Plexus Corp (PLXS) Reports Fiscal Q1 2024 Results: Revenue Meets Revised Expectations

Revenue: Reported $983 million, aligning with revised expectations.

GAAP Operating Margin: Achieved 4.6% for the quarter.

GAAP Diluted EPS: Recorded at $1.04, including stock-based compensation expense.

New Manufacturing Wins: Secured 30 programs estimated at $261 million annualized revenue.

Share Repurchase Program: Announced a new $50 million authorization.

Guidance: Q2 revenue projected between $930 million to $970 million, with GAAP diluted EPS of $0.48 to $0.63.

Restructuring Charges: Anticipated $10 million in Q2, aiming for $20 million annualized cost savings.

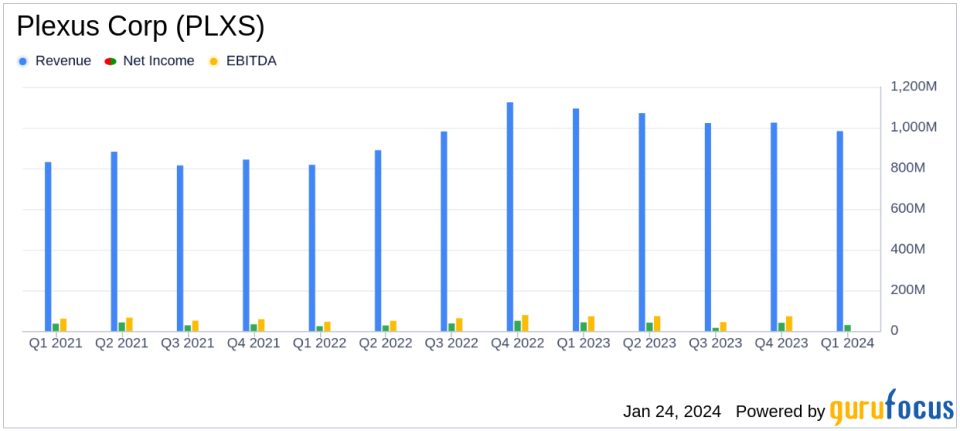

Plexus Corp (NASDAQ:PLXS) released its 8-K filing on January 24, 2024, detailing the financial outcomes for the fiscal first quarter ended December 30, 2023. The company, a leading Electronic Manufacturing Services provider, reported a fiscal first quarter revenue of $983 million, which met the revised expectations set earlier in the month. The GAAP operating margin stood at 4.6%, with a GAAP diluted earnings per share (EPS) of $1.04, inclusive of a $0.19 stock-based compensation expense.

Plexus Corp operates across the Americas, Asia-Pacific, and Europe, Middle East, and Africa (EMEA) segments, offering services from design to manufacturing and after-market support. The company's performance is particularly significant as it navigates a challenging global economic environment, marked by demand softening in key markets such as Healthcare/Lifesciences and certain Industrial subsectors.

Fiscal Q1 2024 Performance Highlights

During the quarter, Plexus won 30 new manufacturing programs, which are expected to contribute $261 million in annualized revenue once fully ramped up. This achievement underscores the company's ability to secure new business and expand its market presence. The Board of Directors also approved a new $50 million share repurchase program, reflecting confidence in the company's financial stability and commitment to delivering shareholder value.

Financial Metrics and Challenges

Despite the positive developments, Plexus Corp faces challenges, including inefficiencies within its engineering and manufacturing teams due to the softening demand. To address this, the company is implementing restructuring actions expected to incur charges of approximately $10 million, or $0.32 per share, in the fiscal second quarter. These actions are projected to yield about $20 million in annualized cost savings.

Outlook and Strategic Actions

Looking ahead, Plexus provided guidance for the fiscal second quarter with revenue projections between $930 million to $970 million and a GAAP diluted EPS ranging from $0.48 to $0.63. The company anticipates the second quarter to mark a revenue trough, with expectations of sequential expansion in revenue and operating margin in the latter half of the fiscal year. Plexus remains committed to achieving a 5.5% GAAP operating margin by fiscal 2025.

Financial Tables and Key Metrics

Key financial details from the quarter include a gross profit of $88.1 million and net income of $29.2 million. The gross margin was reported at 9.0%, with a return on invested capital (ROIC) of 10.3% and an economic return of 2.1%. The company's cash cycle days increased to 95, up from 87 in the previous quarter, indicating a longer duration of capital tied up in operations.

Chief Executive Officer Todd Kelsey highlighted the company's strategic wins and the expansion of its qualified manufacturing opportunities funnel, which now stands at $4.0 billion. Chief Financial Officer Patrick Jermain emphasized the focus on working capital optimization to improve the cash cycle and support anticipated growth and the share repurchase program.

Analysis of Plexus Corp's Performance

Plexus Corp's performance in the fiscal first quarter reflects a resilient business model capable of adapting to market dynamics. The company's strategic actions, including the restructuring plan and share repurchase program, are aimed at improving long-term efficiency and shareholder returns. With a solid track record of securing new manufacturing programs and a robust funnel of opportunities, Plexus is well-positioned to navigate the current challenges and achieve its future financial targets.

For a more detailed analysis and ongoing updates on Plexus Corp's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Plexus Corp for further details.

This article first appeared on GuruFocus.