PNM Resources (PNM) Q4 Earnings Top, Full-Year Revenues Fall

PNM Resources PNM reported fourth-quarter 2023 earnings of 18 cents per share, which surpassed the Zacks Consensus Estimate of 15 cents by 20%. The company reported earnings of 15 cents per share in the prior-year quarter.

Full-year 2023 earnings of $2.82 per share increased 4.8% from the previous year’s figure of $2.69.

Total Revenues

Total 2023 revenues of $1.94 billion decreased 13.8% from $2.25 billion reported in 2022.

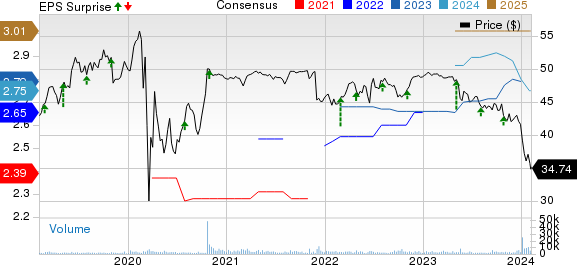

PNM Resources, Inc. Price, Consensus and EPS Surprise

PNM Resources, Inc. price-consensus-eps-surprise-chart | PNM Resources, Inc. Quote

Segmental Details

PNM reported fourth-quarter earnings of 10 cents per share compared with 5 cents in the year-ago quarter. This was due to hotter temperatures, increased transmission margins due to higher system demand, fewer gas plant outages, and improved market performance of decommissioning.

TNMP recorded earnings of 25 cents per share, up 8.7% from the prior-year quarter’s figure. This improvement was due to increased rate recovery through the Transmission Cost of Service and Distribution Cost Recovery Factor mechanisms.

Corporate and Other incurred a loss of 17 cents per share, wider than the year-ago quarter’s reported loss of 13 cents. This was due to higher interest rates on variable rate debt, net of hedges and increased losses.

Highlights of the Release

Total operating expenses for 2023 were $1.71 billion, down 8% from $1.86 billion recorded in the previous year.

Total operating income for 2023 was $231.3 million, down 52.6% from $393.8 million registered in 2022.

Guidance

The company projected consolidated ongoing earnings in the range of $2.65-$2.75 per share for 2024. It also has a long???term earnings growth target of 6-7% through 2028 based on the 2024 guidance midpoint of $2.70. The Zacks Consensus Estimate for 2024 earnings is pinned at $2.75 per share, which is at the high end of the guided range.

The company plans to invest $6.1 billion in the 2024-2028 period to further strengthen its operations.

Zacks Rank

PNM Resources currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Alliant Energy LNT is scheduled to report fourth-quarter results on Feb 15, after market close. The Zacks Consensus Estimate for earnings is pinned at 55 cents per share.

LNT’s long-term (three to five years) earnings growth rate is 6.16%. The company delivered an average earnings surprise of 1.9% in the last four quarters.

Exelon Corporation EXC is scheduled to report fourth-quarter results on Feb 21, before market open. The Zacks Consensus Estimate for earnings is pegged at 58 cents per share.

EXC’s long-term earnings growth rate is 5.69%. The company delivered an average earnings surprise of 1.8% in the last four quarters.

NRG Energy, Inc. NRG is scheduled to report fourth-quarter results on Feb 28, before market open. The Zacks Consensus Estimate for earnings is pegged at 94 cents per share.

NRG’s long-term earnings growth rate is 13.75%. It delivered an average earnings surprise of 4.7% in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC) : Free Stock Analysis Report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

PNM Resources, Inc. (PNM) : Free Stock Analysis Report