PlayStudios's (NASDAQ:MYPS) Q4 Sales Beat Estimates, Shows User Growth

Digital casino game platform PlayStudios (NASDAQ:MYPS) reported Q4 FY2023 results exceeding Wall Street analysts' expectations , with revenue down 2.9% year on year to $77.11 million. The company expects the full year's revenue to be around $320 million, in line with analysts' estimates. It made a GAAP loss of $0.15 per share, down from its loss of $0.01 per share in the same quarter last year.

Is now the time to buy PlayStudios? Find out by accessing our full research report, it's free.

PlayStudios (MYPS) Q4 FY2023 Highlights:

Revenue: $77.11 million vs analyst estimates of $75.31 million (2.4% beat)

Adjusted EBITDA: $14.7 million vs analyst estimates of $12.3 million (19.5% beat)

EPS: -$0.15 vs analyst estimates of -$0.02 (-$0.13 miss)

Management's revenue guidance for the upcoming financial year 2024 is $320 million at the midpoint, in line with analyst expectations and implying 2.9% growth (vs 7.5% in FY2023) (adjusted EBITDA guidance for the period also roughly in line)

Gross Margin (GAAP): 74.7%, up from 72.6% in the same quarter last year

Average MAUs: 13.29 million, up 1.83 million year on year

Market Capitalization: $286.8 million

Andrew Pascal, Chairman and Chief Executive Officer of PLAYSTUDIOS, commented, “We closed 2023 strongly, reporting fourth quarter results that were ahead of consensus expectations and above the midpoint of our guidance. Our profitability continued to rise at a remarkable rate, with year over year Consolidated AEBITDA growing over 20% and Consolidated AEBITDA margins expanding by 390bps vs. the fourth quarter of 2022. Full year 2023 results were even stronger with Consolidated AEBITDA expanding by over 60% and Consolidated AEBITDA margins growing nearly 700bps to 20%. Our goal remains to reach parity with our peers, whose margins are in the 30% range. Revenues in the quarter were largely inline with our expectations, with our portfolio of growth games continuing to perform strongly. playAWARDS added new partners and functionality in the quarter as well as expanding its presence across our games. We believe a full adoption of the myVIP program will meaningfully increase audience participation in our loyalty ecosystem and drive substantial value for our players, games, and reward partners.”

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Sales Growth

PlayStudios's revenue growth over the last three years has been unimpressive, averaging 5.5% annually. This quarter, PlayStudios beat analysts' estimates but reported a year on year revenue decline of 2.9%.

For the upcoming financial year, management expects revenue to reach $320 million at the midpoint, representing 2.9% growth compared to the 7.5% increase in FY2023.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

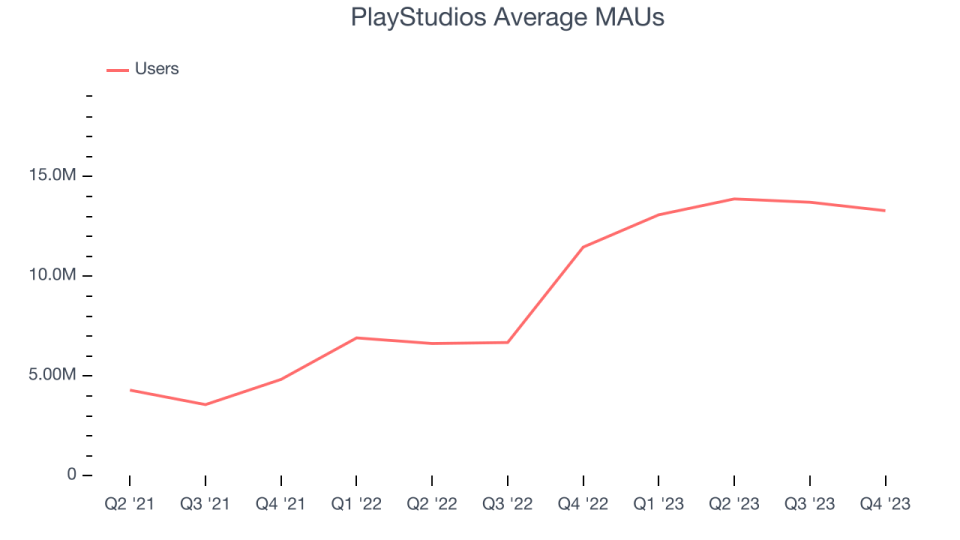

Usage Growth

As a video gaming company, PlayStudios generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

Over the last two years, PlayStudios's monthly active users, a key performance metric for the company, grew 85.5% annually to 13.29 million. This is among the fastest growth rates of any consumer internet company, indicating that users are excited about its offerings.

In Q4, PlayStudios added 1.83 million monthly active users, translating into 15.9% year-on-year growth.

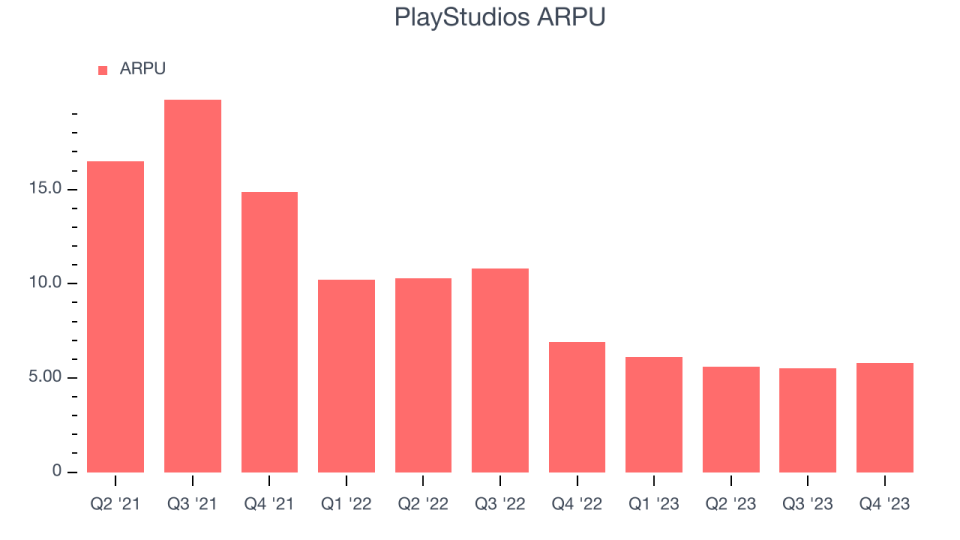

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like PlayStudios because it measures how much revenue each user generates, which is a function of how much paying users spend on its games.

PlayStudios's ARPU has declined over the last two years, averaging 41%. Although it's unfortunate to see the company lose its pricing power, it was still able to achieve strong user growth. This quarter, ARPU declined 16.2% year on year to $5.80 per user.

Key Takeaways from PlayStudios's Q4 Results

It was great to see PlayStudios's strong user growth this quarter. We were also glad its revenue and adjusted EBITDA outperformed Wall Street's estimates. On the other hand, its revenue growth regrettably slowed. Guidance seemed fine even though it wasn't too exciting, with full year revenue and adjusted EBITDA guidance relatively in line with expectations. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. Investors were likely expecting more, and the stock is down 4.8% after reporting, trading at $2.09 per share.

So should you invest in PlayStudios right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.