POSCO Holdings Inc's Dividend Analysis

Assessing the Sustainability of POSCO Holdings Inc's Dividend

POSCO Holdings Inc (NYSE:PKX) recently announced a dividend of $0.47 per share, payable on 0000-00-00, with the ex-dividend date set for 2024-02-28. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into POSCO Holdings Inc's dividend performance and assess its sustainability.

Understanding POSCO Holdings Inc's Business Model

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

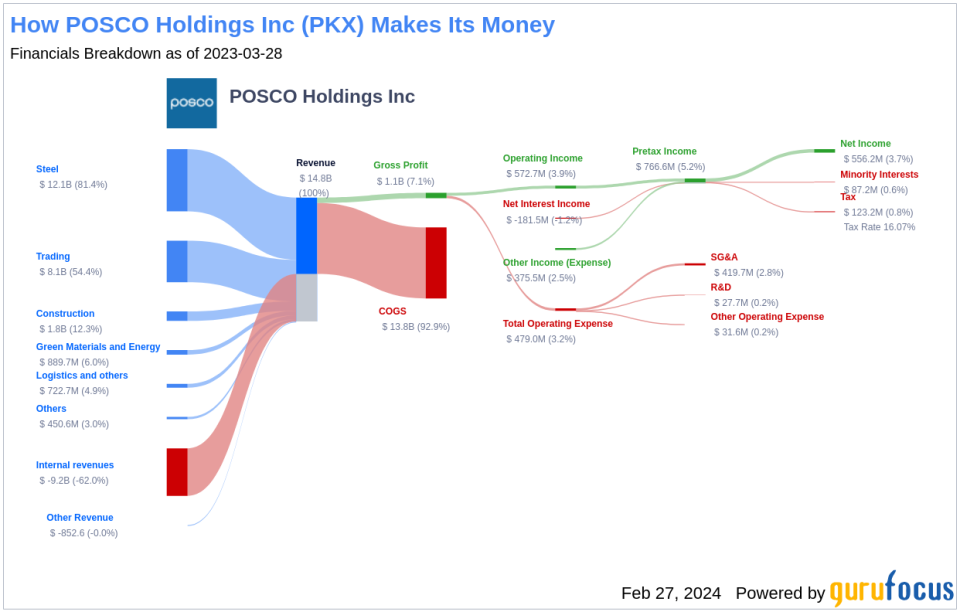

POSCO Holdings Inc is a holding company and operates through its subsidiaries. The company's operating segments are diverse, with a focus on the Steel Segment, which includes the production and sale of steel products. The Green Infrastructure Business provides infrastructure and related services, with operations spanning trading, natural resource development, and construction. Additionally, the Green Materials and Energy Segment deals with energy-related and other industrial materials, while the Others Segment encompasses a variety of activities including power generation and IT/OT services.

POSCO Holdings Inc's Dividend Track Record

POSCO Holdings Inc has upheld a steadfast commitment to dividend payments since 1994, rewarding shareholders with quarterly distributions. To visualize this consistency, here is a chart displaying the annual Dividends Per Share over time, which helps track historical trends.

Analyzing POSCO Holdings Inc's Dividend Yield and Growth

As of today, POSCO Holdings Inc boasts a trailing dividend yield of 1.75% and a forward dividend yield of 2.32%, indicating an anticipated increase in dividend payouts over the next 12 months. Over the past three years, the company has experienced an annual dividend growth rate of -2.10%, but this rate has shown a slight improvement to -0.40% per annum over a five-year period. Looking at the past decade, POSCO Holdings Inc's dividends per share have grown at an annual rate of 4.00%. Consequently, the 5-year yield on cost for POSCO Holdings Inc stock is approximately 1.72% as of today.

Dividend Sustainability: Payout Ratio and Profitability

The sustainability of dividends is often gauged by the dividend payout ratio, which reveals how much of its earnings POSCO Holdings Inc allocates to dividends. A lower ratio suggests better coverage for future growth and financial flexibility. As of the latest data, POSCO Holdings Inc's dividend payout ratio stands at 0.30. The company's profitability rank is 7 out of 10, indicating robust profitability compared to peers. This is supported by a consistent track record of positive net income over the past decade.

POSCO Holdings Inc's Growth Prospects

Growth metrics are essential for dividend sustainability, and POSCO Holdings Inc's growth rank of 7 out of 10 reflects a promising trajectory. The company's revenue per share and 3-year revenue growth rate show a strong model, with an average annual increase of 11.90%. This growth outperforms approximately 52.75% of global competitors. Additionally, POSCO Holdings Inc's 3-year EPS growth rate of 3.50% per annum surpasses that of about 29.63% of global competitors. The company's 5-year EBITDA growth rate of 4.20% also outperforms approximately 33.78% of global competitors, further highlighting its growth potential.

Final Thoughts on POSCO Holdings Inc's Dividends

In conclusion, POSCO Holdings Inc's upcoming dividend, consistent historical payments, and a reasonable payout ratio align with its robust profitability and positive growth metrics, presenting an attractive profile for value investors. These factors, combined with the company's promising growth outlook, suggest that POSCO Holdings Inc may continue to be a reliable source of dividends. Investors seeking high-dividend yield opportunities may find value in exploring stocks like POSCO Holdings Inc using tools such as the High Dividend Yield Screener available to GuruFocus Premium users.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.