Pool Corp (POOL) Q2 Earnings Top, Revenues Miss Estimates

Pool Corporation POOL reported mixed second-quarter 2019 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same. While the bottom line outpaced the consensus mark after missing in the trailing two quarters, the top line lagged the same for the third straight quarter.

Adjusted earnings of $3.22 per share in the quarter exceeded the Zacks Consensus Estimate by a penny and increased 15% from the year-ago quarter number. Meanwhile, quarterly net revenues totaled $1,121.3 million, which fell short of the consensus mark of $1,155 million but improved 6% year over year.

Revenue growth can be primarily attributed to improved performance of the company’s Base Business. Additionally, favorable weather condition in the southeastern United States had a positive impact on the company’s results. However, these gains were negatively impacted by unfavorable weather in the company’s largest markets — California, Texas and Arizona.

Let’s delve deeper into the numbers.

Segmental Performance

Pool Corp reports operations under two segments — The Base Business segment (constituting majority of the business) and the Excluded segment (sale centers excluded from the base business).

Revenues at the Base Business segment increased 4.4% to nearly $1,103.4 million year over year. Also, operating income improved 5.8% to $171.6 million. Operating margin expanded 30 basis points (bps) from the year-ago quarter number.

The Excluded segment reported net revenues of $17.9 million, up from about $0.53 million registered in the prior-year quarter. The segment reported operating income of $0.93 million against the year-ago quarter’s loss of $0.11 million.

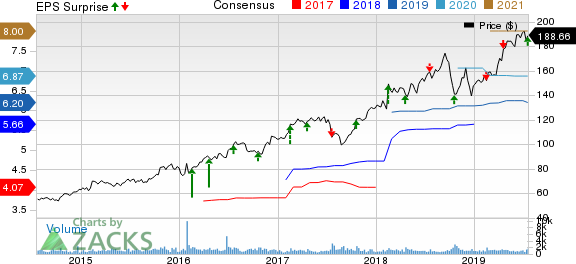

Pool Corporation Price, Consensus and EPS Surprise

Pool Corporation price-consensus-eps-surprise-chart | Pool Corporation Quote

Operating Highlights & Expenses

Cost of sales in the second quarter increased 5.6% from the prior-year quarter. Gross profit, as a percentage of net sales, rose 30 bps to 29.5% from the year-ago figure driven by the Base Business’ solid performance.

Operating income increased 6.5% year over year to $172.5 million. Also, the operating margin expanded 10 bps to 15.4% from the prior-year quarter. Selling and administrative expenses too increased 7.6% year over year. Net income totaled $164 million, up from $148.4 million recorded in the year-ago quarter.

Adjusted EBITDA increased to $183 million in the quarter from $172 million in second-quarter 2018.

Balance Sheet

As of Jun 30, 2019, Pool Corp’s cash and cash equivalents amounted to $60.7 million compared with $42.2 million on Jun 30, 2018. Total net receivables, including pledged receivables, rose 3% and inventory levels grew 14% as of the same date compared with Jun 30, 2018. Its long-term debt summed $692.3 million, up 5.1% from the prior-year quarter. Goodwill decreased 0.2% year over year.

Cash provided by operations declined to $97.4 million in the quarter under review compared with $36.8 million used in the prior-year quarter. The upside can be attributed to payments for pre-price increase inventory purchases in 2018.

2019 Guidance

For 2019, Pool Corp expects EPS in the range of $6.09-$6.34 compared with prior guidance of $6.09-$6.39. The Zacks Consensus Estimate for current-year earnings is pegged at $6.2.

Zacks Rank & Key Picks

Pool Corp has a Zacks Rank #3 (Hold). Other better-ranked stocks that warrant a look in the same space include Callaway Golf Company ELY, Lindblad Expeditions Holdings, Inc. LIND and AMC Entertainment Holdings, Inc. AMC. Callaway Golf and Lindblad Expeditions sport a Zacks Rank #1 (Strong Buy), whereas AMC Entertainment carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Callaway Golf has an impressive long-term earnings growth rate of 25%.

Lindblad Expeditions reported better-than-expected earnings in three of the trailing four quarters, the average beat being 25.9%.

AMC Entertainment has a long-term earnings growth rate of 10%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Callaway Golf Company (ELY) : Free Stock Analysis Report

Pool Corporation (POOL) : Free Stock Analysis Report

Lindblad Expeditions Holdings Inc. (LIND) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research