EBITDA increased to $14.7 million in Q4, up from $12.1 million year-over-year.

Full Year Performance: 2023 full-year revenue rose to $310.9 million from $290.3 million in the previous year.

Guidance: FY2024 revenue is expected to be between $315 - $325 million, with AEBITDA projected at $65 - $70 million.

Liquidity: As of December 31, 2023, cash balance stood at $133 million with full availability on an $81 million loan facility.

Strategic Moves: Key initiatives included realignment around main business lines, studio relocations, and extending Tetris' mobile gaming license.

On March 11, 2024, PLAYSTUDIOS Inc (NASDAQ:MYPS) released its 8-K filing, revealing a mixed set of financial results for the fourth quarter of 2023. The company, known for its playAWARDS loyalty platform and free-to-play mobile and social games, reported a slight decline in quarterly revenue and a significant increase in net loss compared to the same period last year. However, it also saw a notable rise in its Adjusted EBITDA (AEBITDA), reflecting improved profitability margins.

Company Overview

PLAYSTUDIOS Inc operates in the interactive media industry, focusing on the development and operation of online and mobile social gaming applications. These games, available on various platforms including the Apple App Store, Google Play Store, Amazon Appstore, and Facebook, are free-to-play and monetized through in-game virtual currency sales and advertising. The company's unique selling proposition is its loyalty program, which offers real-world rewards from a collection of award partners.

Financial Performance and Challenges

While PLAYSTUDIOS experienced a year-over-year increase in full-year revenue, from $290.3 million in 2022 to $310.9 million in 2023, the fourth quarter saw a slight dip in revenue from $79.4 million to $77.1 million. The net loss for the quarter expanded significantly to $19.9 million, up from a net loss of $1.7 million in the fourth quarter of the previous year. This widening loss is a point of concern and highlights the challenges the company faces in maintaining profitability amidst its strategic realignments and investments.

Financial Achievements and Importance

Despite the challenges, PLAYSTUDIOS reported a robust increase in AEBITDA, a key measure of profitability, which grew over 20% year-over-year to $14.7 million in the fourth quarter. The AEBITDA margin also expanded by 390 basis points from the year-ago levels. For the full year, AEBITDA surged by over 60%, with margins growing nearly 700 basis points to 20%. These achievements are significant as they demonstrate the company's ability to improve operational efficiency and profitability, which is crucial in the competitive interactive media landscape.

Key Financial Metrics

The company's balance sheet remains strong with a cash balance of $133 million as of December 31, 2023. The company also highlighted its liquidity position, with full availability on its $81 million loan facility. No stock was repurchased in the open market during the quarter, although the Board extended the share repurchase authorization through November 10, 2024, increasing the remaining amount authorized to $50 million.

"We closed 2023 strongly, reporting fourth quarter results that were ahead of consensus expectations and above the midpoint of our guidance," said Andrew Pascal, Chairman and Chief Executive Officer of PLAYSTUDIOS. "Our profitability continued to rise at a remarkable rate, with year over year Consolidated AEBITDA growing over 20% and Consolidated AEBITDA margins expanding by 390bps vs. the fourth quarter of 2022."

Analysis of Performance

PLAYSTUDIOS' performance in 2023 reflects a company in transition, focusing on strategic initiatives aimed at long-term growth. The increase in AEBITDA and margins suggests that the company's efforts to realign its business and optimize operations are bearing fruit. However, the widening net loss indicates that these changes come with significant costs, and the company will need to continue to manage these effectively to ensure sustainable profitability.

The company's guidance for 2024, with expected revenue growth and further AEBITDA improvements, suggests confidence in its strategic direction. The focus on expanding the playAWARDS platform and developing new games, particularly within the Tetris franchise, indicates potential areas of growth. However, the company will need to carefully balance investment in growth with the control of operating costs to improve its bottom line.

For a detailed analysis of PLAYSTUDIOS Inc's financials and strategic outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from PLAYSTUDIOS Inc for further details.

This article first appeared on GuruFocus.