Pool (NASDAQ:POOL) Misses Q4 Revenue Estimates

Swimming pool distributor Pool (NASDAQ:POOL) fell short of analysts' expectations in Q4 FY2023, with revenue down 8.5% year on year to $1.00 billion. It made a GAAP profit of $1.32 per share, down from its profit of $1.79 per share in the same quarter last year.

Is now the time to buy Pool? Find out by accessing our full research report, it's free.

Pool (POOL) Q4 FY2023 Highlights:

Revenue: $1.00 billion vs analyst estimates of $1.02 billion (1.6% miss)

EPS: $1.32 vs analyst estimates of $1.26 (5.1% beat)

Free Cash Flow of $121.1 million, down 66.4% from the previous quarter

Gross Margin (GAAP): 29.3%, up from 28.8% in the same quarter last year

Market Capitalization: $15.05 billion

“After a challenging start, we achieved our second highest annual sales in company history of $5.5 billion against a backdrop of unfavorable weather in the first half of the year that delayed pool openings and a slowdown in new pool construction as the housing market came to grips with elevated interest rates. As the year progressed, we were able to adapt to the demand environment and manage the business effectively. In 2023, we added fourteen greenfield and five acquired locations, ending the year with 439 sales centers, showing our strategic investment in organic growth to increase our customer reach and create capacity for additional products and services, while maintaining our industry-leading position. We also generated record operating cash flows of $888.2 million and returned $473.8 million to our shareholders in dividends and share repurchases. Looking back on the year, I am proud of our team who remained focused on delivering an outstanding customer experience, which enabled us to outperform the industry through innovation, execution and collaborative partnerships,” commented Peter D. Arvan, president and CEO.

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ:POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Sales Growth

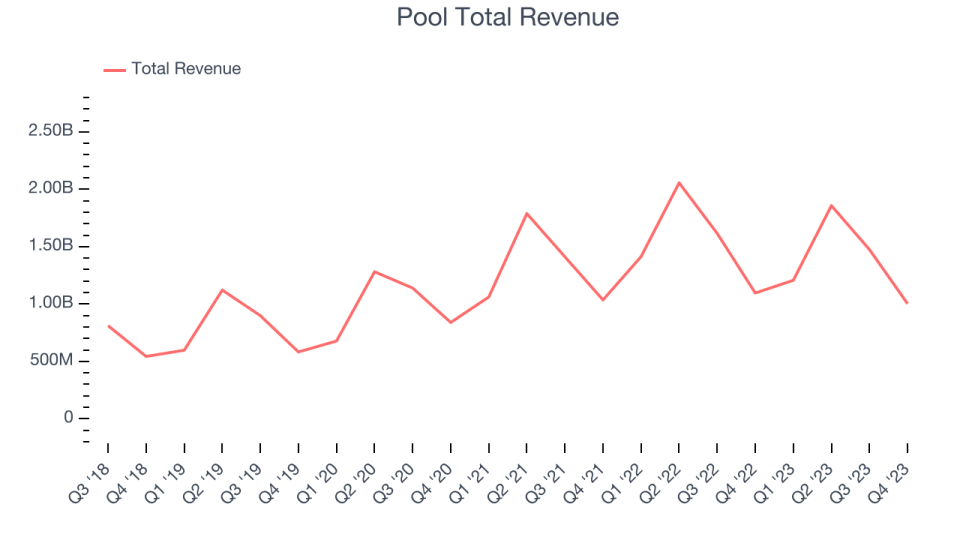

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Pool's annualized revenue growth rate of 13.1% over the last five years was decent for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Pool's recent history shows the business has slowed as its annualized revenue growth of 2.3% over the last two years is below its five-year trend.

This quarter, Pool missed Wall Street's estimates and reported a rather uninspiring 8.5% year-on-year revenue decline, generating $1.00 billion of revenue. Looking ahead, Wall Street expects sales to grow 3.6% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

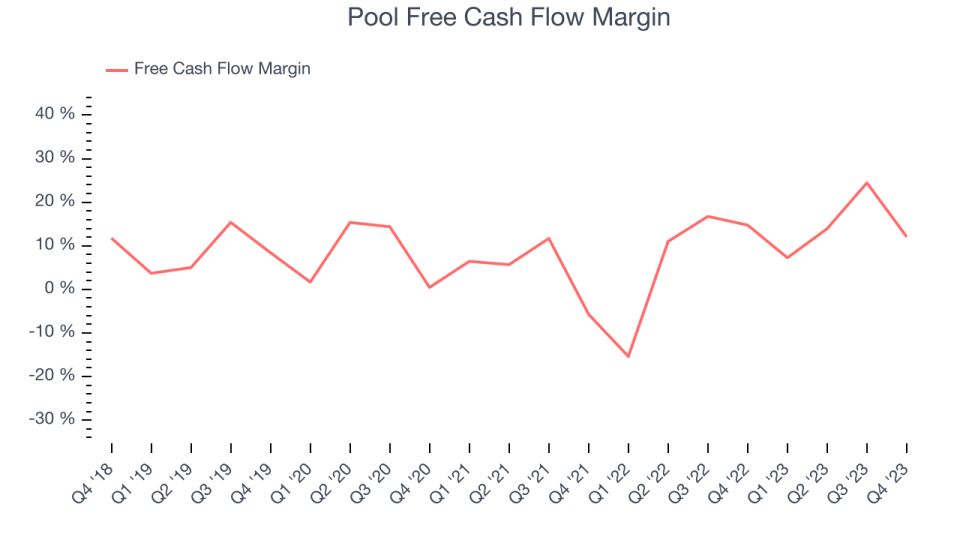

Over the last two years, Pool has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 10.8%, slightly better than the broader consumer discretionary sector.

Pool's free cash flow came in at $121.1 million in Q4, equivalent to a 12.1% margin and down 25.1% year on year. Over the next year, analysts predict Pool's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 14.9% will decrease to 8.7%.

Key Takeaways from Pool's Q4 Results

It was encouraging to see Pool slightly top analysts' EPS expectations this quarter. That stood out as a positive in these results. On the other hand, its revenue fell short and its full-year earnings forecast was underwhelming. Management noted that 2023 was a challenging year as unfavorable weather in the first half of the year delayed pool openings and higher interest rates led to a slowdown in new housing construction, which affected new pool construction. Overall, the results could have been better. The company is down 5% on the results and currently trades at $370 per share.

Pool may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.