PlayStudios (NASDAQ:MYPS) Reports Sales Below Analyst Estimates In Q3 Earnings

Digital casino game platform PlayStudios (NASDAQ:MYPS) missed analysts' expectations in Q3 FY2023, with revenue up 5.17% year on year to $75.9 million. Turning to EPS, PlayStudios made a GAAP profit of $0.03 per share, improving from its profit of $0.02 per share in the same quarter last year.

Is now the time to buy PlayStudios? Find out by accessing our full research report, it's free.

PlayStudios (MYPS) Q3 FY2023 Highlights:

Revenue: $75.9 million vs analyst estimates of $77.3 million (1.89% miss)

EPS: $0.03 vs analyst estimates of -$0.03 ($0.06 beat)

The company dropped its revenue guidance for the full year from $315 million to $310 million at the midpoint, a 1.59% decrease

Gross Margin (GAAP): 73.8%, up from 69.9% in the same quarter last year

Average MAUs: 13.7 million, up 7.03 million year on year

Andrew Pascal, Chairman and Chief Executive Officer of PLAYSTUDIOS, commented, “Year-over-year profitability and margins improved in the third quarter, continuing a trend we’ve seen since the second half of 2022. Compared to 3Q22, AEBITDA margins grew by 430 basis points in the quarter while total AEBITDA was up 39%. Year to date, AEBITDA margins have gained 790 basis points over the prior year comparable period, evidence that our efforts around operational efficiencies, revenue diversification, and cost containment are working. We expect gains to continue and we remain focused on reaching margin parity with our peers. While we’ve yet to see the same level of momentum in our top-line revenues, I’m confident in our growth pipeline. Specific revenue drivers include further refinements in myVEGAS Slots and myKONAMI Slots, the continued scaling up of our early-stage growth games, the introduction of new game titles currently in development, and the expansion of our playAWARDS loyalty marketing platform to external partners.”

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Sales Growth

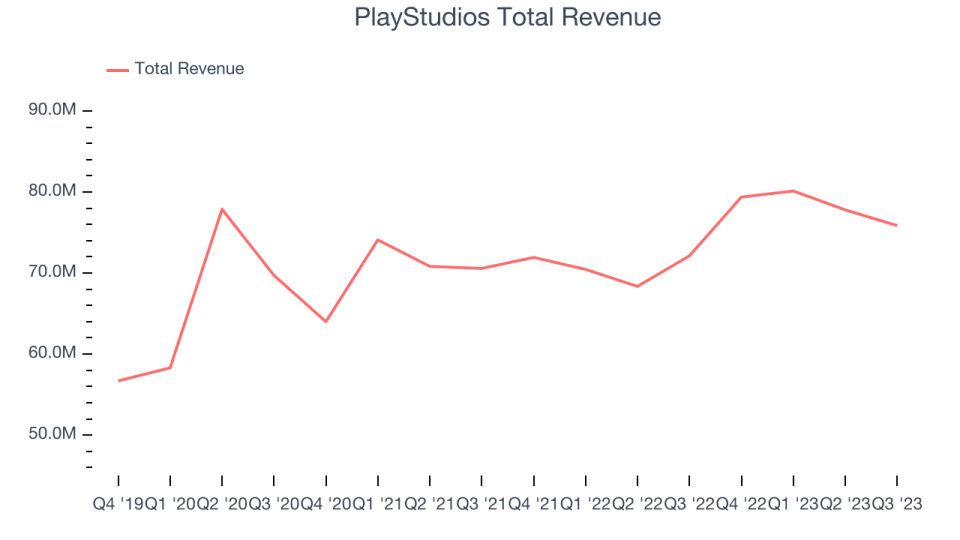

PlayStudios's revenue growth over the last three years has been unimpressive, averaging 6.79% annually. This quarter, PlayStudios reported mediocre 5.17% year-on-year revenue growth, missing Wall Street's expectations.

Ahead of the earnings results, analysts covering the company were projecting sales to grow 4.66% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Usage Growth

As a video gaming company, PlayStudios generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

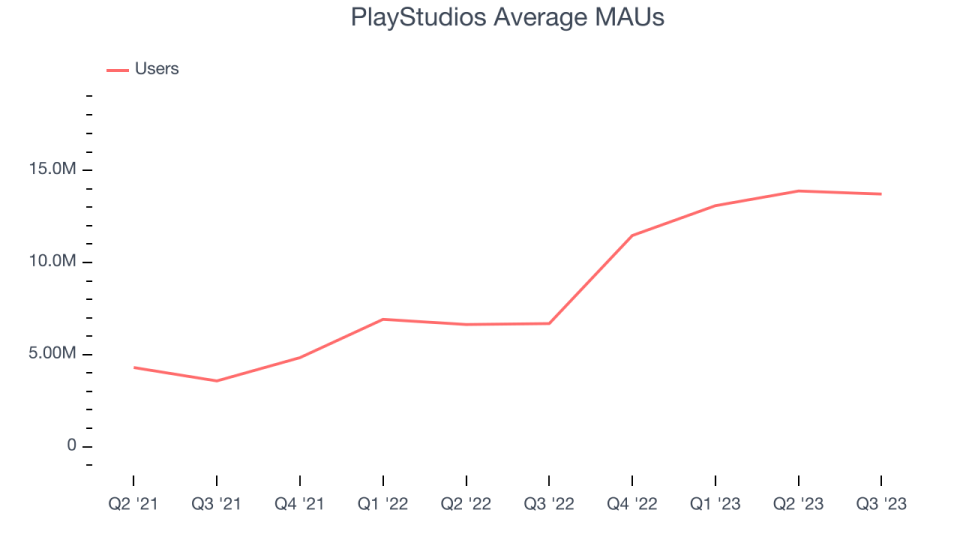

Over the last two years, PlayStudios's monthly active users, a key performance metric for the company, grew 97% annually to 13.7 million. This is among the fastest growth rates of any consumer internet company, indicating that users are excited about its offerings.

In Q3, PlayStudios added 7.03 million monthly active users, translating into 105% year-on-year growth.

Key Takeaways from PlayStudios's Q3 Results

With a market capitalization of $368.2 million and more than $129.8 million in cash on hand, PlayStudios can continue prioritizing growth.

We were very impressed by PlayStudios's robust user growth this quarter. That really stood out as a positive in these results. On the other hand, revenue in the quarter missed and its full-year revenue guidance underwhelmed, as it was lowered and came in below expectations. However, the company did raise its full year EBITDA guidance in spite of the lowered revenue outlook. Overall, this was a mixed quarter for PlayStudios. The stock is flat after reporting and currently trades at $2.9 per share.

PlayStudios may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.