Post Holdings Inc (POST) Reports Strong Q1 Fiscal 2024 Results, Raises Full-Year Guidance

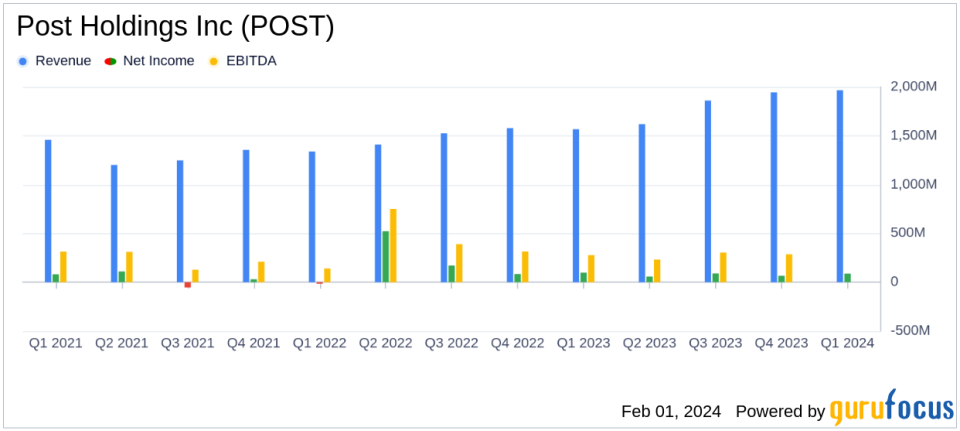

Net Sales: $2.0 billion, a 25.5% increase year-over-year.

Operating Profit: $209.3 million, up 39.6% from the prior year.

Net Earnings: $88.1 million, a slight decrease of 4.1% year-over-year.

Adjusted EBITDA: $359.5 million, a significant 33.2% increase year-over-year.

Full-Year Adjusted EBITDA Outlook: Raised to $1,290-$1,340 million from $1,220-$1,280 million.

Share Repurchase: New $400 million authorization announced.

On February 1, 2024, Post Holdings Inc (NYSE:POST), a leading consumer packaged goods holding company, announced its financial results for the first quarter of fiscal year 2024. The company reported a robust increase in net sales and operating profit, while net earnings saw a slight decline. Post Holdings also raised its full-year Adjusted EBITDA outlook, signaling confidence in its future performance. The company's 8-K filing provides detailed insights into its financials.

Company Overview

Post Holdings Inc operates through various segments, including Post Consumer Brands, Weetabix, Foodservice, and Refrigerated Retail. The company has recently expanded its portfolio with acquisitions in the pet food business from The J. M. Smucker Company and assets from Perfection Pet Foods, LLC, both included in the Post Consumer Brands segment. Additionally, the acquisition of Deeside Cereals I Ltd is now part of the Weetabix segment.

Financial Performance and Challenges

Post Holdings' net sales growth was driven by higher average net selling prices in Post Consumer Brands and Weetabix, along with $428.9 million in net sales from acquisitions. However, the company faced declines in Foodservice due to the elimination of avian influenza pricing premium and lower grain costs, and in Refrigerated Retail due to distribution losses in lower margin egg and cheese products.

The company's operating profit increase is a testament to its ability to manage costs and integrate new acquisitions effectively. However, net earnings decreased slightly due to factors such as a net expense on swaps and a lower gain on extinguishment of debt compared to the previous year.

Key Financial Metrics

Post Holdings' financial achievements, such as the increase in gross profit to $572.6 million (29.1% of net sales), reflect the company's ability to maintain profitability despite market challenges. SG&A expenses increased primarily due to the inclusion of Pet Food, and the company recorded restructuring and facility closure costs related to the closing of a cereal manufacturing facility.

Adjusted EBITDA, a critical metric for evaluating a company's operating performance, saw a significant increase, which is important as it excludes items that can vary significantly from one period to another, providing a clearer picture of the company's underlying financial health.

Analysis and Outlook

Post Holdings' performance in the first quarter of fiscal 2024 demonstrates its resilience and strategic growth through acquisitions. The company's raised outlook for Adjusted EBITDA indicates a positive trajectory for the fiscal year. The new share repurchase authorization also reflects confidence in the company's stock value and a commitment to returning value to shareholders.

For fiscal year 2024, Post Holdings anticipates capital expenditures to range between $420-$445 million, including significant investments in Foodservice and Pet Food segments, as well as costs related to the closure of the Lancaster, Ohio cereal manufacturing facility.

Investors and potential GuruFocus.com members interested in the consumer packaged goods sector may find Post Holdings Inc's strong market position and strategic growth initiatives through acquisitions an attractive opportunity. The company's ability to navigate market challenges and deliver solid financial results makes it a noteworthy player in the industry.

Explore the complete 8-K earnings release (here) from Post Holdings Inc for further details.

This article first appeared on GuruFocus.