PNC Financial Services Group Inc Reports Full Year 2023 Earnings

Net Income: Reported $5.6 billion for the full year 2023, with fourth-quarter net income of $0.9 billion.

Diluted EPS: $12.79 for the full year, $1.85 for Q4, and $3.16 adjusted for Q4.

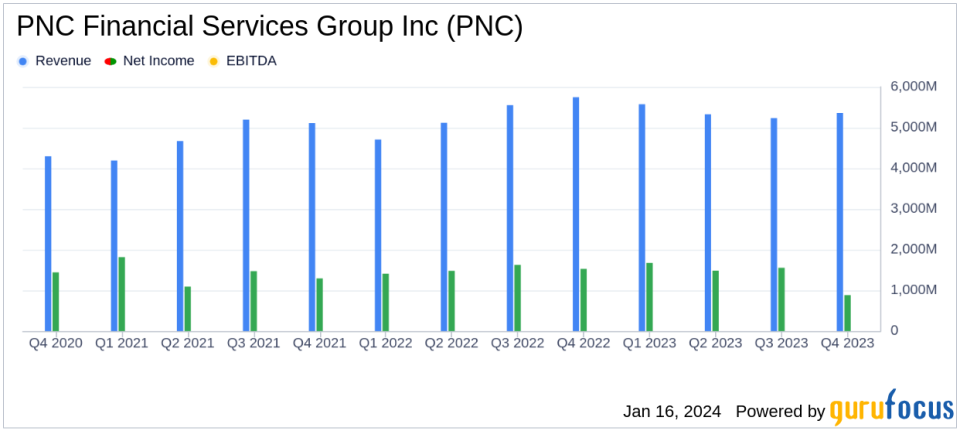

Revenue: Increased by 2% in Q4 to $5.4 billion, with full-year revenue reaching $21.49 billion.

Average Loans and Deposits: Average loans grew by 2% to $324.6 billion, while average deposits saw modest growth.

Provision for Credit Losses: $232 million in Q4, reflecting portfolio activity.

Capital and Liquidity: CET1 capital ratio stood at 9.9%, with a strong capital and liquidity position maintained.

Share Repurchases: $0.1 billion of common shares repurchased in Q4.

On January 16, 2024, PNC Financial Services Group Inc (NYSE:PNC) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. PNC, a diversified financial services company with a presence across the United States, reported a net income of $5.6 billion for the year, translating to a diluted earnings per share (EPS) of $12.79, or $14.10 when adjusted.

Financial Performance and Challenges

PNC's performance in 2023 demonstrated resilience amidst a challenging banking environment. The company managed to grow its revenue and average loans and deposits, which is crucial for a bank's profitability and stability. However, the fourth quarter saw a decrease in net income by 44% compared to the third quarter, primarily due to post-tax expenses related to the FDIC special assessment and workforce reduction charges. These challenges highlight the importance of managing expenses and the impact of external economic factors on the banking sector.

Financial Achievements

The growth in revenue and loans is a significant achievement for PNC, reflecting its ability to attract and retain customers and expand its lending activities. The stable allowance for credit losses to total loans ratio at 1.7% and the improvement in accumulated other comprehensive income (AOCI) by $2.6 billion indicate a strong balance sheet and credit quality. These achievements are particularly important for banks, as they are indicators of financial health and the ability to withstand economic fluctuations.

Income Statement and Balance Sheet Metrics

Key metrics from PNC's financial statements include a 2% revenue increase in Q4, driven by strong noninterest income growth. Core noninterest expenses rose by 5%, reflecting higher business activity. The balance sheet showed a 2% increase in average loans and a modest growth in average deposits. The net loan charge-offs were $200 million, representing 0.24% annualized to average loans. PNC's tangible book value (TBV) increased to $85.08, and the CET1 capital ratio was stable at 9.9%.

"During a challenging year for the banking industry, PNC demonstrated its strength and stability by growing customers, deepening relationships and managing the balance sheet for long-term success. We grew revenue, controlled core expenses, added to our loan portfolio and maintained strong credit metrics. We are well positioned for the year ahead to grow our businesses and deliver value for our stakeholders," said Bill Demchak, PNC Chairman, President and Chief Executive Officer.

Analysis of Company's Performance

PNC's ability to grow revenue and manage core expenses amidst economic headwinds is commendable. The bank's focus on maintaining strong credit metrics and a stable CET1 capital ratio suggests a strategic approach to balance sheet management. However, the impact of the FDIC special assessment and workforce reduction charges on net income underscores the need for vigilance in cost management. Going forward, PNC's positioning for growth and value delivery to stakeholders will be critical as it navigates the evolving financial landscape.

For a detailed analysis of PNC Financial Services Group Inc's financial performance and what it means for investors, visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from PNC Financial Services Group Inc for further details.

This article first appeared on GuruFocus.