Pool Corp (POOL) Reports Year-End and Q4 2023 Results; Issues 2024 Earnings Guidance

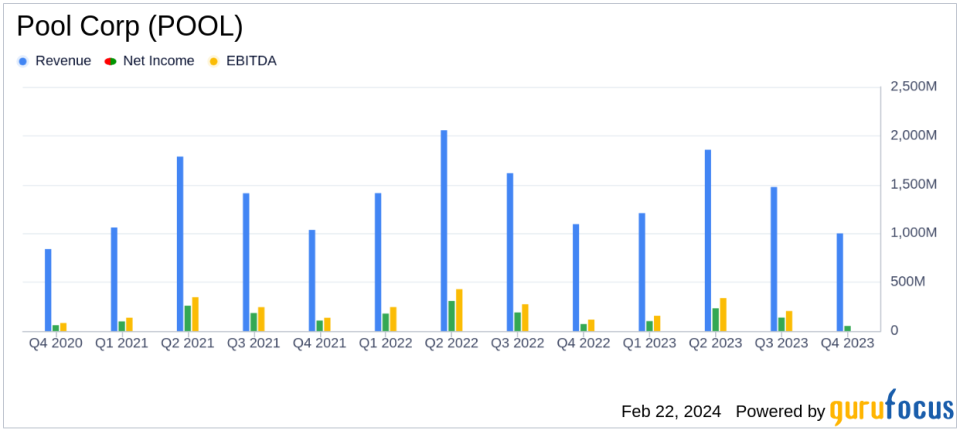

Annual Revenue: $5.5 billion, a 10% decrease from $6.2 billion in 2022.

Operating Income: $746.6 million, down 27% from $1.0 billion in 2022.

Net Income: $523.2 million, a 30% decline from $748.5 million in 2022.

Diluted EPS: $13.35, a 29% decrease from $18.70 in 2022.

Adjusted EBITDA: $806.9 million, a 25% decrease from $1.1 billion in 2022.

2024 EPS Guidance: Projected to be between $13.10 and $14.10, including an estimated $0.10 tax benefit.

Balance Sheet: Inventory levels decreased by 14%, and total debt outstanding decreased by $333.5 million.

On February 22, 2024, Pool Corp (NASDAQ:POOL) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a leading distributor of swimming pool supplies, equipment, and related products, faced several challenges throughout the year, including unfavorable weather conditions and a slowdown in new pool construction due to elevated interest rates. Despite these headwinds, POOL achieved its second-highest annual sales in company history and expanded its market presence.

Financial Performance and Challenges

POOL's annual net sales for 2023 were $5.5 billion, a 10% decrease compared to $6.2 billion in 2022. This decline was attributed to a slow start to the swimming pool season and reduced pool construction activity. Gross profit also saw a 14% decrease to $1.7 billion, with gross margin declining by 130 basis points to 30.0%. Operating income fell by 27% to $746.6 million, and net income declined by 30% to $523.2 million. Diluted earnings per share (EPS) decreased by 29% to $13.35, or $13.18 without tax benefits.

Strategic Growth and Shareholder Returns

Despite the downturn in sales and income, POOL continued to invest in strategic growth, adding fourteen greenfield and five acquired locations, ending the year with 439 sales centers. The company also generated a record net cash provided by operations of $888.2 million in 2023, returning $473.8 million to shareholders through dividends and share repurchases. This demonstrates POOL's commitment to maintaining its industry-leading position and delivering shareholder value.

Balance Sheet and Liquidity

POOL ended the year with a strong balance sheet, with inventory levels decreasing by 14% to $1.4 billion, in line with inventory reduction goals. Total debt outstanding decreased significantly by $333.5 million to $1.1 billion, as the company used its operating cash flows to reduce debt. The days sales outstanding ratio remained consistent at 26.8 days.

2024 Outlook

Looking ahead, POOL expects to capitalize on the intrinsic growth of the outdoor living industry, driven by consistent additions to the installed base of swimming pools and trends in product upgrades and technological advancements. The company has issued earnings guidance for 2024, projecting diluted EPS to be in the range of $13.10 to $14.10, including an estimated $0.10 favorable impact from tax benefits.

Pool Corp's performance in 2023 reflects the resilience of its business model in the face of economic headwinds. The company's ability to generate strong operating cash flow and its strategic investments in expanding market reach position it well for future growth. Value investors may find POOL's commitment to shareholder returns and prudent financial management appealing as they consider the company's prospects in a recovering market.

For a detailed analysis of Pool Corp's financial results, including income statements and balance sheets, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Pool Corp for further details.

This article first appeared on GuruFocus.