Plexus (PLXS) Reports Preliminary Q1 Results, Shares Fall

Plexus Corp PLXS recently reported preliminary results for the first quarter of fiscal 2024. The company noted that quarterly performance was affected by incrementally weaker demand from the Healthcare/Lifesciences and Industrial markets as well as broad market-driven inventory corrections.

As a result, PLXS now expects revenues in the range of $980-$985 million for the fiscal first quarter. Earlier, the company had projected revenues between $990 million and $1.03 billion.

GAAP operating margin is now anticipated to be 4.6% (previous projection: between 4.8% and 5.3%). GAAP EPS is now forecast in the range of $1.02-$1.06 (previous projected range: $1.15-$1.33).

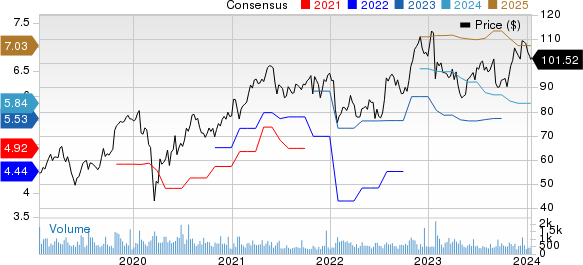

Plexus Corp. Price and Consensus

Plexus Corp. price-consensus-chart | Plexus Corp. Quote

PLXS also announced a new $50 million worth of share repurchase authorization. The company is scheduled to report its fiscal first-quarter results on Jan 24, 2024.

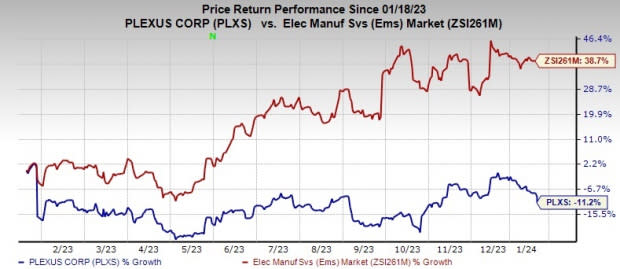

Following the announcement, shares of PLXS were down nearly 2% in the pre-market trading on Jan 17. In the past year, shares have lost 11.2% against the sub-industry’s growth of 38.7%.

Image Source: Zacks Investment Research

Headquartered in Neenah, WI, Plexus is a well-known name in the electronic manufacturing services (“EMS”) industry. It offers wide-ranging advanced solutions throughout the product's lifecycle (including design and development, new product introduction, manufacturing and sustaining services, and supply-chain solutions) to companies across Healthcare/Life Sciences, Industrial and Aerospace/Defense sectors worldwide.

Plexus reported revenues of $1.02 million in fourth-quarter fiscal 2023. Revenues decreased 8.9% year over year. The top-line performance was affected mainly due to weakness in the Healthcare/Life Sciences and Industrial sectors. However, revenues surpassed the Zacks Consensus Estimate by 0.4%.

Healthcare/Life Sciences, Industrial and Aerospace/Defense accounted for 44%, 41% and 15% of total revenues in fourth-quarter fiscal 2023, respectively. The top 10 customers of the company accounted for 48% of quarterly net revenues.

In the fiscal fourth quarter, Plexus won 30 manufacturing contracts worth $192 million in annualized revenues when fully ramped into production. Trailing four-quarter manufacturing wins totaled more than $946 million in annualized revenues.

At present, PLXS carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks worth consideration in the broader technology space are Watts Water Technologies WTS, NETGEAR NTGR and Blackbaud BLKB. While NETGEAR and Blackbaud currently sport a Zacks Rank #1 (Strong Buy) each, Watts Water carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Watts Water Technologies’ 2023 EPS has improved by 1% in the past 60 days to $8.08.

WTS’ earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 11.8%. Shares of WTS have jumped 28.1% in the past year.

The Zacks Consensus Estimate for 2023 is pegged at a loss of 9 cents per share for NETGEAR, which remained unchanged in the past 30 days. NTGR’s earnings outpaced the Zacks Consensus Estimate in three of the last four quarters while missing once. The average surprise was 127.5%. Shares of NTGR were down 30.6% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2023 EPS has improved by 1% in the past 60 days to $3.86.

BLKB’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 10.6%. Shares of BLKB have gained 33% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Plexus Corp. (PLXS) : Free Stock Analysis Report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report